Streaming giant Netflix kicked off a series on mega-cap tech earnings and did not disappoint. 🤩

The company’s adjusted earnings per share of $2.11 lagged estimates of $2.22, but revenues of $8.83 billion and total memberships of 260.8 million both topped estimates. 💪

Netflix now has more paid members than ever at 260.8 million, with the 13.1 million subscribers it added during the fourth quarter easily beating its third-quarter results and Wall Street estimates. The company’s efforts to crack down on password sharing and provide a cheaper, ad-free option are clearly helping drive results.

Its full-year 2023 revenue growth of 12% was double the prior year’s, with operating margin growing by 300 bps to 21%. Free cash flow also rose to $6.9 billion for the year. Looking ahead, management is forecasting a full-year 2024 operating margin of 24% and $4.49 per share in earnings during the first quarter. Both estimates are above prior expectations. 📈

To continue the momentum this year, Netflix will use its profitability to its advantage. While competitors cut back on spending and face further consolidation, Netflix continues investing. It plans to further improve its core series and film offering while broadening its product to include games and live and sports-adjacent programming.

Scaling its ad business should help offset its investments in the product and consumer experience. And although it has plenty of dry powder, management says it’s not interested in acquisitions of traditional entertainment companies or linear assets. However, it remains open to partnering with content makers who have traditionally operated in that space. 🤑

For example, it announced earlier today that it would stream the popular WWE Raw starting next year, marking its most significant step into live entertainment so far.

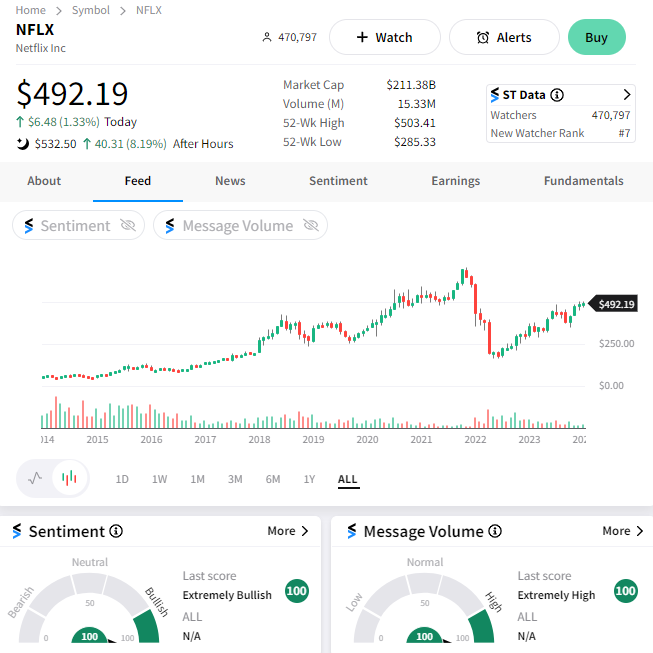

$NFLX shares soared to their highest level in two years on the results. Meanwhile, on the Stocktwits stream, sentiment and activity were off the charts as traders and investors debated the news. Bulls came out on top, with the sentiment meter firmly in bullish territory. Make sure to follow the stream to see how the price action develops in the coming days. 🐂