Today’s consumer price index showed inflation rose more than expected in January. 📝

Headline inflation rose by 0.5% MoM and 6.4% YoY (vs. the 0.4% and 6.2% expected). Stripping out food and energy, core CPI rose 0.4% MoM and 5.6% YoY (0.1% higher than expected). 🔺

Driving those increases were two things. ✌️

First, energy prices rose 2% MoM, and food prices rose 0.5% MoM. Those numbers are typically volatile and not something the Fed is too focused on. Within the core CPI number, rising shelter costs contributed a good portion of the gain…but those numbers involve a significant lag. ⏲️

As a result, many market participants and the Fed are looking at “super-core” inflation, which takes out shelter prices. That value rose just 0.2% MoM and 4% YoY. The argument is that this way of looking at inflation is a lot more reflective of the prices the Fed can directly impact through its policy. And for now, those are headed in the right direction.

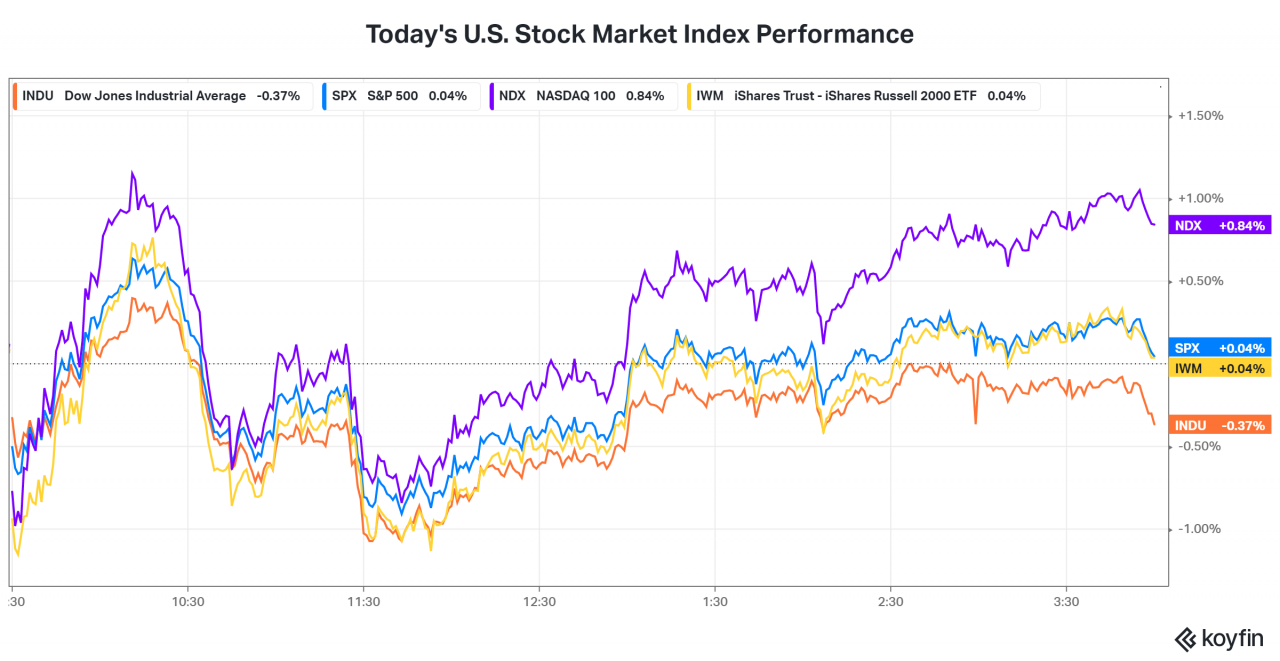

That’s likely why the stock market’s initial reaction was to sell off. Meanwhile, the bond market is no longer pricing in any rate cuts in 2023. Instead, it sees a terminal rate between 5% and 5.25%, where it’s likely to stay until more progress is made on inflation.

Overall, the stock market continues to err on the side of optimism. Leading today’s gainers was the tech-heavy Nasdaq index. 👍

Now we wait to see if the producer price index on Thursday indicates a similar trend. ⌚