Tale of the Tape

Hey guys. Markets closed down for a third straight day. 🔻

Nifty and Sensex corrected sharply in the final 30 minutes to end near the day’s low. Midcaps and Smallcaps continued to bleed; down 2% each. The market breadth was extremely weak with over 5 stocks declining for every 1 gainer. 🐻

Most sectors ended in the red. Metals stocks fell over 5% after a widespread sell-off in global commodities. Energy (-3.6%) and Real Estate (-3%) also witnessed deep cuts. ✂️

Asian Paints rallied over 3% intraday on blockbuster Q4 results. Read more below. 🔥

JSW Group bid $7 billion to acquire Holcim Group’s 68% stake in Ambuja Cement and ACC. Arcelor Mittal and Adani are also reportedly in the race. 💰

Sun Pharma (-3%) received 10 negative observations from the US Food and Drug Administration (USFDA) for its Halol unit. 🚨

Adani Wilmar extended its losing streak to day 8. The stock is down 34% from its all-time high. 👀

Rainbow Children Medicare had a muted listing. The stock closed at Rs 450 per share, down 17% from its issue price. 😞

Delhivery’s Rs 5,200 cr IPO opens tomorrow. All details are below. 💸

Cryptos were crushed. Bitcoin (-6%) sank below $30K. Ethereum fell over 3%. Luna nearly halved after Binance suspended trading citing network issues. 🤕

Here are the closing prints:

| Nifty | 16,240 | -0.4% |

| Sensex | 54,364 | -0.2% |

| Bank Nifty | 34,482 | +0.6% |

Earnings Roundup

Asian Paints (+3%) Q4 results blew past Street expectations. Volumes grew 8% over the previous year vs estimates of 2%-4% growth. Industrial and exports business also witnessed strong growth despite a high base. 📊

Multiple price hikes, higher sales of premium paints and prudent cost control measures boosted operational performance. Bottomline growth was restricted due to an exceptional loss of Rs 116 cr in Q4. 💰Here are the key stats:

- Revenue: Rs 7,893 cr; +19% YoY (vs Est: Rs 7,700 cr)

- EBITDA: Rs 1,443 cr; +10% YoY (vs Est: Rs 1,370 cr)

- EBITDA Margin: 18.3% (vs Est: 17.9%)

- Net Profit: Rs 874 cr; +1% YoY (vs Est: Rs 913 cr)

Going forward, Asian Paints is focused on protecting margins and will increase prices by 1.5%-2% from June. Strong real estate demand, hopes of a normal monsoon, and a cool-off in oil prices from the peak are key positives. ✅

Asian Paints is +21% in the past year. 📈

Delhivering The Gains?

Delhivery IPO will open on May 11. The price band is fixed at Rs 462-487 per share. The company plans to raise Rs 5,235 cr from the markets.💰

Founded in 2011, Delhivery is India’s largest and fastest-growing fully-integrated logistic services player. They handle +1.5 million packages a day through their 43,000-strong team across India. Delhivery recently acquired its smaller rival Spoton Logistics for $300 million to boost its B2B vertical. SoftBank, Tiger Global, Carlyle Group, and Steadview Capital are among the investors in the startup. The company will use the IPO money to scale its operations and pursue acquisitions. 😎

Financial Snapshot:

- 9MFY22 Revenue: Rs 4,911 cr (FY21 Revenue: Rs 3,838 cr)

- 9MFY22 Net Loss: Rs 891 cr (FY21 Net Loss: Rs 416 cr)

Big Picture: The Indian logistics market is estimated to grow to $365 billion by FY26, according to RedSeer Consulting. Sustained economic growth, improvement in transport infrastructure, and the rapid rise of e-commerce firms are key positives. 🤗

Delhivery’s market leadership, superb execution track record, and high industry growth potential may drive investor attention. But, the carnage in recently listed loss-making startups like Zomato, and Paytm is still fresh in investors’ memory. Steep valuation plus global market volatility may further dampen sentiment. 👎

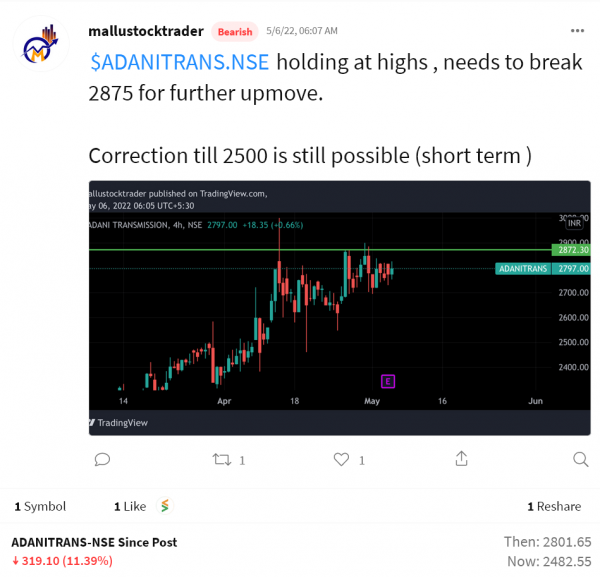

Stocktwits Spotlight

Adani Transmission is down over 11% in just three days. Follow mallustocktrader for more awesome trade ideas like these and add $ADANITRANS.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3zL3xJ9.

Earnings Highlights

- GNFC: Revenue: Rs 2,772 cr; (+60% YoY) | Net Profit: Rs 643 cr; (+1.1X YoY)

- Godrej Agrovet: Revenue: Rs 2,076 cr; (+43% YoY) | Net Profit: Rs 140 cr; (+1.2X YoY)

- SRF: Revenue: Rs 3,549 cr; (+36% YoY) | Net Profit: Rs 606 cr; (+59% YoY)

- Polycab India: Revenue: Rs 3,979 cr; (+35% YoY) | Net Profit: Rs 322 cr; (+19% YoY)

- MRF: Revenue: Rs 5,305 cr; (+10% YoY) | Net Profit: Rs 165 cr; (-50% YoY)

Calendar

A ton of companies will post their Q4 results tomorrow… Here are all the important earnings you don’t want to miss:

Links That Don’t Suck

🥇 India Still Best Equity Story Not Only In Asia But Globally, Says Chris Wood Of Jefferies

🖼️ Madonna Launches First NFTs With Beeple—And They’re NSFW

🧑 7 Similarities That Prove Elon Musk & Howard Wolowitz Are Basically The Same Person

🚀 NASA To Launch £240 Million Spacecraft To Destroy Asteroids; Thanks To Netflix Film ‘Don’t Look Up’

😂 Bride Marries Sister’s Groom After Power Cut During Wedding Ceremony

🔥 Erling Haaland Close To Completing Manchester City Move From Borussia Dortmund

🏋️♂️ Build A Powerful Back: The 101 On Pull-Ups And Pulldowns