Tale of the Tape

Hey guys. Markets were down for a second straight day. 📉

Nifty and Sensex cracked over a percent each. Concerns over rising inflation, geopolitical tensions in Europe and the Middle East plus constant FII selling dented investor sentiment. Midcaps and Smallcaps closed flat. 👎

Most sectors ended lower. IT (-2.2%) dropped the most in 6 weeks. NBFCs and FMCG stocks declined ~1% each. 🔻

Bajaj Finance (-2%) hit a new all-time high on strong results. The stock cooled off tracking overall market weakness. L&T Technology Services tanked 6% on weak Q3 earnings. More details below. 📊

Oil and Gas stocks were in high demand. GAIL, ONGC, and Gujarat Gas rose between 3%-4%. Check out their charts below. 💰

Reliance Jio continues to break records. The company became the largest broadband operator in just two years. Read more below. 💯

Vedanta jumped 5% intraday after 5.1 cr shares changed hands in multiple block deals. 💸

Adani Green extended its gaining streak to a 14th straight day. The stock is +44% in January. 🔥

Raymond (+3%) will develop a residential project in Mumbai. The project is estimated to earn Rs 2,000 cr in revenue over the next 5 years. 🏗️

Paytm slipped another 4% to hit a new all-time low of Rs 990 p/sh, down 54% from its IPO price. 🤐

Cryptos cooled off after opening higher. Bitcoin dropped 1%. Ethereum (-3%) hung on the $3,000 mark. Cardano slipped 7% after yesterday’s big move. ⏬

Here are the closing prints:

| Nifty | 17,938 | -1.0% |

| Sensex | 60,098 | -1.1% |

| Bank Nifty | 38,041 | -0.4% |

Earnings Roundup

Bajaj Finance jumped +4% intraday on blockbuster results. Strong all-around growth plus lower bad loans aided the outperformance. Bajaj Finance added 26 lakh new customers in Q23. The company’s Assets Under Management (AUM) rose 26% YoY to hit an all-time high of Rs 1.8 lakh cr. Here’s its report card: 📊

- Net Interest Income: Rs 6,000 cr; +40% YoY (vs Est: Rs 4,910 cr)

- Net Profit: Rs 2,125 cr; +85% YoY (vs Est: Rs 2,075 cr)

- Gross NPA at 1.73% Vs 2.45% (QoQ)

- Net NPA at 0.78% Vs 1.1% (QoQ)

Going forward, Bajaj Finance expects Covid 3.0 to have a limited impact on business. Robust customer acquisition and pickup in economic activity may drive overall growth, said experts.

Bajaj Finance is +51% in the past year. 🤑

L&T Technology Services (-6%) hit a one month on weak results. Lower than industry average topline growth, slowdown in deal wins, and muted management commentary sent the stock crashing. Here’s its key stats:

- Revenue: Rs 1,687 cr; +5% QoQ (Est: Rs 1,705 cr)

- Net Profit: Rs 250 cr; +8% QoQ (Est: Rs 265 cr)

Amit Chadha, CEO & Managing Director at L&T Technology Services said:

During the quarter, LTTS won 3 deals with TCV of USD10 million-plus and our revenue from digital & leading-edge technologies increased to 56%… We continue to see a healthy demand environment across segments and maintain our FY22 USD revenue growth guidance of 19-20%

Overall, the results weren’t so bad. Demand postponement impacted deal wins in Q3. Margins too may see an improvement as they hired more freshers. However, at such steep valuations, the room for error is limited. 🙃

L&T Technology is +115% in the past year.

Jio All The Way!

Reliance Jio has overtaken state-run BSNL to become India’s #1 broadband operator. Jio added ~2 lakh new customers in November taking its overall tally to a record 43 lakh. And, in typical Motabhai style, it took the company just two years to achieve the feat. 🔥

BSNL dominated the segment since its inception about 20 years ago. Fun fact: When Jio was starting from scratch, BSNL had nearly 87 lakh customers. That number has now halved. Jio launched its broadband operations in 2019 with an aim to reach +1,000 cities across India. Attractive pricing, better speed plus connectivity, and extra freebies instantly boosted its popularity. Also, who does not need fast internet while watching Netflix and filing out boring spreadsheets during WFH? 🤷🏻

Speaking of Jio, it further solidified its position in the mobile segment after adding 20 lakh new customers in November. The company also repaid Rs 31,000 cr in spectrum charges to the Department of Telecom. This will reduce its annual interest cost by Rs 1,200 cr. Here’s Business Insider with more. 🤓

Overheard

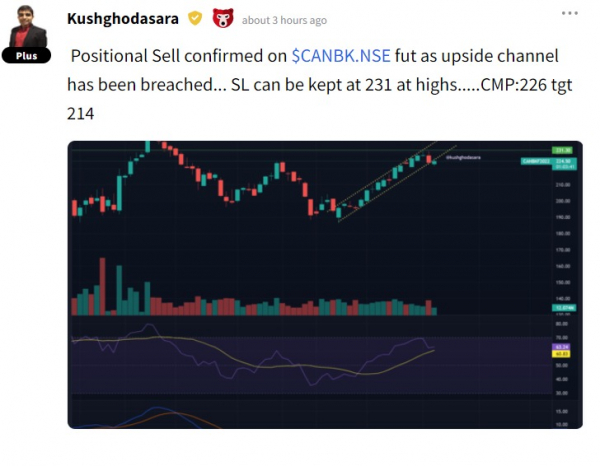

Canara Bank is showing signs of tiredness after gaining ~15% in the past month, according to Kush Ghodasara. Add $CANBK.NSE to your watchlist and be on top of the latest trends, news, and analysis.

Chartbusters

Oil and Gas stocks were pumped up today. GAIL, ONGC, and Gujarat Gas rose between 3%-4%. Check out their charts below. 📈

Pickup in economic activity and easing travel curbs has boosted fuel demand. Oil prices hit a seven-year high of $87 per barrel amidst strong demand and lower supplies. Media reports of the Government bringing natural gas under the Goods & Services Tax (GST) ambit is another positive. ✅

Earnings Highlights

- JSW Energy: Revenue: Rs 1,893 cr; (+17% YoY) | Net Profit: Rs 324 cr; (+1.6X YoY)

- Sterlite Technologies: Revenue: Rs 1,356 cr; (+3% YoY) | Net Loss: Rs 137 cr

- Saregama: Revenue: Rs 150 cr; (+12% YoY) | Net Profit: Rs 43 cr; (+37% YoY)

Calendar

We’re in the thick of the earnings season. Here’s all the companies that will announce their results:

Links That Don’t Suck

🎮 Microsoft to buy Activision in $68.7 billion all-cash deal

💪 UFC Champ Francis Ngannou Teams With Cash App to Take Winnings in Bitcoin

🥪 Jubilant Foodworks opens first Popeyes outlet in Bengaluru

🦸♂️ ‘Moon Knight’ Trailer Reveals Oscar Isaac as Marvel’s Newest Superhero

🚙 MS Dhoni Buys A 1971 Land Rover Series 3 Station Wagon In BBT Online Auction

👨💻 Obsessed with the FacePlay trend on Instagram? Here’s all the data you’re giving away

⚽ Transfer Centre latest: Dusan Vlahovic to Arsenal? Everton target Mourinho and more

🏋️♂️ Are You Losing It Right? The Connection Between Weight Loss And Hair Loss