Tale of the Tape

Hey guys. Markets were at their boring best today. 🥱

Nifty and Sensex closed barely down as investors remained on the sidelines ahead of the crucial US Fed meet outcome. Midcaps (+0.4%) and Smallcaps (+0.6%) had a rare green day. The advance-decline ratio was split evenly. ✌️

Most sectors ended lower. Energy (-1.2%) and Metals (-0.7%) were the top losers. Auto (+1%) stocks continued to outperform. 💪

Media stocks were in focus after the massive Rs 48,390 cr IPL media rights sale. Read more below. 🏏

Bajaj Finserv was the top gainer on Nifty. The stock jumped over 4%; the highest single-day gain since Jan. 📈

Aurobindo Pharma (+1%) received the US Food and Drug Administration (USFDA) approval for a new drug used to treat partial-onset seizures. 💊

The Competition Commission of India (CCI) greenlit IIFL Wealth’s (+2%) stake sale plans. ✅

Canara Bank (-4%) will consider raising funds on June 24. 💸

Cryptos continued to sink lower. Bitcoin fell 10%. Ethereum crashed 15% barely holding above the $1,000-mark. Solana, Doge, and Matic slipped between 10%-15% each. 🔻

Here are the closing prints:

| Nifty | 15,692 | -0.3% |

| Sensex | 52,541 | -0.3% |

| Bank Nifty | 33,339 | +0.1% |

Money Ball

The BCCI will pocket a massive Rs 48,390 cr from the TV + online streaming rights sale of the Indian Premier League (IPL). This would make it the world’s second-biggest sporting event behind only the National Football League (NFL). That’s insane!!! 🤯

The IPL’s streaming rights were split into two parts – TV and digital for the first time in its history. Star India retained the TV rights for a winning bid of Rs 23,575 cr. Meanwhile, Viacom18 bagged the digital media rights for Rs 23,758 cr. FYI – Viacom18 is a joint venture between Mukesh Ambani-owned Tv18 Broadcast and Paramount Global. 💰

Streaming is Future: Voot, Viacom18’s streaming platform initially focused on the general entertainment category. But, stiff competition from Netflix, Amazon, Disney, and Zee meant that it languished towards the end. They gradually pivoted towards sports streaming and launched a dedicated service to broadcast its sports content across football, tennis, and NBA. Media baron James Murdoch and ex-Star India boss Uday Shankar were also roped in ahead of the IPL media right sale. 💯

India is a cricket-crazy nation with IPL its poster boy. Fun Fact: The previous edition of IPL broke all the records with a total viewership of 405 million!! Voot is expected to grow big time over the next 5 years after securing the digital rights. For users, it means adding one more service to their streaming bill. The question now is which one makes way? Watch out for this space. 🔥

Formula For Portfolio Gains

Chemical stocks have been the darlings of Dalal Street gaining 5x-10x in the last five years. The China-plus One strategy, strong domestic demand, and supportive Government policies have turbocharged the sector’s growth. 🚀

But, do they still make for a good investment case? Yes, absolutely. Then how do you spot the next multi-bagger? Here’s some solid advice from Saurabh Mukherjee, founder of Marcellus Investment Managers. Saurabh recommends identifying companies that produce key inputs for FMCG and Pharma sectors. Besides consistent demand, they also enjoy pricing power which is absolutely essential in the current environment. ✅

Saurabh is bullish on Fine Organics. They make plant-based oleochemicals used in food products, cosmetics, and textiles. Its profits have grown 27% CAGR in the past 5 years plus it’s a debt-free company. He is also positive on Alkyl Amines. They are India’s largest producers of aliphatic amines used in pharma, agrochemicals, and water treatment industries. Its profits have grown ~35% CAGR in the past 5 years plus its deb-free. Valuations, too, have turned reasonable post the recent correction. 👌

Saurabh is also betting big on GMM Pfaudler. Unlike the previous two, GMM is not a speciality chemical maker. Instead, they supply key equipments and complete chemical process systems to these companies. Kinda like an auto-ancillary company but for chemical producers. Makes sense? 🤑

Big picture: The Indian chemical industry is estimated to nearly double by 2025 to $304 billion. Identifying market leaders with a solid management team may be highly rewarding. Invest wisely. 😎

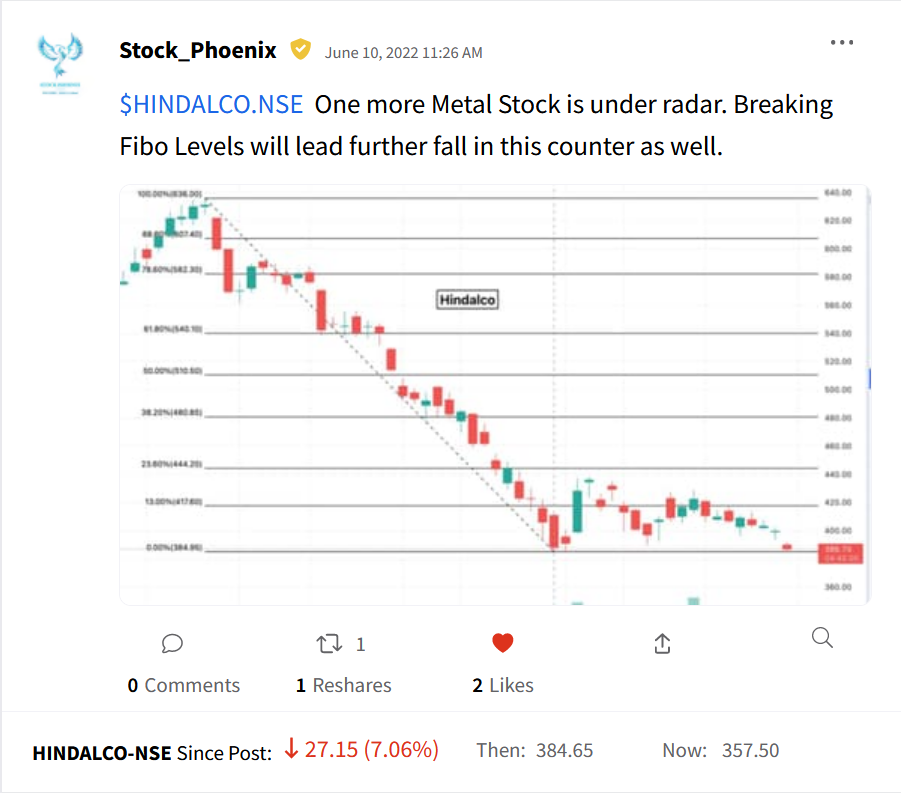

Stocktwits Spotlight

Hindalco hit a fresh 52-week low! Thank you Stock Phoenix for the awesome call. Follow them for more amazing trade ideas and add $HINDALCO.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3MTx200.

Links That Don’t Suck

✂️ Coinbase To Lay Off 18% Of Staff Amid Crypto Meltdown

🙈 What Happens If Bitcoin Falls Below $20,000?

🏖️ Work-From-Bali: You May Soon Live And Work Tax-Free In Indonesia With A Unique 5-Year Visa

🙏 5 Times Cheaper Than Imports, IIT-M’s ‘Kadam’ Helps Amputees Walk Comfortably