Tale of the Tape

Good evening, ladies and gentlemen. Another week is in the books. 🤓 📚

Markets snapped their three-day gaining streak. Nifty and Sensex cooled off sharply after hitting record highs. Midcaps (-1.3%) and Smallcaps (-0.7%) saw steep cuts. Three stocks were down for every one gainer. 👎

Most sectors ended in the red. PSU Banks (-3%) witnessed profit booking. Metals (-2.4%) and Real Estate (-2.3%) stocks were also hammered. 📉

IRCTC (+2.5%) hit a new all-time high of Rs 4019.7 per share. The stock is up +12x since listing. 💰 More details are below.

Hero MotoCorp (+0.4%) will increase prices across models from September 20. 💸

Abhay Bhutada, Managing Director at Poonawalla Fincorp, resigned after being found guilty of insider trading. 🚫 The stock closed up ~3%.

Airline stocks were buzzing in trade. InterGlobe Aviation (+11%) hit a record high. SpiceJet rose +3%. August air traffic improved by +34% over the previous month. 🛫

Serum Institute Life Sciences will buy a 15% stake in Biocon’s subsidiary. 👍 The stock closed +0.2%.

eClerx Services (+3.5%) will buy back shares at Rs 2,850 per share. The buyback price is at a premium of 18% over Friday’s closing price. 🤑

IDFC Ltd (-2%) board approved to sell its mutual fund business. 🙅♂️

TVS Motor (+0.4%) acquired Swiss e-bike company EGO Movement for $18 million. 🔌

Cosmo Films (+3%) will invest Rs 350 cr to set up a new factory in Aurangabad. 🏭 The company also approved Rs 25 per share interim dividend.

Cryptos drifted lower. Bitcoin (-1%) hovered around $48K mark. Ethereum slipped 3%. Solana tanked 13%. 😓

Here are the closing prints:

| Nifty | 17,585 | -0.3% |

| Sensex | 59,016 | -0.2% |

| Bank Nifty | 37,812 | +0.4% |

Full Steam Ahead

IRCTC rallied ~7% to hit a new all-time high of Rs 4019.7 per share. The stock is up +12x since listing in October 2019. 🤯

IRCTC will benefit big time from the travel boom. It is the only company authorized by Indian Railways to offer catering services, online tickets, and packaged drinking water at stations and trains. 🥘

The Government plans to build 400 more stations and add more trains over the coming years. This will have a direct impact on IRCTC earnings because of its monopoly status. 🥇

Besides this, the company is also aggressively expanding its hospitality business. IRCTC aims to become the one-stop-shop for all your traveling needs. To achieve this the company is tying up with hotels, tour and travel service providers, and local food suppliers. 🏨

Despite its fast and furious rise, experts remain bullish on the stock. A diversified business model, healthy return ratio, and debt-free status make IRCTC a compelling story. Those who missed the rally can buy the stock on dips, said experts. 💪

Knock Knock

Paras Defence and Space Technologies IPO will open on Sept 21. The price band is fixed at Rs 165-175 per share. The company plans to raise Rs 171 cr from the markets. 💸

Paras Defence and Space Technologies is an R&D-driven manufacturer of defense and space engineering products and solutions. It is the only supplier of critical imaging components for space applications in India. The company has strong ties with defense companies like Bharat Electronics, Bharat Dynamics, and Hindustan Aeronautics. The company has two manufacturing plants in Maharashtra. ✌

Financial Snapshot:

- FY21 Revenue: Rs 145 cr; -3% YoY

- FY21 Net Profit: Rs 16 cr; -20% YoY

Falling net profits, high dependence on government contracts, and expensive valuations make the IPO a hard sell. Let’s see how this goes. 😑

Tata’s On Fleek

Tata Digital is finalizing plans to launch a new e-commerce platform to sell only beauty and cosmetics products, according to ET. 💄

The new platform will be separate from existing verticals like Westside, which also offers beauty products. This would put the company head-to-head against mass brands like Nykaa, MyGlamm, MamaEarth.

The $13 billion Indian cosmetics market is expected to grow 16% compounded annually over the next 5 years. A big chunk of this growth will be driven by online retails. The Indian beauty e-commerce industry is still in its early days with only a handful of large players. Tata’s, with its strong track record and financial muscle, could become the big disruptor in the space. 💪

Tata is steadily ramping up its digital offerings. In May, the company had acquired a majority stake in BigBasket. Soon after, they purchased online pharmacy, 1mg Technologies, and fitness startup Cult.fit. 👨💻

Movers and Shakers

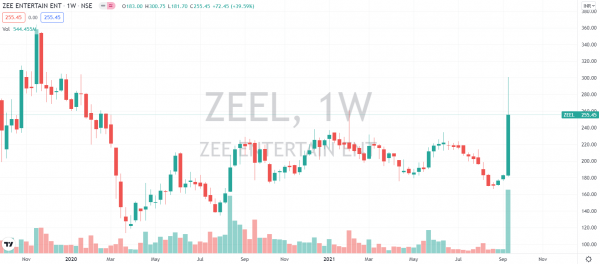

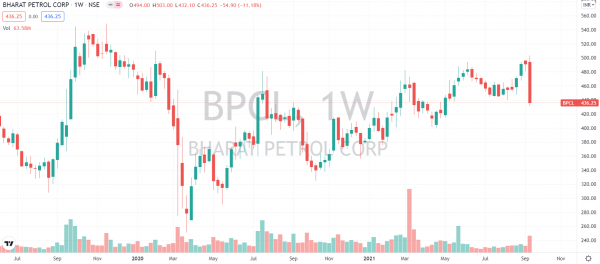

Here’s a look at this week’s top movers. Zee Entertainment soared ~40% after large investors sought a complete revamp of its management. Vodafone Idea ripped 33% on telecom relief package announcement. BPCL closed down 11% after going ex-dividend. GSPL (-8%) posted its worst weekly loss in 5 months.

Links That Don’t Suck

💸 Byju’s Acquires Coding Platform Tynker For $200 Million In US Expansion Push

🛵 Ola Electric Sells Scooters Worth Over ₹ 1,100 Crore In Just Two Days

🚫 $3M In Ether Stolen From Sushiswap’s Miso Launchpad

🍺 Craft Beer Can Be Full Of Surprises, Textures, And Tastes

📱 US, Dubai, And Other Places Where Apple iPhone 13 Series Is ‘Significantly Cheaper’ Than India

🔥 It’s Official! Coldplay X Bts Is Happening With Single ‘my Universe’ And Fans Are Over The Moon

💔 Virat Kohli To Step Down As T20i Captain After 2021 T20 World Cup