Market Cap: $2.89 billion

YTD: +68.03%

Project Focus: Render Token ($RNDR) is a distributed GPU rendering network built on the Ethereum blockchain. It aims to connect artists and studios needing GPU computing power with mining partners willing to rent out their GPU capabilities. This project facilitates the rendering of complex 3D scenes and virtual reality experiences, making high-quality rendering accessible and more cost-effective for creators and developers.

What Makes It Unique: RNDR is pioneering leveraging blockchain technology to democratize access to high-end rendering capabilities. Using a decentralized network optimizes the rendering process regarding speed and cost. It incentivizes GPU owners with RNDR tokens, creating a win-win ecosystem for creators and GPU miners.

From a price action perspective, Render looks a little top-heavy. This is especially true if you look at the white trendlines.

The angle of the trendlines has gradually become more extreme, a behavior some analysts and traders believe warns of a parabolic move. Two additional bearish warning signs are the firm rejection against the 261.8% Fibonacci extension and the current candlestick pattern developing: a bearish shooting star.

Here’s something to digest: parabolic moves are the definition of irrational behavior, and as Warren Buffet once said, markets can remain irrational longer than you can remain solvent.

In other words, just because the technicals here are screaming this is ‘done’, don’t be surprised if FOMO catches and it keeps going. ⌚

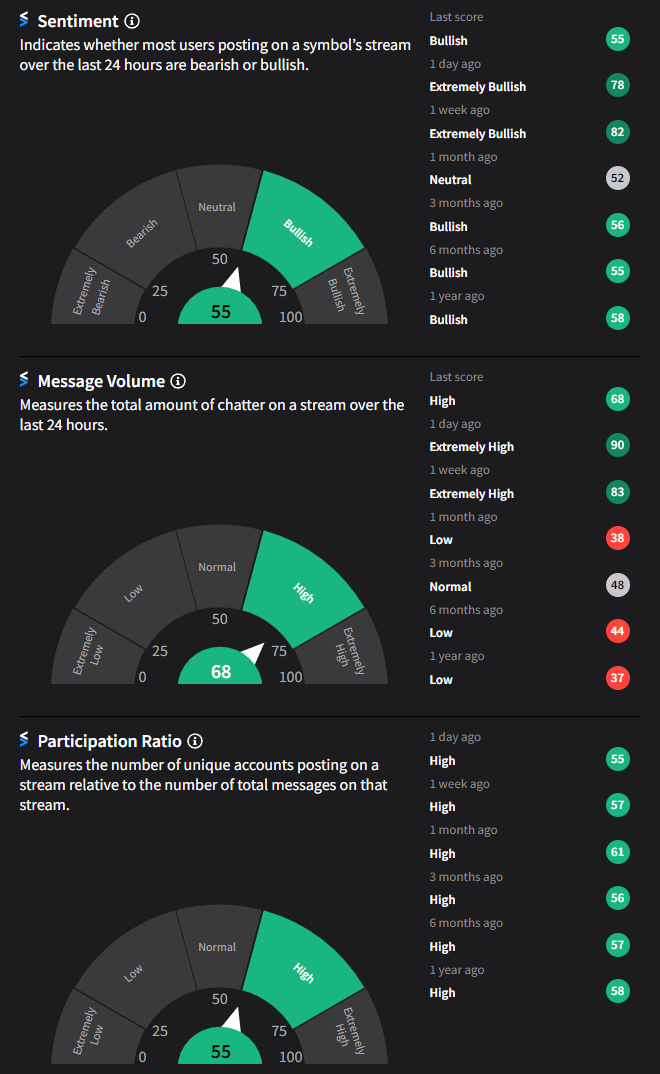

Stocktwits Sentiment Data for Render Protocol