After failing to reach a deal with the “Big Three Automakers” before Thursday’s 11:59 p.m. deadline, the United Auto Workers (UAW) union officially launched its historic strike. Although there have been major strikes before, there has never been a strike against all three automakers at once. ❌

Combined, the automakers have 150,000 UAW-represented employees across their operations. For now, though, the strike is beginning at just one factory from each automaker, accounting for roughly 13,000 workers. However, union leaders say they could gradually expand the strike to additional plants (or all of them) if their demands are unmet.

As for those demands, the UAW is asking for several concessions, the largest being a 36% pay increase and a return to traditional pensions and retiree health care. The most recent offers fell well short of those expectations, offering pay increases ranging from 17.5% to 20% over the next 4.5 years. 😐

Additionally, the transition to electric vehicles is a major sticking point for workers. ⚡

The Big Three automakers want to secure a deal that allows them to compete with non-unionized competitors like Tesla. That’s particularly important given Tesla’s electric-vehicle-only focus already gives it a significant advantage over traditional automakers. However, union workers fear they’ll not reap any benefits of the rapidly growing (and heavily subsidized) industry they’re supporting on a daily basis.

Thus, the impasse. The longer the strike goes on, the further these company’s electric vehicle (EV) ambitions are pushed out. But if they settle and meet the UAW’s demands, higher costs could prevent them from competing in an already cutthroat electric vehicle market.

As for what the union is working with, it’s relying on a $825 million strike fund to keep the workers on the sidelines. The roughly 13,000 striking workers will receive about $500 per week from the strike fund, which is about $6.5 million per week. That barely puts a dent in the strike fund, but if walkouts extend to other plants, its runway to force a deal will be much shorter. 💰

The strike’s impact is major, not just for the automakers but for the entire U.S. economy. Current estimates are the stoppage could cause $5.6 billion in lost economic activity for every ten days it runs. And that would hit the local economies where the strikes take place hardest.

Given those facts, the White House is looking to get more directly involved in negotiations. Joe Biden’s comment that “record profits have not been shared fairly with workers.” created a lot of debate online but highlighted the key point labor unions are making in the current environment. 🎯

BREAKING: Biden addresses the nation on the United Auto Workers strike.

"Record profits have not been shared fairly with workers." pic.twitter.com/aYkOtSA8PW

— Stocktwits (@Stocktwits) September 15, 2023

And so far, they’ve been winning a lot of their battles. Just look at the Airline industry, where pilots have secured significant pay increases and quality of life improvements. The historically tight labor market has given workers more leverage than they’ve had in decades, especially in blue-collar industries. So they’re striking while the iron is hot. 🔥

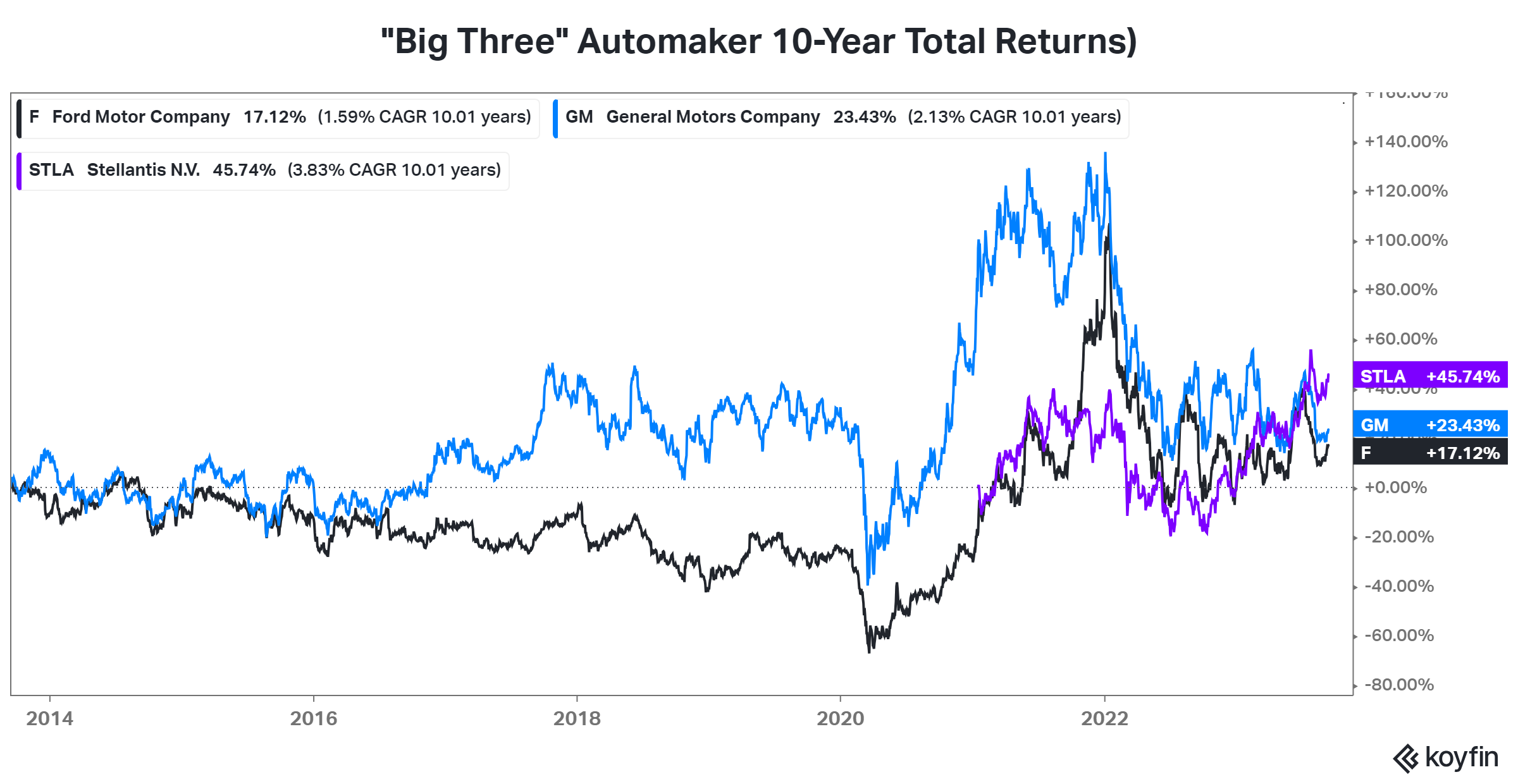

However, investors were quick to point out that record profits have not necessarily meant record stock market returns. The Big Three have delivered lackluster returns over the last decade, and higher costs would likely not improve their odds of changing that trend. 😬

Overall, we’ll have to wait and see how the talks develop. Both sides have valid points and a lot of ammunition, so this could be a long and difficult battle. But hopefully, they can reach an agreement soon to get production and their local economies back on track. 🤝