Tale of the Tape

Happy weekend everyone! Markets posted their highest ever weekly close. 😇

Nifty and Sensex were volatile AF today, but closed in the green. Midcaps (+0.4%) and Smallcaps (+1.2%) saw decent gains. ✌

Most sectors ended higher. IT (+2%) and PSU Banks (+1.7%) topped the list of gainers. Real Estate (-2.2%) stocks saw profit booking after yesterday’s massive jump. 💸

The three-day Monetary Policy Meeting (MPC) concluded today. The Reserve Bank of India (RBI) governor Shaktikanta Das left interest rates unchanged and maintained an “accommodative” stance. ✅ More details below.

Tata Consultancy Services will report its Q2 results later today. Analysts expect the company’s Sales and Net Profit to grow by 5% and 10%, respectively. 📊

Reliance Industries (+4%) was the top gainer on Nifty. The company’s market cap crossed Rs 18 lakh crore mark. Take a bow! 🙏

Tata Motors (+2%) is in talks with private equity giant TPG group to invest $1 billion in its EV business, as per media reports. ⚡

Hotel stocks were buzzing in trade. The government will issue fresh tourist visas to foreign nationals visiting India in chartered flights from October 15. Lemon Tree Hotels (+7%), Indian Hotels (+4%), and EIH (+3%) saw healthy gains. 🤑

Mahindra XUV700 bookings crossed the 50,000 mark in less than 48 hours. That translates into an ex-showroom value of Rs 9,500 cr! 🤯

The National Company Law Tribunal (NCLT) ordered Zee Entertainment (+0.7%) to file its reply in the Invesco dispute by Oct 22. 👩⚖️

Cryptos inched higher. Bitcoin and Ethereum rose +2%. Solana jumped +4%. On the other hand, Shiba Inu tanked 31%. Insane! 🎢

Here are the closing prints:

| Nifty | 17,895 | +0.6% |

| Sensex | 60,059 | +0.6% |

| Bank Nifty | 37,775 | +0.1% |

Not Messing Around

The Reserve Bank of India’s (RBI) policy outcome was on expected lines. The Monetary Policy Committee (MPC) kept interest rates unchanged and maintained an “accommodative” stance. ✅ RBI Governor Shaktikanta Das remains committed to reviving growth:

Overall, aggregate demand is improving but slack still remains; output is still below pre-pandemic levels and the recovery remains uneven and dependent upon continued policy support.

There’s a lot more to the RBI policy meet than just interest rates. Here are a few key takeaways. RBI lowered its inflation target for FY22 from 5.7% to 5.3%. They also maintained their FY22 growth forecast at +9.5%. Now that’s what I’m talking about. The Street gave the policy a big thumbs up and markets rebounded from the day’s low. 👍 Here’s the full lowdown.

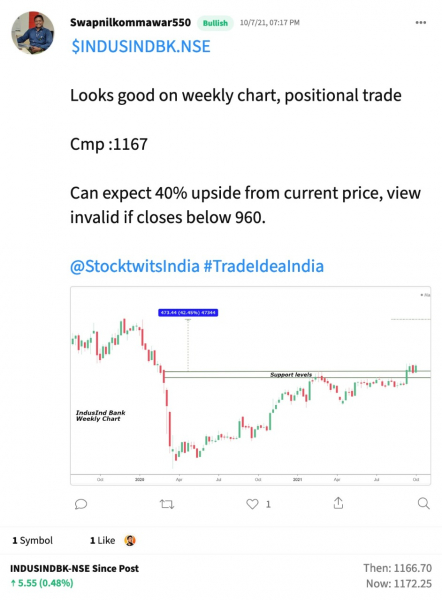

Overheard on Stocktwits

Here’s an interesting chart setup by Kush Ghodasara on Stocktwits that might interest you. Add $BALKRISIND.NSE to your watchlist and track its performance. Here’s the link: bit.ly/3Fl9Vcx

Go Ahead Son

Digital payments startup Mobikwik received SEBI approval for its Rs 1,900 cr IPO. The public offer may hit the markets later this month. Mobikwik is aiming for a $1 billion valuation post listing. Wow! 💸

