Tale of the Tape

Good evening everyone. Markets closed at a record high! 💓

Nifty and Sensex surged 1.6% each. Hopes of a strong economic rebound and steady earnings offset the global weakness. 💪 Midcaps (+0.1%) and Smallcaps (-0.2%) traded mixed.

Most sectoral indices advanced in trade. FMCG and Financial Services rose 1.7% each. ✅ Metals closed flat.

Dabur jumped ~4% from the lows on strong results. Barbeque Nation soared 5% despite recording a net loss of Rs 43 cr. Read more below. 📊

Tata Motors increased car prices by 1%. The stock gained +2.5%. 🚘

Zomato (-1%) announced unlimited free deliveries with new “pro-plus” subscriptions. 🥘

Vodafone Idea tanked 10%. Aditya Birla group chairman Kumar Mangalam Birla offered to give up his stake in the company. 📵

Coming soon. Adani Wilmar and Nykaa filed their IPO papers with SEBI. 🤑

Crypto dashed lower. Bitcoin fell 3%. Ethereum was down 4%. XRP, ADA, and Doge also declined between 3%-5%. 🔻

Here are the closing prints:

| Nifty | 16,131 | +1.6% |

| Sensex | 53,823 | +1.7% |

| Nifty Bank | 35,207 | +1.4% |

Nifty Scales Mount 16K (Finally)

It’s done! After countless failed attempts, Nifty successfully crossed the crucial 16,000-mark. 😇 The index had been stuck in a narrow range for nearly 3 months. Technical analysts believe today’s big breakout should unlock further upside for the Nifty. 📈

Fundamentally too, there are multiple triggers to support this. The economy has seen a sharp turnaround post the easing of lockdown curbs. Resilient earnings and pick-up in vaccination also bode well for the outlook. ✅ Having said that, rising inflation and fears of a third-wave act as key risks for the market.

So far the RBI has been focused on kickstarting growth. But should inflation rise further, the RBI may be forced to raise interest rates which is negative for equities. Plus the rapid spread of Covid’s Delta variant in several parts of the world is also worrisome. 👎

Ideally, we all wish for markets to go up and dips to get bought. 😎 But, we don’t live in an ideal world. Keep this in mind before investing your hard-earned money.

Earnings Roundup

Dabur jumped ~4% from its intraday low on bumper results. 💪 The company beat estimates on both topline and bottomline. Volumes grew 34% vs an expectation of 17%-19%. 🤯 Operating margins remained steady despite higher raw material costs. Here are the key stats:

- Revenue: Rs 2,612 cr (vs Est: Rs 2,420 cr)

- Net Profit: Rs 438 cr (vs Est: Rs 410 cr)

Mohit Malhotra , CEO at Dabur said:

We continue to post strong growth and market share gains across all key verticals like Health Care, Home Care, Personal Care, and Foods in Q1 2021-22. E-Commerce reported an over 100% growth and today contributes to 8.2% of the India FMG business. We continue to invest ahead of the curve in expanding our rural footprint.

Dabur is up 15% YTD. 📈

Barbeque Nation’s (+5%) earnings improved over the previous quarter despite Covid-led disruptions. 😊 The company’s net loss narrowed to Rs 43 cr vs Rs 60 cr last year. Deliveries accounted for 50% of total revenue. The company plans to open 20 new stores in FY22. 🍝 Here are more details:

- Revenue: Rs 102 cr vs Rs 9.8 cr (YoY)

- Net loss: Rs 43 cr vs net loss of Rs 60 cr (YoY)

- Same-store sales growth: 960%

Kayum Dhanani, Managing Director at Barbeque Nation said:

While this quarter was a similar situation to Q1 FY21 we were better prepared and our diversification strategy has helped mitigate the decline in revenues. We have transformed Barbeque Nation from a casual dining restaurant chain to a diversified food services company, focusing on building a strong delivery business and develop our digital assets.

Barbeque Nation is up 58% YTD. 💰

Hot Wheels

CarTrade Tech’s IPO will open on August 9th. The price band is fixed at Rs 1,585-1,618 a share. The company plans to raise Rs 3,000 cr from the markets. 💸

CarTrade is an online auto classifieds platform. The company helps users buy and sell new/used cars. 🚗 Its vision is to create a digital ecosystem which connects customers, automakers, dealers, and other stakeholders – much like “Amazon for Car Shopping”. 🛒 In Q1, the company reported 27 million unique visitors per month.

Financial Snapshot:

- FY21 revenue: Rs 250 cr; -16% YoY due to the pandemic

- FY21 earnings: Rs 101 cr; +3x YoY boosted by one-offs

CarTrade’s IPO comes on the heels of several startups charting a course to the capital markets this year. 🏃♂️ Shares of the company in the unlisted market are up 46%, as per reports. We have no doubt that the IPO will be a huge hit among investors. 🔥

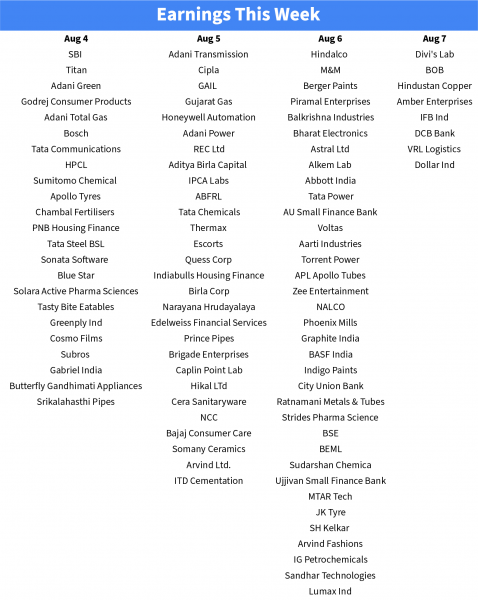

Earnings Calendar

Be sure to know when your stocks report earnings. Here’s the earnings calendar:

Links That Don’t Suck

💰 Infra.Market Gets Funding At $2.5-Billion Valuation, Eyes Acquisitions

📱 This Is The Pixel 6, Google’s Take On An Ultra High End’ Phone

🧧 Explained: What Is E-RUPI And How Does It Work?

📈 India’s Unemployment Rate Drops To 13.3% In Q2 From All-time High Of 20.9% In Q1

🎥 Watch: Never Seen Before Bts Footage From The Set Of ‘F.R.I.E.N.D.S.’

🤸♂️ Tokyo Olympics 2020 Live Updates: Tajinderpal Singh 12th After Final Throw In Shot Put Qualifiers