Tale of the Tape

Hey, there guys and gals. Markets were back in the red. 🔻

Nifty and Sensex went belly up in the second half to close near the day’s low. Midcaps (-0.2%) and Smallcaps (-0.1%) also ended with minor cuts. The advance-decline ratio was split evenly. ✌️

Most sectors ended in the red. IT (-0.7%) and Banks (-0.4%) witnessed profit booking. Energy (+0.8%) stocks bucked the trend. 📈

Tata Motors (+1%) has big plans for its EV business. Find out more below. 🚗

HDFC Bank (-0.5%) got the green light from the Reserve Bank of India (RBI) for its merger with HDFC Ltd. ✅

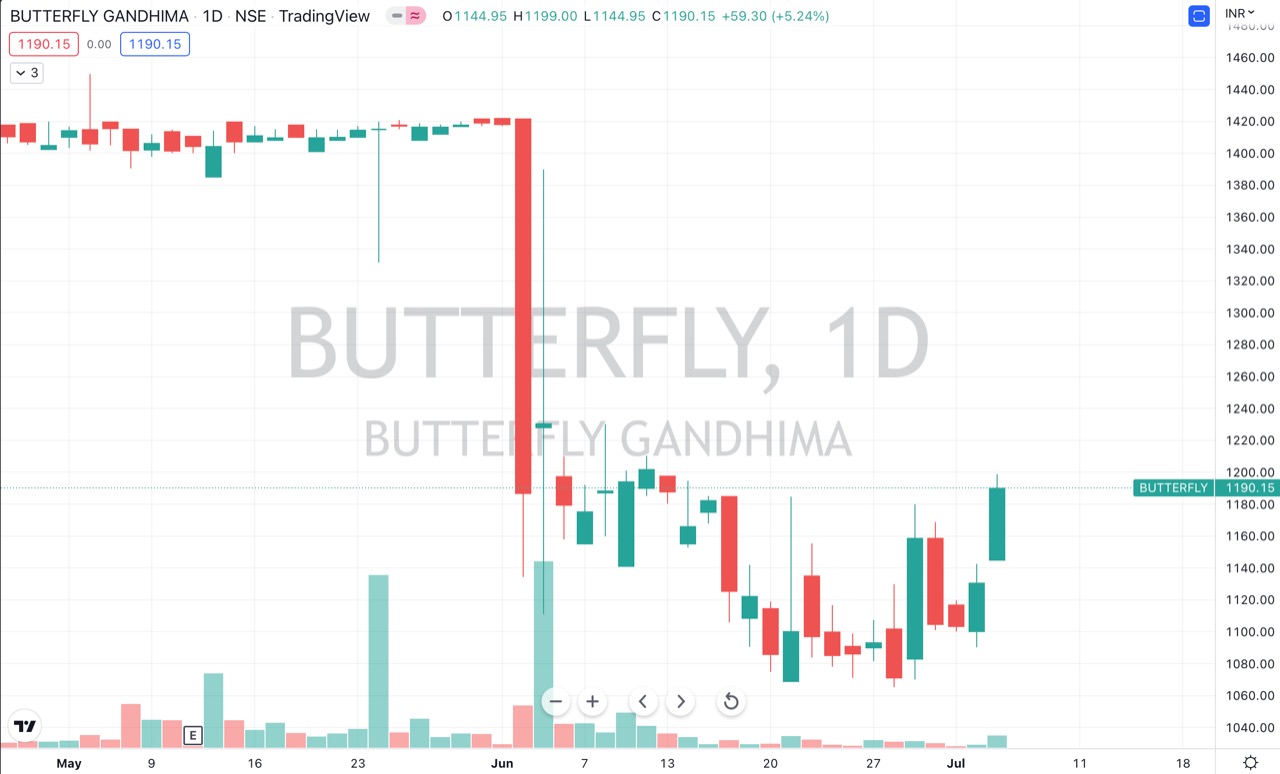

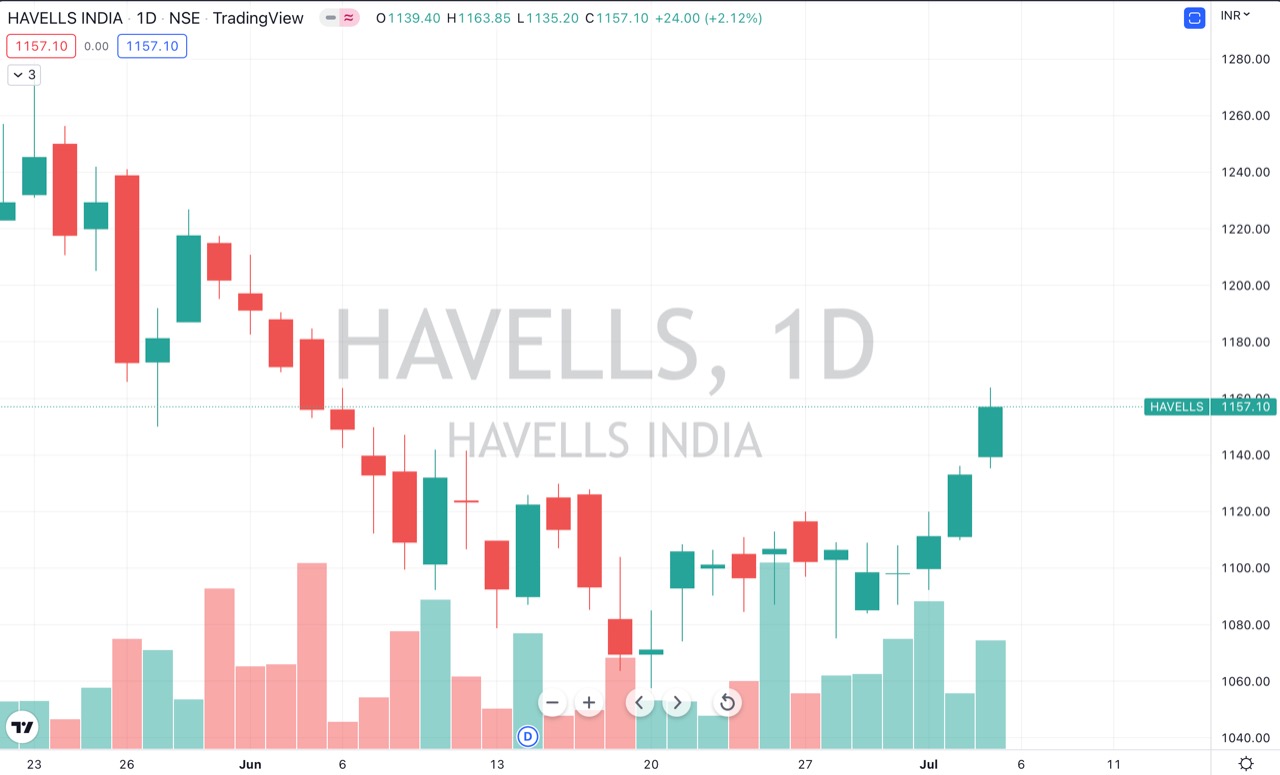

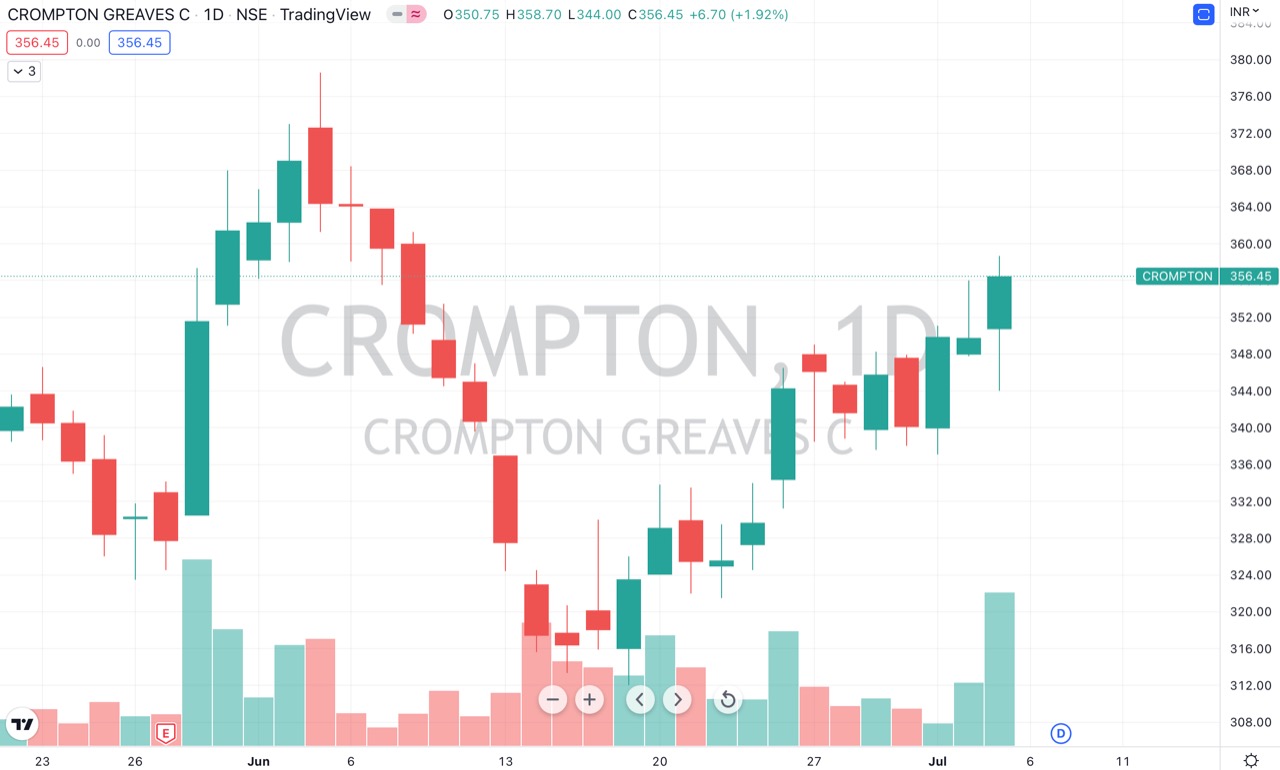

Electrical goods and wire makers were buzzing in trade. Butterfly Gandhimati, Havells India, and Crompton Greaves gained between 2%-5% each. Read more below. 📈

Britannia (-1%) shareholders rejected Rs 5,000 cr investment plan. 🚫

RBL Bank tanked 7% after a disappointing Q1 business update. 😟

LIC surged over 3% intraday. Domestic brokerage firm Motilal Oswal sees a +20% upside from current levels. 💸

Marksans Pharma (+15%) will consider the proposal of a share buyback on July 8. 🤑

Cryptos trended higher. Bitcoin rose 2%. Ethereum rallied ~6%. Matic and Uniswap jumped between 7%-8% each. 🚀

