Tale of the Tape

Happy Monday everyone! Markets were volatile but closed up. 😏

Nifty and Sensex ended with modest gains after opening sharply higher. Midcaps (-0.9%) and Smallcaps (-1.9%) continue to sulk. Four stocks were down for every one gainer. 💔

Except for IT (+2%), most sectors ended in the red. Autos (-1.7%) topped the list of losers. 🚨

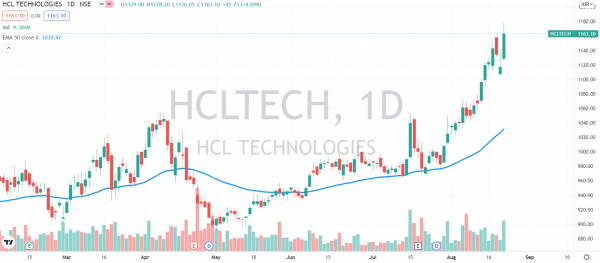

IT stocks broke out in trade. Mindtree (+5%), HCL Tech (+4%), and L&T Infotech (+3%) hit a fresh 52 week high. Check out their charts below. 📈

Cadila Healthcare surged +5% after receiving Emergency Use Authorization (EUA) for its Covid-19 vaccine, ZyCoV-D. 💊The stock closed up +2%.

Arvind Fashions rallied +9%. The company raised Rs 439 cr from marquee investors like Akash Bhansali, Ashish Dhawan among others. 💸

Capacite Infraprojects was locked in a 20% lower circuit. India Ratings and Research downgraded the company to a default rating with a negative outlook. 👎

Zomato dropped -9% after large institutional investors booked profits. The 30 day post-IPO lock-in period got over on Friday. 🤕

Weak debut. Nuvoco Vistas closed down 7% on listing day. Read more below. 😓

Cryptos are killing it. Bitcoin (+2%) crossed the $50,000-mark. Ethereum rose 2%. XRP and ADA jumped 4%-8%. ✅

Here are the closing prints:

| Nifty | 16,496 | +0.3% |

| Sensex | 55,556 | +0.4% |

| Bank Nifty | 35,124 | +0.3% |

Time For A Break?

The 2021 IPO mad rush is on course to break several records. 36 companies have raised Rs 60,000 cr+ this year. 🤑 That’s the highest since the calendar year 2017. While the general mood remains positive, recent trends suggest the primary markets are starting to tire.

For instance, new offerings like Nuvoco Vistas and Chemplast Sanmar barely sailed through. And, 6 out of the 8 companies listed in August are trading below their issue price. ❌ For comparison, 13 companies prior to August have given average returns of +40%. The last IPO to disappoint the Street was Kalyan Jewellers (-25% from IPO price) which was listed on March 26.

So what went wrong? 🤔 Large share sales by promoters, exorbitant valuations, and the overall weakness in midcaps and smallcaps have dented sentiment. Experts predict the IPO activity to slow down in the near term. All eyes are now on the mega $2.2 billion Paytm IPO and big boy LIC early next year. 🔥

Breakout Trades

IT stocks were in high demand. Mindtree (+5%), HCL Tech (+4%), and L&T Infotech (+3%) among others hit a fresh 52 week high. 📈 Here are their charts for your viewing pleasure:

The Covid-19 pandemic has been a catalyst in the tech boom. 💻 Demand for modern technology and better support have increased as work habits changed. Global research firm Gartner upped its 2021 IT spends for a third time, pegging it at $4 trillion. Better margins aided by a weaker rupee is just the icing on the cake. 🎂

Here We Go Again

Grofers became the 24th startup to achieve unicorn status. Let’s go!

Zomato and Tiger Global have invested $120 million in the e-grocer valuing it at $1.1 billion. The latest fundraising round is still open and may attract more cash, as per reports. 💰 For Grofers, securing the funding is essential for the execution of its growth strategy.

The company is building up dedicated e-commerce stores to complete deliveries in 10 minutes. ⏲ The new model is still in the pilot phase with no timeline for a full-scale launch yet.

Albinder Dhindsa, co-Founder and CEO at Grofers told Livemint:

We will be taking our 10-minute grocery model to all cities we operate in eventually. The focus, for now, is the top 12 cities where we will be introducing this model, and over time take it to the next 25 cities.

The online grocery market has become a crowded space recently. 🏃♂️ Tata’s BigBasket, Reliance’s JioMart, and Amazon are formidable competitors with deep pockets. For Grofers to grow and gain market share it will need two things – cash and constant innovation. Let’s see how this goes.

Links That Don’t Suck

💰 Ola, Ola Electric Have Plans To Go Public Next Year: Bhavish Aggarwal

👨💻 Meet The Indians Raking In Lakhs To Find Software Glitches

🍨 How Ben & Jerry’s Makes Nearly 1 Million Pints Of Ice Cream A Day

🚗 2023 Cadillac Lyriq: Get A First Look At The New Luxury Electric Suv

🎭 Rajkumar Hirani Locks The Script Of His Next With Shah Rukh Khan; Casting Begins!

⚽ Premier League Hits And Misses: Manchester United Will Rue Failure To Win At Southampton

🎮 Think You’re A Top-level Gamer? Alienware Wants You To Prove It