Tale of the Tape

Good evening everyone and welcome to the new trading week. 🎲

Nifty and Sensex ended lower for the fifth time in six days. Weak global cues plus consistent FII selling pressure dragged markets lower. Midcaps (1.4%) and Smallcaps (-1.8%) continued to underperform. Over 3 stocks fell for every 1 gainer. 🔻

Except for IT (+0.4%), all sectors ended in the green. State-owned banks (-2%) were the top losers. 📉

L&T Infotech (-3%) will merge with Mindtree (-5%) to form India’s 5th largest IT services company. Read more below. 🤝

Reliance Industries fell over 4% intraday despite steady Q4 results. More details below. 📊

Indostar Capital was locked in a 10% lower circuit amidst reports of financial regularities. Here’s ET with more. 🕵️♂️

HCL Tech (+2.5%) acquired Switzerland-based digital banking and wealth management specialist Confinale AG for Rs 413 cr. 💯

Spring in its step. Campus Activewear kicked off its Dalal Street debut in style. The stock closed at Rs 379 per share, +30% from its issue price. 🤑

LIC IPO was subscribed ~3x on the final day. Hip hip hurray. 🥳

Cryptos were beaten out of shape. Bitcoin (-3%) slipped below $35K. Ethereum tumbled over 4%. Solana, Cardano, and Matic fell between 5%-8% each. 🤕

Here are the closing prints:

| Nifty | 16,031 | -0.7% |

| Sensex | 54,470 | -0.7% |

| Bank Nifty | 34,275 | -0.9% |

BFF

L&T Infotech will merge with Mindtree to form India’s 5th largest IT services company with a market cap of $18 billion. 🚀

What’s popping? The merger will help both companies fix gaps in their services portfolio. For instance, L&T Infotech has a strong presence in the BFSI sector meanwhile, Mindtree is dominant in the retail vertical. The combined entity will also be able to bid for larger deals and cater to a wider customer base. The merger will also help reduce operating expenses which may ease margin pressure. 💰

Here are the deal contours for those who care: It will be an all-stock transaction, which means no cash will exchange hands. Investors will get 73 shares of L&T Infotech for every 100 shares held in Mindtree. The merger will take 9-12 months to complete. Debashis Chatterjee, CEO and Managing Director of Mindtree will lead the combined entity. 🔥

A merger between the two companies was always on the cards after L&T acquired a majority stake in Mindtree three years ago. But, the sudden exit of Sanjay Jalona, CEO and MD of L&T Infotech, concerns over execution plus steep valuations are top risks, said experts. 👀

Earnings Roundup

Reliance Industries (-4%) Q4 results were slightly better than estimates. Strong growth in refining and telecom business boosted operational performance. Rising gas demand plus lower supply due to the Russia-Ukraine conflict sent prices soaring. 📈

Jio’s Average Revenue Per User (ARPU) rose 11% over the previous quarter to Rs 168 thanks to price hikes and rising share of active users. Recent acquisitions plus aggressive store expansion (7 stores added every day in FY22) boosted the retail segment. Here are the key stats: 📊

- Revenue: Rs 2.07 lakh crore; +12% QoQ (vs Est: Rs 2.15 lakh crore)

- EBITDA: Rs 31,366 cr; +6% QoQ vs Est: Rs 31,000 cr

- EBITDA Margin: 15.1% vs Est: 14.6%

- Net Profit: Rs 16,203 cr; +3% QoQ vs Est: Rs 16,640 cr

Mukesh D. Ambani, Chairman and Managing Director at Reliance Industries Limited said:

The gradual opening up of economies coupled with sustained high utilization rates across sites and the improvement in transportation fuel margins and volumes have bolstered our O2C earnings… I am pleased to report that our Retail business has crossed the 15,000 store benchmark. JioFiber is now the largest broadband provider in India within two years of launch. Oil and Gas business is now contributing 20% of domestic gas production.

However, RIL’s Q4 performance failed to excite the Street. Why so? Concerns over volatility in oil prices, muted return ratios, and profit booking after the recent rally hurt sentiment. RIL is +30% in the past year. 💪

Stocktwits Spotlight

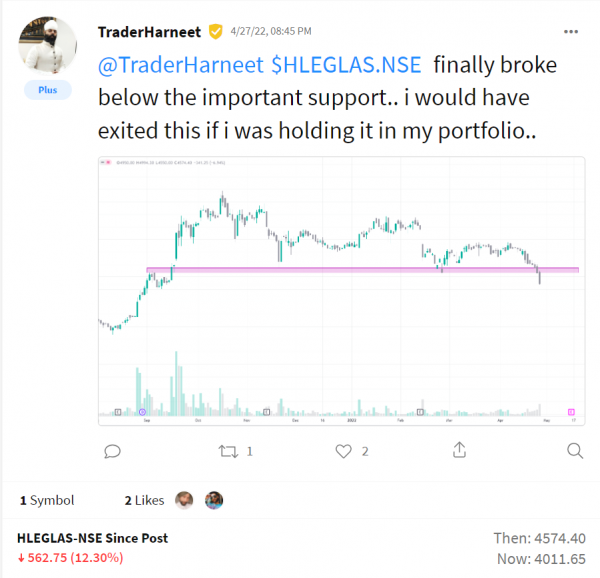

HLE Glascoat is down 12%! The writing was on the chart, according to Trader Harneet. Follow him now for awesome trade ideas and add $HLEGLAS.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3zL3xJ9.

Earnings Highlights

- Tata Power: Revenue: Rs 11,960 cr; (+15% YoY) | Net Profit: Rs 503 cr; (+28% YoY)

- PVR: Revenue: Rs 537 cr; (+1.9X YoY) | Net Loss: Rs 106 cr; (+64% YoY)

- Go Fashion: Revenue: Rs 116 cr; (+29% YoY) | Net Profit: Rs 12 cr; (+73% YoY)

- Navin Fluorine International: Revenue: Rs 409 cr; (+22% YoY) | Net Profit: Rs 75 cr; (+1% YoY)

- UPL: Revenue: Rs 15,861 cr; (+24% YoY) | Net Profit: Rs 1,379 cr; (+30% YoY)

Calendar

Be sure to know when your stocks report earnings. Here’s the results calendar:

Links That Don’t Suck

🤓 Worried About A Recession? Here’s How To Prepare Your Portfolio

🚀 Snoop Dogg, Gary Vee Latest To Buy Ethereum Ownership NFTs In Ice Cube’s Big3 Hoops League

🤭 NASA Is Planning To Send Nudes Into Space To Attract Aliens And We Want What They Are Smoking

💯 Meet Priyanka Mohite, The First Indian Woman To Scale The 5 Peaks Above 8,000m

💰 Box Office: Doctor Strange Conjures Fourth Biggest Opening Weekend For Hollywood In India