Software company Palantir Technologies is back on investors’ radars after its earnings results. 💪

The company reported adjusted earnings per share of $0.08, which matched expectations—meanwhile, revenues of $608.40 million topped expectations of $602.40 million by about 1%.

Revenues were up 20% YoY, and management expects the momentum to continue. CEO Alex Karp said the company’s expansion and growth “have never been greater,” especially as demand for large language models in the U.S. “continues to be unrelenting.”

As for its defense and intelligence work with the U.S. government, U.S. commercial revenue rose 70% YoY, with customer count increasing 55% YoY to 221. 📊

In terms of numbers, management expects $612 to $616 million in revenues (slightly below estimates) and full-year revenue of $2.65 to $2.67 billion (matching estimates). However, investors are noting that the company reported its fourth-straight quarter of profitability, which would make it eligible to enter the S&P 500 index. 🤩

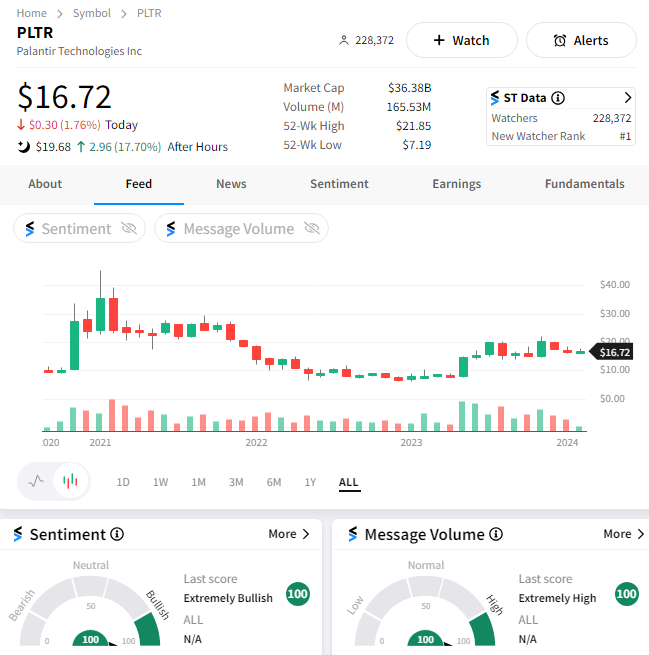

$PLTR shares rose 18% after hours and are again trying to emerge from the $16-$20 price range they’ve been stuck in for the last six months. As for the Stocktwits community, sentiment is leaning “extremely bullish,” with the stock adding the most watchers on the platform today. 🐂