Tale of the Tape

Sup guys? Markets continued to climb higher. 📈

Nifty and Sensex reversed the majority of last week’s losses. Midcaps (+1.4%) and Smallcaps (+1.1%) were back with a bang. The advance-decline ratio (2:1) ratio remained firmly in favour of the bulls. 😇

Not a single sector ended lower. Pharma stocks (+3%) had the best day in four months. Auto’s (+1.7%) and Metals (+1.6%) also witnessed healthy gains. 💪

Multiplex operators are down 20% from their August highs. Should you buy the dip or avoid them completely? Find out below. 🧐

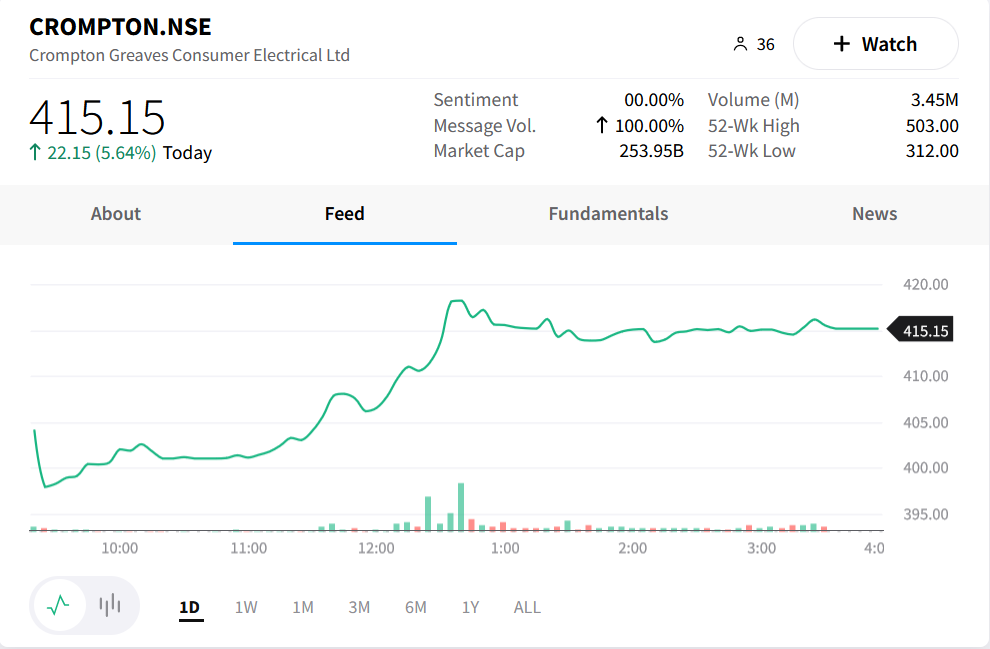

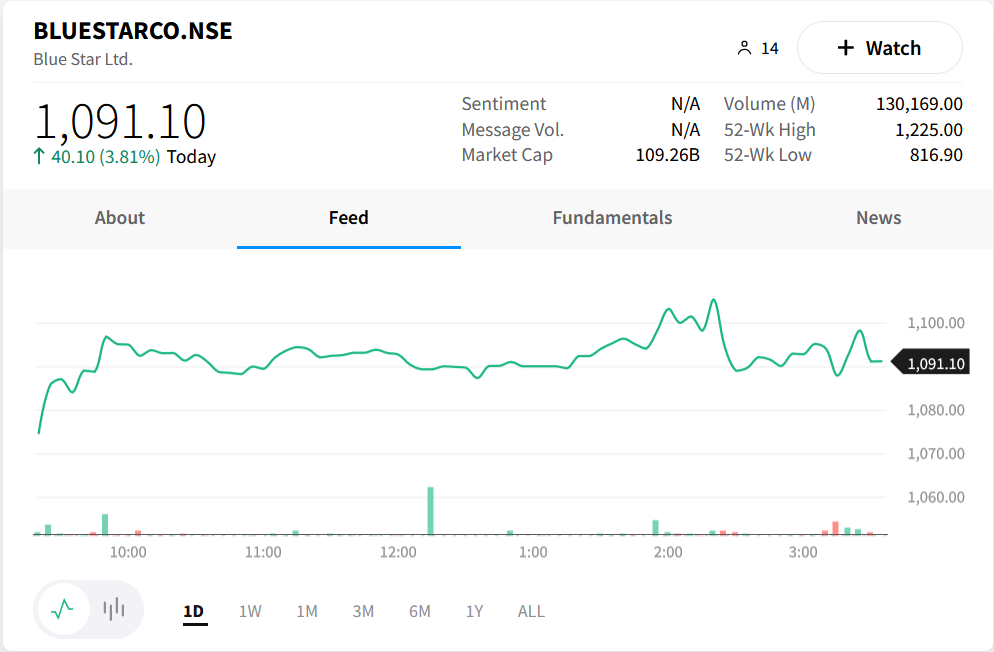

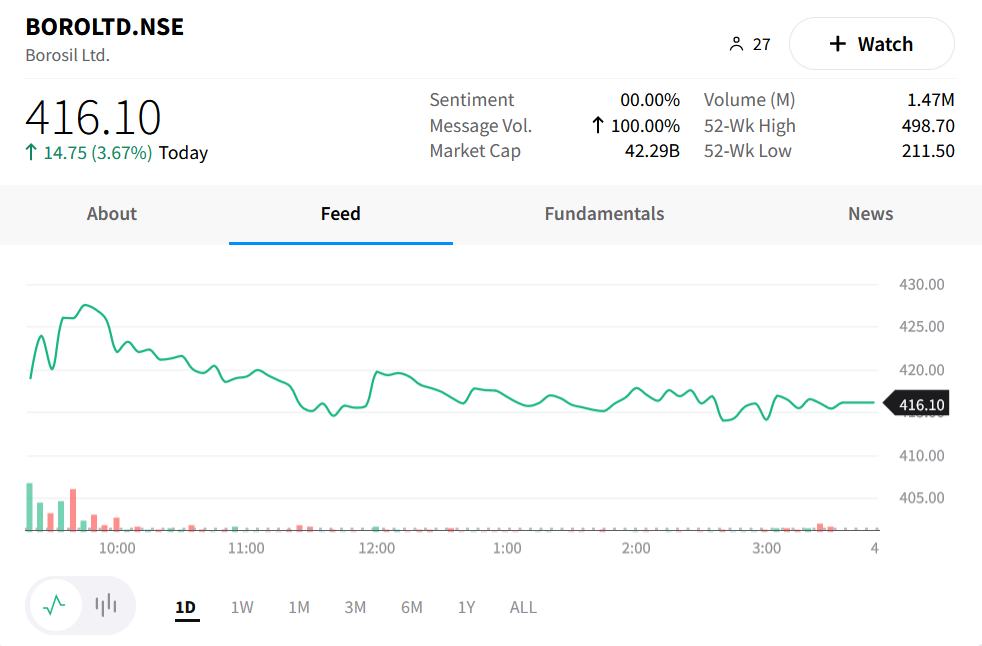

Consumer durables broke out in trade. Crompton Greaves Consumer, Blue Star and Borosil jumped between 4%-6% each. Check out their charts below. 🚀

Adani Ports & SEZ (+2%) hit a new all-time high after winning the bid to develop the 25,000 cr Tajpur Port from the West Bengal government. 🏗️

Advanced Enzyme rallied +15% intraday after Nalanda India Equity Fund bought 29 lakh shares. 💸

Sugar stocks were in high demand on reports that the GOI may increase ethanol prices by Rs 2 per litre. ✅

Canfin Homes extended losses to day 2; the stock hit a two-month low after falling over 7% intraday. 🤕

Bombay Dyeing (+5%) will consider raising funds on Sept 22. 💰

Cryptos were back in the green. Bitcoin bounced +4% but traded below the key $20K-mark. Ethereum rose +5%. 🔥

Here are the closing prints:

| Nifty | 17,816 | +1.1% |

| Sensex | 59,719 | +1.0% |

| Bank Nifty | 41,468 | +1.4% |

Lights, Camera, Action!

As we all know, the last few years have been rough for multiplex runners. Back-to-back Covid waves plus stiff competition from deep-pocketed OTT players messed up business big time. If that wasn’t enough, the recovery was delayed further as a slew of flops at the box office slowed footfalls!!! 👎

Weak content, social media boycott and high ticket prices were some of the main reasons for their failure, said experts. A short OTT window (typically a month or two since release) also discouraged viewers to step out in large numbers. But, going forward, industry watchers expect this trend to reverse. 🤞

