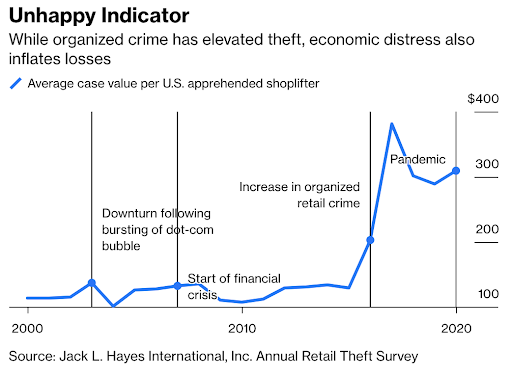

Inflation is pummeling the retail sector, but now retailers are reportedly hurting for another reason — shoplifting. Rates of shoplifting have drastically increased since the onset of the pandemic, which is consistent with periods of recession or consumer distress.

According to the Retail Industry Leaders Association, it was estimated that about $68.9 billion worth of products were stolen from companies like Target, Best Buy, and Walgreens in 2019. Since then, shoplifting has reportedly increased. According to Bloomberg, the average case value per shoplifter has risen with it:

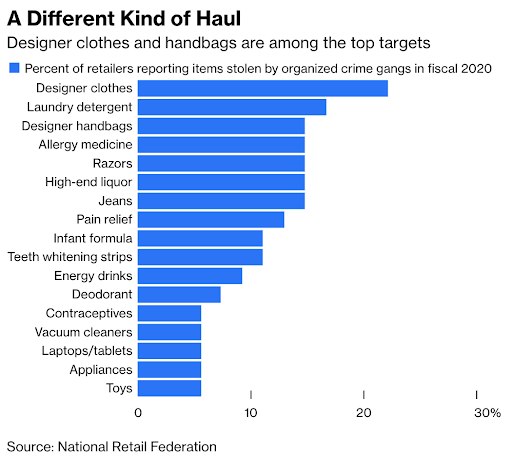

While designer clothes and handbags were the most-stolen items during the shoplifting surge of 2020, necessary items (like pregnancy tests, infant formula, and allergy medicine) also saw a surge in shoplifting during the pandemic. On the whole, the shoe fits: the pandemic stressed millions of people and rising theft points to a distressed public.

Congress’s response to the sudden pandemic-related rise has been pushing through legislation to crack down on third-party sales of stolen goods. However, to play devil’s advocate, they have not done anything about wage theft or the crooked state of civil forfeiture law. Friendly reminder: crime rates have plunged since 1990.

Ultimately, we’re not sure if this is a real problem for companies yet — yes, business journals can write all they want, retailers are mum on detailing these kinds of incidents, and investors can scare of what this can do to earnings. But what is obvious is that: a) a large number of Americans are struggling to make ends meet; and that b) the “increased prevalence of organized crime” is likely real, but nothing historically unprecedented.