Okay, we’re being a bit facetious with the title. But the renowned fund manager is betting against U.S. treasury bonds, unveiling his latest public investment thesis on X (aka Twitter). 📝

If treasury bonds sound familiar, we discussed them earlier in the week when discussing the breakout in cyclical stocks like Caterpillar. Did he read our newsletter and find his next great idea? It’s certainly possible (we’re totally kidding. But just in case, thanks for reading, Bill).

Anyway, let’s take a look at his thesis and why he is short the 30-Year treasury bond “in size.” 😮

I have been surprised how low US long-term rates have remained in light of structural changes that are likely to lead to higher levels of long-term inflation including de-globalization, higher defense costs, the energy transition, growing entitlements, and the greater bargaining…

— Bill Ackman (@BillAckman) August 3, 2023

Ultimately, Ackman believes several structural changes are happening in the U.S. (and global) economy that will keep inflation persistently high. They include de-globalization, higher defense costs, the energy transition, growing government entitlements, and the historically tight labor market. 🥵

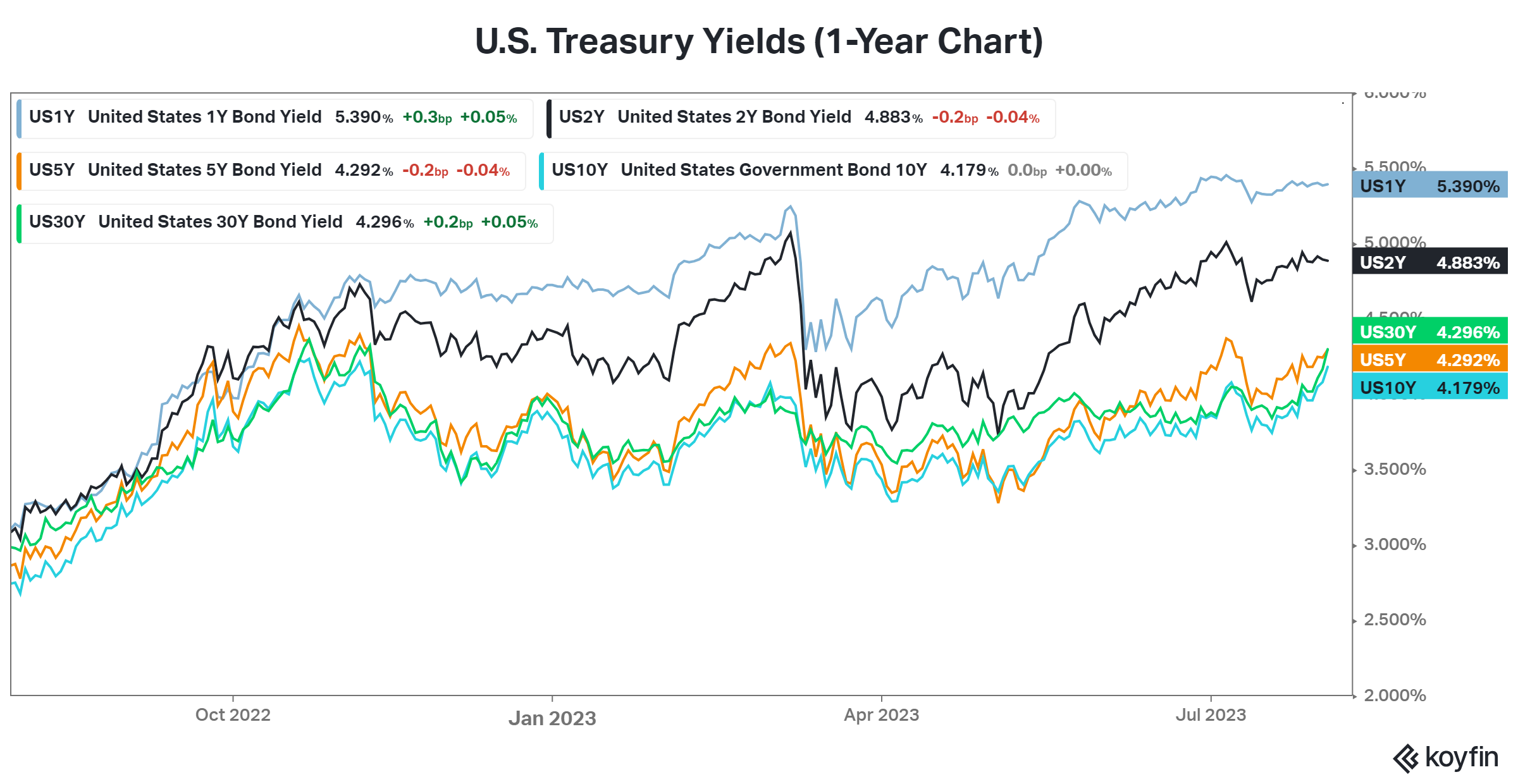

If long-term inflation settles at 3% instead of 2%, then the long end of the bond market will need to reprice significantly. And historically, he claims that this has happened rapidly once the market realizes these conditions exist. He also points to other supply/demand dynamics impacting the market in the short term, but his broader thesis focuses on inflation.

Whether or not he’s right remains to be seen. Bill Ackman is certainly a great investor but has had his fair share of poorly-timed market calls (what well-known investor hasn’t). 🤷

However, it doesn’t take away from the fact that this week’s move in interest rates is catching many investors’ attention. And while Fitch’s downgrade of the U.S.’s credit rating is the most recent catalyst to point to, the real reason for the move may be a lot simpler. 🔻

The U.S. bond market has been pricing in a recession for some time. But now, the narrative has shifted to a successful “soft landing,” where inflation comes down while the economy chugs along at a moderate pace. If that’s the case, then yields across the curve will need to adjust since most have been at the same level since October.

So far this week, we’ve gotten some significant movement, and the market is watching closely to see if rates are headed for new highs. Ackman certainly believes they are. Time will tell! ⏳