Today’s big story is the U.S. 10-year yield closing at its highest since 2007. July’s Federal Open Market Committee (FOMC) Minutes showed that officials see ‘upside risks’ to inflation, causing an already weak bond market to continue falling. 📊

In the U.S., stronger-than-anticipated growth and a historically strong labor market have investors concerned that rates could need to stay higher for longer. As a result, most of the yield curve has been pressing to new highs, with big investors like Big Ackman betting against bonds. The recent uptick pushed 30-year U.S. mortgage rates to 7.16%, their highest since 2001. 📈

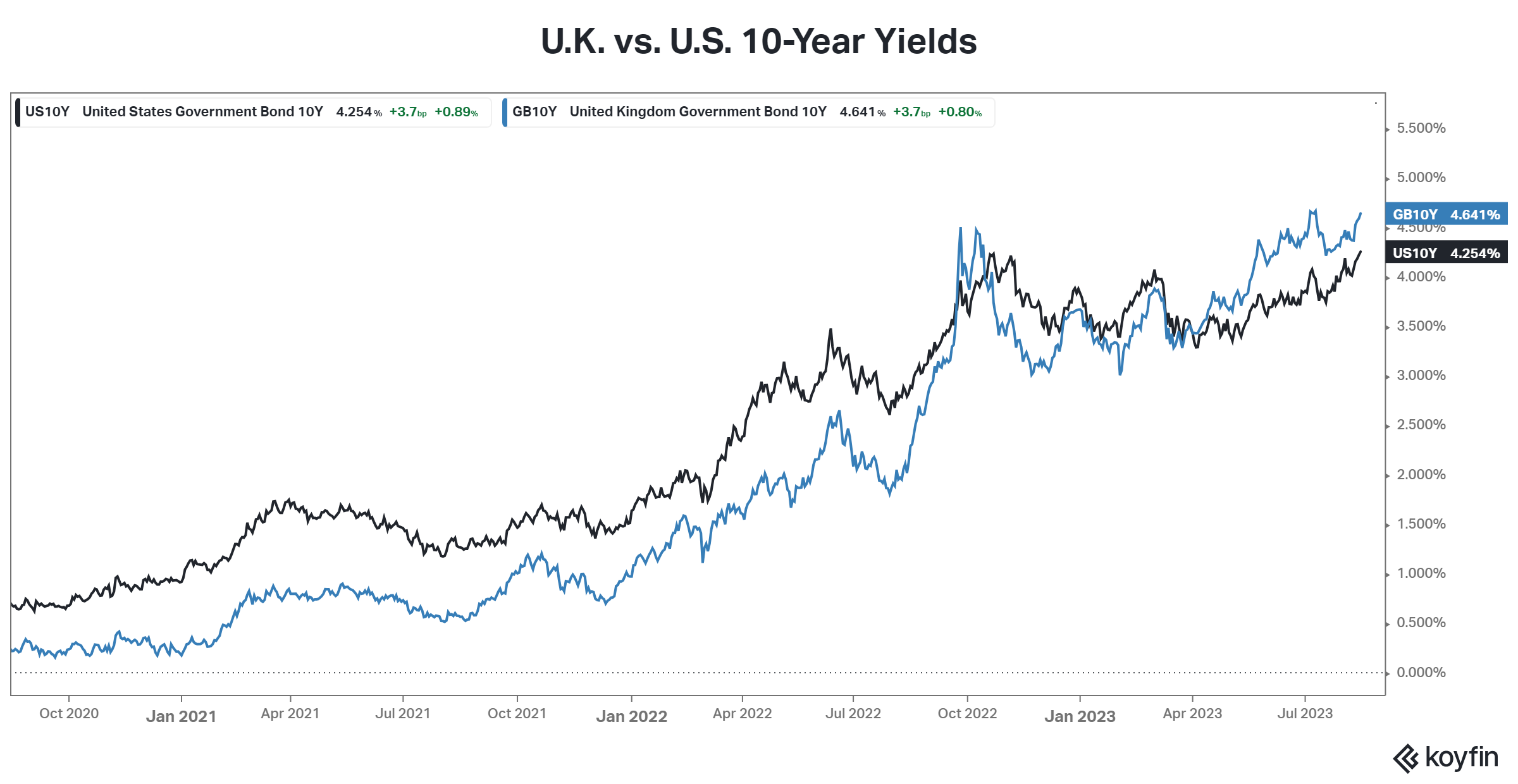

What’s interesting, however, is that it’s not just a U.S. phenomenon. In the U.K. and most of Europe, yields are also pushing to new highs. In fact, U.K. 10-year yields are currently greater than the U.S., for the first time since 2014. 😮

The U.K.’s economy continues to hold up better than anticipated, but inflation remains hotter than its central bank can tolerate. July’s reading came in at a 17-month low of 6.8%; however, core inflation remained unchanged at 6.9%. Driving that is an acceleration in services inflation from 7.2% to 7.4%. This sets up the Bank of England to raise rates another quarter-percentage-point next month to 5.5%. 🔺

Meanwhile, fears of a global slowdown continue to rise. One of China’s biggest shadow banks skipped payments on several investment products without immediate plans to make its clients whole. Liquidity and solvency fears are causing investor angst, so much so that the government is asking for some investment funds to avoid selling more equities than they buy.

And adding to those growth fears is news from companies like ZIM Integrated Shipping Services. The company’s shares fell 10% towards all-time lows after a major earnings and revenue miss. 🚢

Overall, global markets are trying to cope with the prospect of higher rates. If real interest rates are heading higher, many believe the S&P 500’s price-to-earnings (P/E) multiple of over 19x is a bit too rich, given the lack of earnings growth. Time will tell, but for now, the volatility looks here to stay during the seasonally weak August through September timeframe. 😨