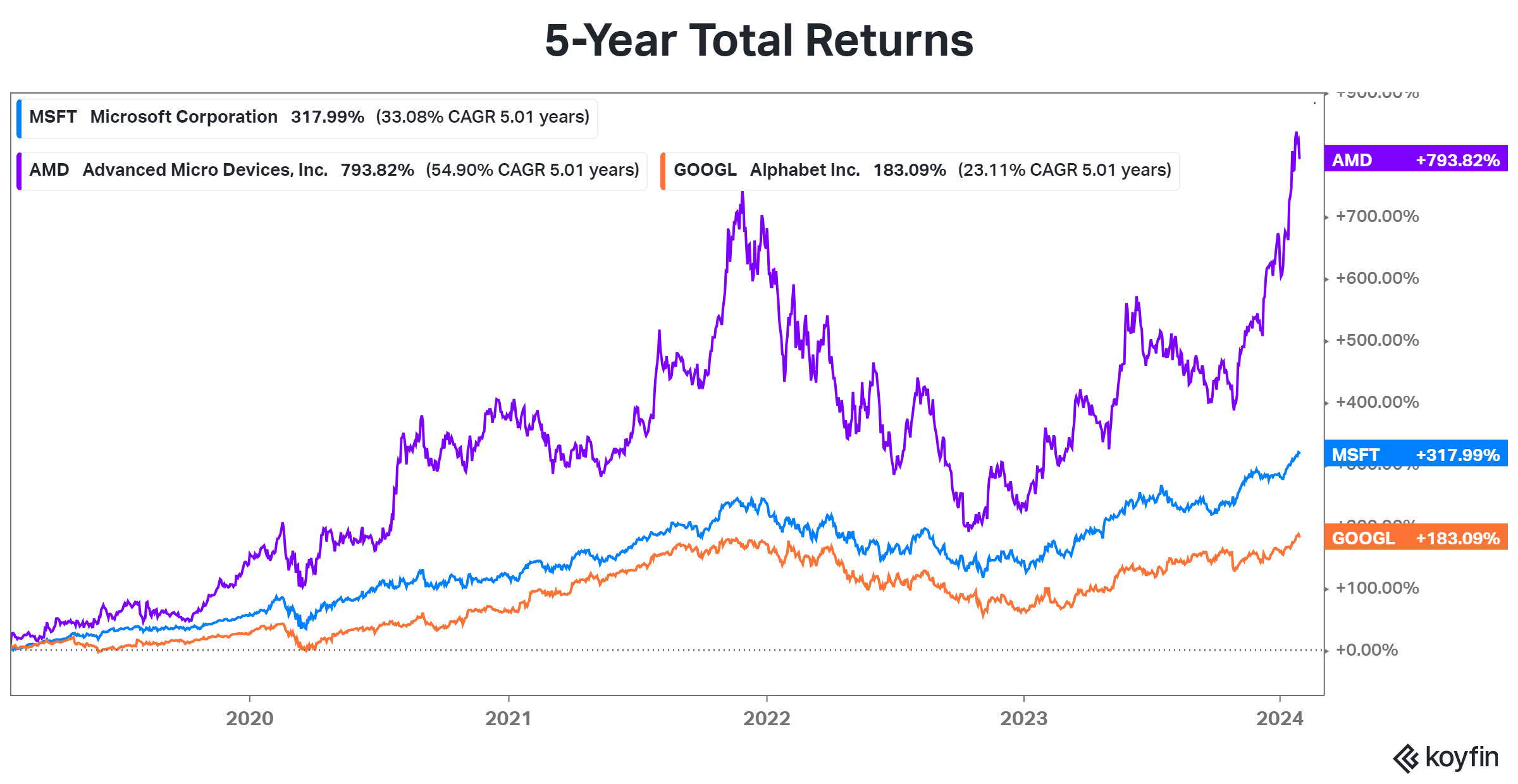

The “Magnificent Seven” stocks and other tech sector leaders have rallied significantly over the last three months. But with earnings season upon us, some are not living up to expectations.

Investors are selling Microsoft, Alphabet, and AMD shares after their reports, so let’s recap. 👇

First, we’ll start with $3 trillion Microsoft. The company’s earnings per share of $2.93 and revenues of $62.02 billion topped expectations of $2.78 and $61.12 billion. 💪

Revenues rose 17.6% YoY, with its Intelligent Cloud segment revenues increasing 20% YoY and beating the consensus view of $25.29 billion. Azure and other cloud services revenue rose 30%, up from the previous quarter’s 29%, beating Wall Street’s expectation for a slight QoQ decline. Its Productivity and Business Processes unit and Personal Computing segments also exceeded expectations, growing 13% and 19%, respectively. ⛅

Given the intense focus on cloud and artificial intelligence (AI) these days, investors were happy to see that the segment is firing on all cylinders. $MSFT shares are down marginally after the bell.

Unfortunately for Alphabet, delivering its fastest quarter of revenue growth since early 2022 was not enough to satisfy investors. Sales jumped 13% YoY, with Google Cloud revenue of $9.19 billion vs. the $8.94 billion expected. 📊

However, softer-than-expected ad revenue is weighing on the stock. YouTube ad revenue essentially matched expectations, but traffic acquisition costs were about $200 million shy of traffic acquisition costs. Last quarter, the concern was Google’s cloud business, and now it’s the core advertising segment. So, investors are frustrated it couldn’t deliver an “all-around” solid quarter.

Like other tech giants, Alphabet is cutting costs and restructuring its efforts around core products and initiatives. The company recently faced backlash from employees claiming leadership lacks a clear vision. $GOOGL shares are down about 6% after the bell. 😡

Lastly, chipmaker Advanced Micro Devices is falling despite solid data center segment revenue. It reported fourth-quarter adjusted earnings per share of $0.77, matching estimates. Revenue came in slightly ahead at $6.20 billion vs. $6.13 billion.

Fourth-quarter revenues were up 10% YoY, but full-year numbers were down 4%. Full-year net income also fell 35% on slipping margins, but data center revenues remained a bright spot, rising 38% YoY in the fourth quarter and 7% for the full year. 🔺

However, the company is struggling after forecasting first-quarter revenue of $5.10 to $5.70 billion, below the consensus estimate of $5.73 billion. $AMD shares are down 6% after hours.

With all these stocks selling off from all-time highs, we’ll have to see how quickly investors step in to “buy the dip.” With many missing the discounted prices of 2022, some may be tempted to jump back in despite the mixed earnings results. 🤷