Tale of the Tape

Good evening, folks. Markets ended lower for a third straight day. 📉

Nifty and Sensex hit an 11-month low amidst weak global cues. Midcaps (-0.2%) and Smallcaps (-0.6%) continued to grind lower. 🔻

Most sectors ended in the red. Energy (-0.6%) stocks hit a 3-month low. Autos and PSU Banks closed down half a percent each. Real Estate (+0.8%) stocks had a rare green day. 👍

It’s almost a year since Zomato listed on the bourses but markets continue to be split. What is the bull vs bear case for the food delivery giant? Find out below. 🧐

French energy giant TotalEnergies will invest $12.5 billion in Adani Enterprises’ green hydrogen business. 💰

Bajaj Auto tanked 7% after they deferred their share buyback plans. 😟

HDFC Mutual Fund increased its stake in Delta Corp to 9.2% vs 2.2% in the previous quarter. The stock closed up 2%. 💪

Metropolis Healthcare slipped 4% after the company’s promoters denied reports of a stake sale. 🙅♂️

Torrent Power (+3%) acquired a 50 MW solar power plant in Telangana for Rs 416 cr. ⚡

LIC (+1%) closed up for the first time in 11 days. 🙏

Cryptos continued to bleed. Bitcoin tumbled 7%. Ethereum was down 2%. Cardano jumped 13% after hitting new 2022 lows. 🙃

Here are the closing prints:

| Nifty | 15,732 | -0.3% |

| Sensex | 52,693 | -0.3% |

| Bank Nifty | 33,311 | -0.3% |

Wiped Out!

Did you know that Rs 1 lakh invested in Nifty last year would become Rs 99,000 now! That’s right. The recent rout in global equities has wiped out all of Nifty’s gains in the past year. 🤕

What’s the deal bro? Despite a slight improvement in May, retail inflation continues to remain well above the RBI’s 6% tolerance limit. A double whammy of soaring commodity prices especially oil and record-low Rupee has only made matters worse. Experts fear that the RBI may increase interest rates even more in order to control inflation, which is a huge negative. 🚨

The US too is dealing with the same problem but on a much larger scale! The short-term US 2-year Treasury yield zoomed past 3%, the highest level since the 2007 Global Financial Crisis. Rising short-term rates reflect poor long-term market sentiment, meaning investors are losing confidence in the future of the U.S. market. This is a classic recession indicator. Yikes! 🤯

What next? Experts believe that the next 6-12 months may be extremely difficult as markets adjust to the “new” normal. Mahesh Nandurkar, MD & Head of Research, at Jefferies India does not see any upside in the Nifty from current levels for the rest of 2022. Opportunities for wealth creation may be restricted to a handful of sectors. Nandurkar’s top bets include defensives, utilities, consumer staples and autos. He is also selectively bullish on IT stocks post the recent correction. ✅

Zomato: Bull vs Bear

Zomato is down ~60% from its all-time high. Valuations have corrected, but the key question still remains: Is it a buy at current levels? Well, it depends on who you ask. 🤭

Paytm-killer Macquarie initiated coverage on Zomato with an “underperform” rating and a target price of Rs 55 p/sh; -20% from current levels! To be clear, Macquarie is bullish on the long-term growth prospects of the food delivery business. But, Zomato’s inability to ramp up its user base (flat for the past 3 quarters) is a key concern. Rapid growth in transacting users will also be critical in driving profitability. Shortage of delivery partners, margin pressure from higher oil prices, and the recent acquisition of Blinkit are key risks. ⛔

On the flip side, Jefferies believes Zomato is a play on India’s fast-growing food service and digital commerce industry. They expect Zomato’s user base to grow multifold over the next 5 years. Increased preference for ordering, rising smartphone penetration plus cheap data rates, and attractive discounts are key growth drivers. Macquarie has a buy rating with a target price of Rs 100, indicating a +40% upside. 💸

Closing thoughts: Zomato had rebounded sharply in recent weeks on strong Q4 results, a robust business outlook, and a pullback in global tech stocks. But, the contrasting brokerage views mean it all lies in the hands of investors to steer the ship forward. Let’s see how this goes. 😇

Stocktwits Spotlight

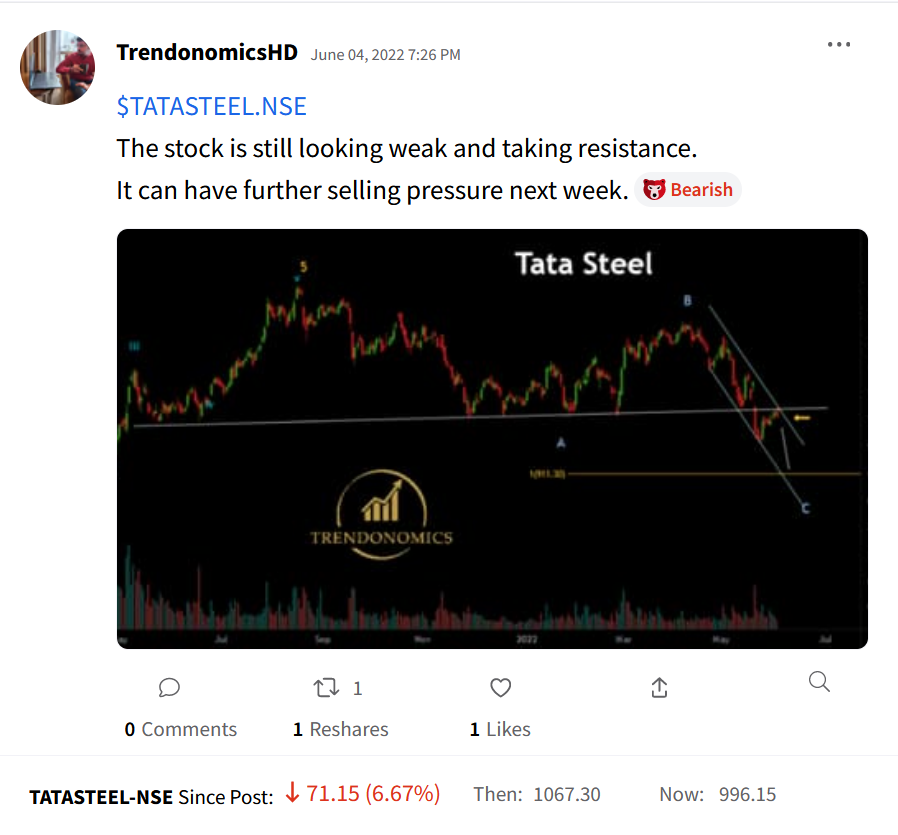

Tata Steel is down 7% since Harsh Dixit aka TrendonomicsHD shared his view on Stocktwits. Follow him for more amazing trade ideas and add $TATASTEEL.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3Qn6vv0.

Links That Don’t Suck

👀 Jim Rogers Says This Could Be The Worst Bear Market Of His Lifetime!

🔻 What Is Celsius And Why Is It Crashing?

🤖 Google Suspends Engineer Who Claimed Company’s AI Had Become ‘Sentient’

💯 Novel Device Makes Saltwater Drinkable 2,400 Times Faster Than Current Methods

📹 Youtube Shares Its First-Ever Video Uploaded 17 Years Ago, Internet Nostalgic