After missing out on last year’s tech run, many investors are choosing not to risk that feeling again. As a result, they continue to pile into stocks in the semiconductor industry and related fields. Arm Holdings joined the fray today, jumping sharply after reporting results.

The chip design technology giant reported third-quarter adjusted earnings per share of $0.29 on $824 million in revenues. That topped estimates of $0.25 and $761 million. 🤩

If the semiconductor industry is going to surge, companies like Arm are well-positioned to benefit. It makes money through royalties when companies pay for access to build Arm-compatible chips. During its latest quarter, its customers shipped 7.7 billion Arm chips, driving an 11% YoY increase in royalty revenue to $470 million. 📊

Outside of royalties, Arm’s bet on licensing (swelling access to more complete designs) has also paid off handsomely. License and other revenues rose 18% YoY to $354 million, with the company seeing an uptick in demand that may allow it to charge higher licensing fees for advanced designs.

Like Qualcomm and others, the company flagged a recovery in the smartphone market as a significant driver, along with automotive and cloud provider sales. Overall, management expects the momentum to continue, with its fiscal fourth-quarter earnings and revenue guidance blowing estimates out of the water. 📈

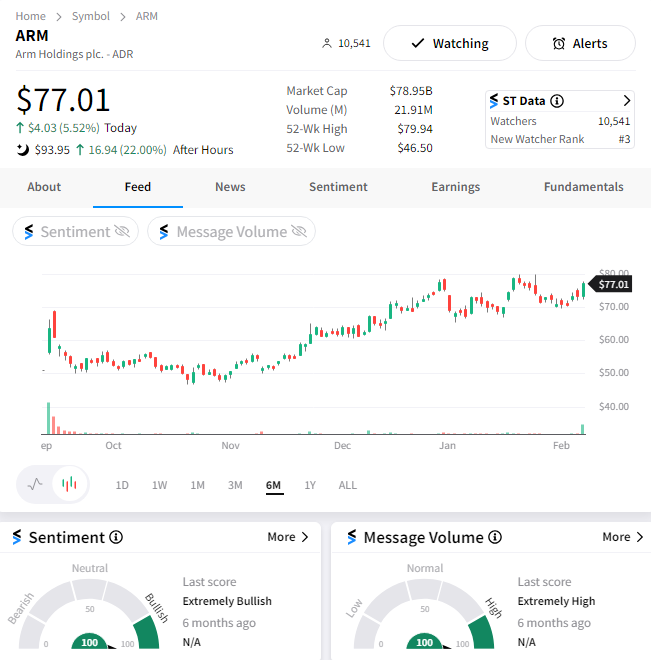

Arm remains one of last year’s best-performing initial public offerings (IPOs). And despite some skepticism from the Stocktwits community initially, these results and after-hours move have propelled sentiment back into “extremely bullish” territory. 🐂