The company will issue Rs 1,500 cr of shares to new investors. Rs 400 cr shares will be sold by existing investors to new investors. Sequoia Capital India, Bajaj Finance, Abu Dhabi Investment Authority, and Cisco Investments are some of the marquee investors in the company. Like its peers, MobiKwik has evolved from a mobile wallet player to providing a suite of financial services. The company was valued at $700 million in its latest funding round. 😎

Financial Snapshot:

- FY21 Revenue: Rs 302 cr; -18% YoY

- FY21 Net Loss: Rs 111 cr; up from a Net Loss of Rs 99 cr YoY

Mobikwik is a curious name on the long list of consumer internet companies eyeing a stock market debut. The company deals in a number of financial products without a significant market share in either of them. Don’t even get us started on the huge losses. 🤨

Movers and Shakers

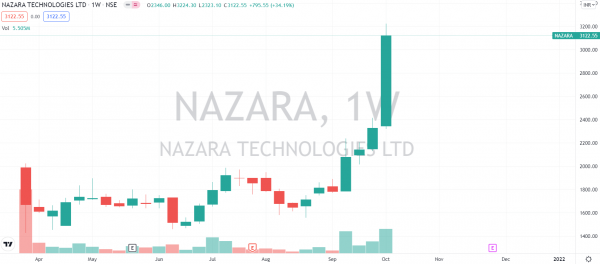

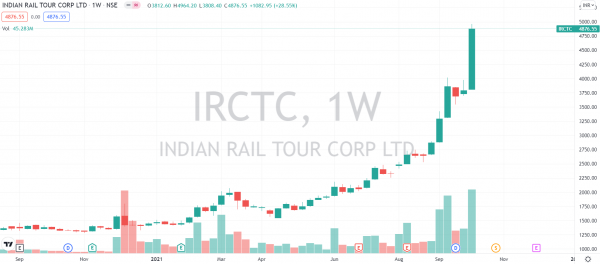

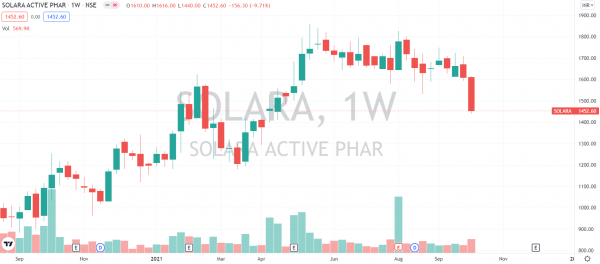

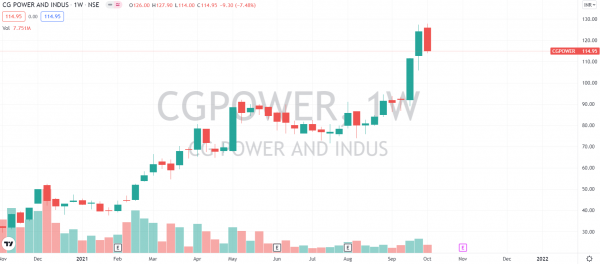

Here’s a look at this week’s top movers from the Nifty 500. Nazara Technologies took the pole position after rallying +34%. 🥇 IRCTC (+28%) posted its highest weekly gain of all time. Solara Active Pharma (-10%) dropped the most in nearly eight months. CG Power (-7.5%) snapped its three-week gaining streak. 📉 Check out their charts below:

Links That Don’t Suck

💓 Tata Wins Air India Bid, Ending 68 Years Of Government Control

💰Twitter Sells Mobile Ad Firm MoPub To Applovin For $1.05 Billion

🐟 This Fish Can Cost As Much As A Car

🤔 Nestle Brings Vegan Shrimp To Plant-Based Market

💑 Tinder And Lyft Partner So You Can Send Your Match A Ride For An “IRL” Date

🏆 Amanda Staveley Says Newcastle’s Long-Term Ambition Is To Win Premier League After Takeover