Tale of the Tape

Good evening everyone and Happy Friday Jr. 🤗

Markets continue marching higher. Nifty and Sensex close up for a third straight day. Midcaps (+0.4%) and Smallcaps (+0.2%) were relatively quiet. 📈

Most sectors ended in the green. State-owned Banks (+5.4%) were the biggest gainers today. Metals and IT saw profit booking; down -0.6% each. 👍

Give it up for ITC everyone. The cigarette maker ripped +7% after 17 lakh shares changed hands in multiple block deals. Not bragging, but we called it first. 😉🥇

Vodafone Idea skyrocketed +26% after the Government unveiled a host of measures to support the ailing sector. 🤑

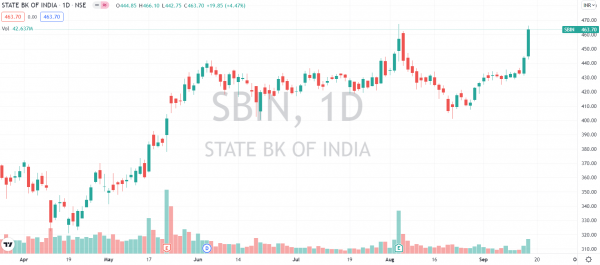

Vodafone’s bankers are cheering. They’ll now probably get repaid. SBI, IndusInd Bank, Yes Bank, and IDFC First rallied between 5%-15%. Check out their charts below. 📊

Hindustan Copper slumped 6%. The Government will sell up to 10% stake in the company via Offer for Sale (OFS). 😓

Fineotex Chemicals (+8%) will take over the India business of Belgian specialty chemical maker, Eurodye-CTC. 💸

HG Infra (+4%) received two new highway projects from the National Highways Authority of India (NHAI). 🛣

Sansera Engineering IPO was oversubscribed 11.5x on Day 3 💰

Crypto’s are adding to recent gains. Bitcoin (+2%) trades above $48,000-mark. Ethereum galloped +7%. Cardano, Ripple, and Doge gain between 2%-4%. 💪

Here are the closing prints:

| Nifty | 17,629 | +0.6% |

| Sensex | 59,141 | +0.7% |

| Bank Nifty | 37,669 | +2.2% |

Put It On My Tab

“Buy Now Pay Later” or BNPL” is the hottest fintech trend of 2021. From BNPL platforms raising millions, to fintech disruptor Square buying AfterPay for $29 billion, it’s all moving real quick. But what is BNPL and why is it so big? 🤔

Buy Now Pay Later is a flexible payment method. It allows users to pay for online purchases in low/no interest installments, or all together at a fixed date. Depending on the service provider, consumers can pay back on a monthly, semi-monthly, or weekly basis. Credit limits range between Rs 5,000-60,000. 💸

Post-Covid, online shopping, and digital payments have obviously jumped. Fixed payments, zero interest (if paid on time), and no hidden fees have boosted the appeal of BNPL services. Rising digitization and low credit card penetration offers a long runway of growth. ✅

In India, Goldman Sachs believes BNPL could drive financial inclusion. 5 cr “new-to-credit” consumers should hit credit markets by 2026. But, BNPL’s astronomical rise has seen several players enter the markets. Currently, there are ~40 platforms, including start-ups, e-commerce firms, banks among others. Also worth watching how BNPL competes with credit cards.

Goldman believes fintechs like Paytm and MobiKwik will benefit in the short run, but large banks like HDFC Bank, ICICI Bank, SBI, and Axis Bank are also well-positioned. Let’s see how this goes. 🔥

Lending Support

It’s no secret that Vodafone Idea will gain substantially from reforms announced yesterday. Experts believe the measures would lead to thousands of crores in savings. Vodafone Idea can hopefully now rather smoothly repay their ~Rs 30,000 cr debt-load. ✌

SBI, which has the highest Vodafone exposure at Rs 11,000 cr, will benefit big time. Mid-sized banks like IndusInd Bank, Yes Bank, and IDFC First can also heave a sigh of relief. Check out their charts below: 📈

Welcome To The Hood

Blue-collar jobs platform, Apna, is the latest entrant to the Unicorn club. What makes this all the more special is that Apna has achieved this feat in under two years!! Congratulations guys 🥳

The company raised $100 million in its latest funding round, led by Tiger Global. The Series C raise valued the startup at $1.1 billion. Owl Ventures, Insight Partners, Sequoia Capital India, Maverick Ventures, and GSV Ventures were investors in the round. 😎

Apna is a networking platform for mid/low skilled workers, much like LinkedIn. Users can access local jobs, network with peers, and tap into upskilling opportunities. They’ve amassed a massive base of 16 million users in a super short period of time. Some of its biggest clients include Zomato, Flipkart, Byju’s, PhonePe, and others. 📊

Apna is still early in the monetization phase. Going forward, it plans to use these funds to aggressively grow. The company is targeting a nationwide presence by the end of the year, and global expansion after that. All the best 👍

Links That Don’t Suck

💰 Swedish Caller-Identification Service Truecaller Seeks To Raise Over $100 Million In IPO

🚀 SpaceX Launches Its First Private Crewed Mission To Space

😂 ‘PM Modi Sent Me Money…’: Bihar Man Refuses To Return Wrongfully Credited Funds

🧥 Canada Goose Jackets Are Made To Withstand The Coldest Places On Earth. And They Are Very Pricey!