The recent success of the Ranbir-Alia starrer Brahmastra, despite mixed reviews, is a sign of strong pent-up demand amongst moviegoers. A power-packed lineup of movies ahead of the festive season like Avatar 2, Black Adam and Vikram Veda have also spurred sentiment. Strong marketing, differentiated content (high on VFX) and solid star cast continue to give movie houses an edge over OTT platforms, said experts. 💯

The completion of the PVR-Inox merger, to form India’s largest entertainment company, is also a major positive. The combined entity will have +1,500 screens pan India and control ~40% of the multiplex market. This share would increase further as they add more screens and old-school theatres (70% of the total film exhibition market) continue to bleed. The merger will also result in significant revenue and cost synergies like negotiating better terms for ad income. PS – domestic brokerage firm JM Financial sees upto 30% in multiplex stocks. 🤑

Chartbusters

The BSE Consumer Durables Index rallied +30% in the past 3 months to hit a new all-time high. But, why so? 🤔

Markets are expecting demand for consumer goods and electronics to shoot up ahead of the all-important festive season. Early trends indicate healthy demand and experts are optimistic that sales would match (if not exceed) pre-Covid levels. For instance, a record 1.6 crore 5G smartphones are expected to be sold during this period, according to industry body Techarc. That’s insane!!! 🤯

Besides this, prices of key raw materials like copper, steel and aluminum have also cooled off in recent months. Lower input costs plus recent price hikes may boost profitability, said experts. 📊

For those who don’t know, the festive period makes up nearly a third of the annual sales for these companies. Covid-led restrictions and supply chain bottlenecks hurt business in the past two years. 😵💫

Crompton Greaves Consumer, Blue Star and Borosil Ltd jumped between 4%-6% each. Check out their charts below: 📈

Stocktwits Spotlight

Mangalam Cement is buzzing! The stock is up +6% in the past week. Huge shoutout to Mishika Chamria for catching the move early (as always). Follow him for more awesome trade ideas and add $MANGLMCEM.NSE to your watchlist and track its performance. Here’s the link: https://bit.ly/3BTaYAt.

Links That Don’t Suck

🔥 Hinduja Group: India is the ‘best bet’ in the global economy

🪙 SEC Claims All of Ethereum Falls Under US Jurisdiction

🪐 Hubble Space Telescope Observes Extraordinary Astronomical Explosion

🤑 Kerala Autowallah Wins ₹25 Crore Lottery & We Be Like Bhagwaan Hum Par Bhi Chheetein Gira Do