Here are the closing prints:

| Nifty | 15,810 | -0.2% |

| Sensex | 53,134 | -0.2% |

| Bank Nifty | 33,815 | -0.4% |

All Electric

Tata Motors (+1%) aims to sell 1 lakh electric cars in the next two years. PS – they sold a grand total of 5,000 EVs in FY22. Ay caramba! ⚡

What’s the matter, bro? Tata Motors is the poster boy of India’s EV revolution. They have almost complete control of the EV market with an 80% market share. Rising environmental consciousness plus its significantly low running cost boosted EV adoption. Tata’s first mover advantage helped it big time but competition is starting to catch up. Local and international car makers like M&M, Hyundai, and Kia are investing billions to launch electric cars. 🚘

Private equity giant TPG Group has partnered with Tata Motors to scale its EV business. The company will invest $2 billion to create a dedicated line of electric-first cars. They aim to earn 25% of their total revenue from the EV business in the next 5 years! 📊

Zooming Out: India is home to the fifth-largest auto market in the world. But, EVs form only a fraction of it. India has set an ambitious target of achieving 65% electrification by 2030. This translates into a $200+ billion market opportunity, according to the CEEW Centre for Energy Finance. 💰

Chartbusters

Electrical goods and wire makers were in high demand despite overall market weakness. Why so? Copper prices tanked over 20% in the quarter ended June, the worst quarterly fall since 2011. Global manufacturing slowdown and back-to-back lockdowns in China – the world’s largest consumer are key reasons. 📉

The demand-supply imbalance sent copper prices crashing to a 17-month low of $7,982 per tonne. This is positive for consumer durable makers as copper is a key raw material. The cool-off in copper prices along with recent price hikes may boost earnings, according to experts. Butterfly Gandhimati, Havells India, and Crompton Greaves gained between 2%-5% each. Check out their charts below: 😍

Stocktwits Spotlight

Gabriel India hit a five-month high of Rs 137.25 per share. Super call as always by Trader Harneet. Follow him now for awesome trade ideas and add $GABRIEL.NSE to your watchlist to track its performance. Here’s the link: https://bit.ly/3ykaL6o.

Links That Don’t Suck

🔒 Crypto Lending Platform Vauld Halts Operations Citing Financial Difficulties

😅 Bill Gates Shares 48 Years Old Resume To Motivate People But It Didn’t Really Land Well

💯 Kerala Duo Create India’s First Amphibious Building That Floats On Flood Waters

🏍️ From Yamaha R1 To Mv Agusta; Bollywood Star John Abraham Has A Crazy Super Bike Collection