Tale of the Tape

Good evening everyone. Markets snapped their three-day gaining streak. 👎

Nifty and Sensex drifted lower as investors booked profits. Midcaps (-0.7%) and Smallcaps (-0.5%) were under equal pressure. The advance-decline ratio (1:2) ratio remained firmly in favor of the bears. 🐻

Most sectors were beaten down. Real Estate (-3%) stocks snapped their five-day gaining streak. Tech stocks (-2%) saw heavy correction for a second straight day. Energy, on the other hand, bucked the trend (+2%). 🔋

Coal India (+5%) hit a new 52-week high. The stock is up +22% in the last month. What’s fuelling the rally in Coal India? Find out below. 📈

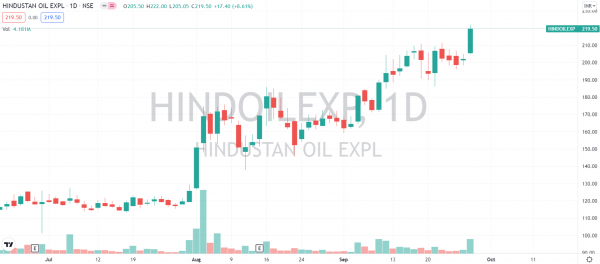

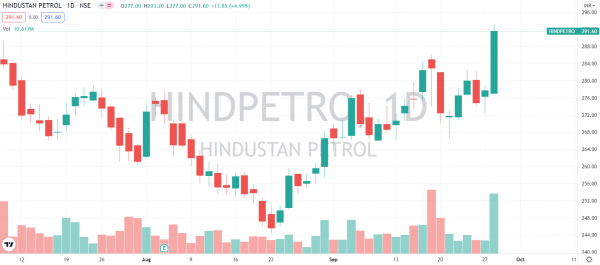

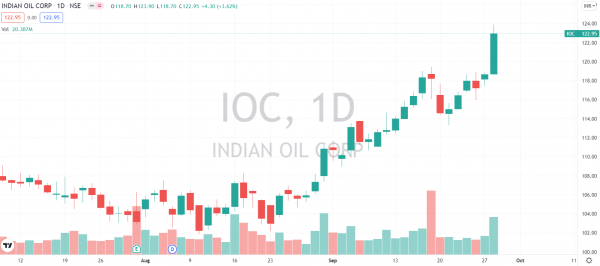

Oil and Gas stocks were also in high demand. Hindustan Oil Exploration, HPCL, and IOCL gained between 4%-8%. Check out their charts below. 💸

PowerGrid will raise Rs 6,000 cr. The stock jumped ~5%. 💰

Raymond (+2%) has approved the plan to reorganize its various businesses. Here’s more details. 📊

Anupam Rasayan (+1%) won new orders worth Rs 145 cr. ✅

Shyam Metalics will invest Rs 750 cr to increase steel manufacturing. 🏭 The stock closed flat.

Man Infraconstruction (-2%) will consider the proposal of a bonus issue on Oct 4. ✌ The stock cooled off after hitting a new all-time high.

Allcargo Logistics (+0.1%) is in talks to reduce its stake in ECU Worldwide. 🤑 Here’s more details.

Cryptos were back under pressure. Bitcoin slipped 4%. Ethereum dipped 5%. Cardano (-4%), Ripple, (-3%) and Solana (-5%) all declined. 😓

Here are the closing prints:

| Nifty | 17,749 | -0.6% |

| Sensex | 59,668 | -0.7% |

| Bank Nifty | 37,945 | -0.6% |

Firing on all cylinders

Coal India, aka the ITC of state-owned companies, is on a tear. The stock is up +22% in the last month to hit the highest level since March 2020. 📈

Coal India is the world’s largest coal producer and accounts for 80% of India’s total coal output. +70% of India’s power capacity is coal-dependent. As you know by now, power demand has increased sharply post reopening. Last month, electricity demand rose 18% YoY crossing pre-Covid highs. ⚡

Coal India said that it will increase supplies, but demand remains substantially high. As per official data, 100 out of 135 plants had less than seven days of coal stock left, as of Sept. 13. This supply shortage may drive prices higher. 📊

Pramod Agrawal, CMD at Coal India, told CNBCTV18 that e-auction prices are up 40-50% in certain segments. Prices are likely to be stable or even increase further in the coming months. This will directly aid the company’s bottomline. 🤑 Coal India’s cheap valuations and a high dividend yield further enhance its appeal.

Pumping In The Gains

Oil and Gas stocks were pumped up today. Hindustan Oil Exploration, HPCL, and IOCL gained between 4%-8%. Check out their charts below. 📈

Pickup in economic activity and easing travel curbs has boosted fuel demand. Oil prices hit a three-year high of $80 per barrel amidst strong demand and lower supplies. Media reports of the Government bringing natural gas under the Goods & Services Tax (GST) ambit is another positive. ✅

Fight For Your Shopping Cart

Swiggy is in talks to raise up to $600 million. This rumored funding round, led by Invesco, could double its valuation to $10 billion! 🍻 But why does it need sooo much money after raising $1.2 billion less than three months ago?

Online food ordering has picked up big time post-Covid. Swiggy has gained share and kept up with its largest rival Zomato thanks to high discounts and low delivery charges. Going forward, Swiggy also aims to utilize these funds to double down on its grocery delivery business. 🛒

India’s online grocery market is expected to touch $24 billion by 2025. This is however just 3% of India’s total grocery market. Reason: 90%+ of the market is in the unorganized sector (local or kirana stores). This presents a massive opportunity. 🔥

While the market size is huge, the space is equally tricky to navigate. Only large players with deep pockets can afford to be in the game. 😎 Margins can be low and it’s a scale game. Reliance has steadily built its own e-commerce platform JioMart. Meanwhile, Tata’s bought a majority stake in BigBasket for $1.3 billion. And then there is Amazon.

So far, Swiggy has done a commendable job. It’s established itself as a dominant food delivery platform and successfully transitioned into hyperfast grocery delivery. Let’s see how this one goes. All the best, you guys 👍

Links That Don’t Suck

💰 Amazon-Backed Buy Now, Pay Later Platform Capital Float Raises $50 Million

👟 Nike Shares Fall As Supply Chain Havoc Leads Retailer To Slash Revenue Forecast

👾 Epic’s CEO Has Bad News If You Were Hoping To See Fortnite NFTs

🕺 Mike Tyson To Star In Vijay Deverakonda’s Liger

🥃 How This Family In India Hand Makes A 500-Year-Old Cashew Liquor

⚽ European Super League: UEFA Suspends Legal Action Against Barcelona, Real Madrid, And Juventus

💑 Pro Tips To Break The Ice While Chatting With A Date Online