Tale of the Tape

Good evening y’all.

Markets recovered from day’s low to end with minor cuts. Midcaps (+1.1%) and Smallcaps (+0.4%) fared better. The advance-decline ratio was evenly split. 👍

Most sectors edged higher. Metals (+2.3%) and Energy (+1.9%) stocks cornered most of the gains. Banks (-0.5%) and NBFCs (-0.9%) remain under pressure. 🔻

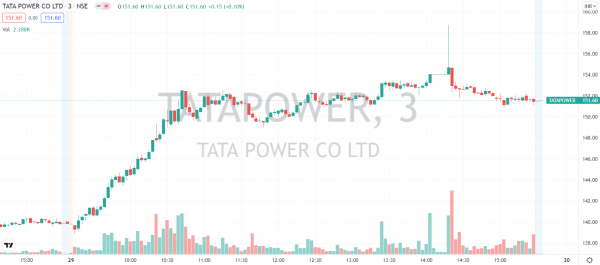

Power companies were at the heart of all the action. Tata Power, Sterling & Wilson Solar and NTPC advanced between 7%-8%. Check out their charts below. 📈

HDFC AMC dropped 5% after promoter Standard Life sold +1 cr shares of the company. 💸

HDFC Bank (-1%) said it issued 4 lakh new credit cards after The Reserve Bank of India (RBI) lifted its ban on the lender. Check out what this means for the company here. 💳

Bharti Airtel will hold a press conference tomorrow at 12:15 PM. The company did not disclose the agenda of the meet. We’ll let you know once we hear something. 🧐

Future Group stocks were up. The National Company Law Tribunal (NCLT) allowed the Group to hold a shareholders meeting to seek approval for the Reliance Industries deal. ✅

The Government may sell its stake in NBCC (+2%) and SAIL (+3%), according to media reports. 📰

SVP Global Ventures (-2%) will enter the textiles business. The company will invest Rs 100 cr to set up a new plant in Rajasthan. 🏭

IPO update. Aditya Birla Sun Life AMC IPO was subscribed 0.6x on Day 1. Paras Defence and Space Technologies IPO allotment details are out. Check out if you’re one of the lucky few here. 👍

Cryptos trended higher. Bitcoin rose 1.5%. Ethereum was up 1%. Solana (+4%) and Polkadot (+3%) also advanced. 🤗

Here are the closing prints:

| Nifty | 17,711 | -0.2% |

| Sensex | 59,413 | -0.4% |

| Bank Nifty | 37,743 | -0.5% |

Black Out?

Believe it or not, most countries are facing an acute power shortage. This may severely impact several industries and push prices higher. But, how did we get here in the first place? 🤔

There are many reasons behind the global energy crisis. The global economy has recovered faster than expected. Demand for everything from electronics, cars, to fashion has increased. Supply chains, on the other hand, have yet to fully recover. Also, companies have increased the usage of clean energy to combat climate change. But, a lack of investment in the renewable space means there’s only enough natural gas supply to fuel our post-pandemic recovery. ⛽

As a result, energy prices have shot up. Oil now costs nearly $80 per barrel. European natural gas prices are up 500% this year. Meanwhile, coal prices hit a 13-year high in Europe and trade at record levels in Asia. 🤯

China, the world’s manufacturing hub, is again at the receiving end of things. At least 20 provinces, making up 66% of the country’s total GDP, have announced some form of power cuts. China’s power cuts are targeting heavy industrial users like steel, cement, and aluminum companies. The combination of strong demand, high fuel cost, and supply tightness may drive prices higher, say experts. 💸

We only have one thing to say. Winter is coming. 🥶

Let There Be Gains

Power stocks saw big moves today (no surprise if you read above 😊). Hopes of improved earnings driven by strong power demand boosted sentiment. Tata Power, Sterling & Wilson Solar and NTPC gained between 8%-12%. 🤑 Check out their charts below:

All Things Digital

Unified Payments Interface (UPI) transactions hit a new all-time high in July! 🥇The value of all transactions more than doubled YoY to Rs 6.06 lakh cr. This beats the previous best of Rs 5.47 lakh cr monthly value in June.

Digital payments have seen a big jump in popularity, particularly amongst young millennials. Be it for shopping groceries or buying the latest gadgets, UPI is everywhere. In July, the number of digital transactions +2x YoY to 3.25 billion. But, guess what – this is just the beginning.✌

The digital payments market in India is estimated to 3x from Rs 2,153 lakh cr to Rs 7,092 lakh cr by FY25. Increased smartphone penetration and cheap data prices, attractive discounts, and ease of use will drive adoption. 📱

This is good news for a host of fintech startups including Paytm. One97 Communications, its parent company, is gearing up for the launch of India’s biggest IPO in over a decade. The Rs 16,600 cr issue is expected to hit the markets later this year. Paytm, which has over 333 million users, has also expanded into equities, gold, and insurance in recent years. 😎

Links That Don’t Suck

✅ Sebi Provides Incentive For High Net Worth Tech Startup Founders To List In India

🦄 Vedantu Turns Unicorn After A $100 Mn Round

🤖 Here’s Everything Amazon Just Announced: A Home Robot Named Astro, A Fitness Band And More

💑 Angelina Jolie And The Weeknd Fuel Dating Rumours Post Another Night Out Together

💯 Meet Paralympic Gold Winner Pramod Whom Sachin Called ‘Inspiration To The World’?

💉 Covid Trials For First Multivariant Coronavirus Jabs Begin: What It Means And How They Will Work