Popular fintech giant SoFi Technologies rose sharply today after its earnings impressed Wall Street. Let’s see how it did. 👇

The neobank earned $0.02 per share, topping last year’s $0.05 per share loss and analyst expectations for a breakeven quarter. Adjusted net revenue rose 34% YoY to $594.25 million, beating expectations for $572 million. 💪

With interest rates rising, student loan payments restarting, and inflation continuing to hit people’s pockets, the lender saw a significant increase in volumes. Personal, student, and home loan origination volumes rose 31%, 95%, and 193% YoY, respectively. 📊

However, CEO Anthony Noto says investors are focused too much on lending and not on its other two businesses. On its earnings call, executives called 2024 a “transitional year,” forecasting the technology platform and financial services segments to contribute more revenue growth as lending shrinks slightly from 2023.

As a result, it expects $0.07 to $0.08 per share in earnings for the fiscal year, topping estimates of $0.05. Beyond 2024, it’s looking for 20% to 25% compound revenue growth from 2023 to 2026 and annual earnings per share at the end of that period to be in the range of $0.55 to $0.80. 🔮

Despite the positive developments and cheery outlook from management, some analysts fear that momentum could slow in 2024. With its high valuation relative to its peers, the stock could be vulnerable if it encounters any operational missteps. ⚠️

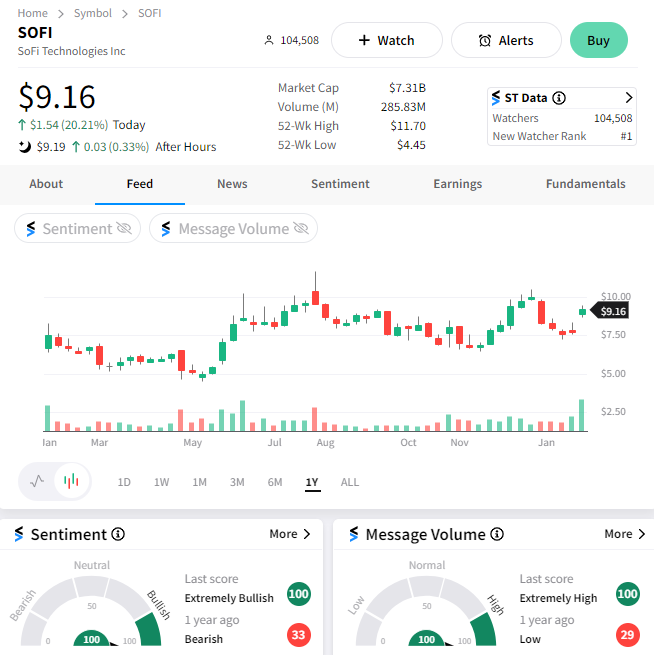

$SOFI shares jumped 20% on the news, with the Stocktwits community rallying behind it. Sentiment reached “extremely bullish” territory, with the stock becoming the #1 most newly watched on the platform today. 🐂