Tale of the Tape

Happy Weekend everyone. 🕺

Markets were at their boring best. Nifty and Sensex cooled off in the final hour of trade to end with minor losses. Midcaps (-0.8%) and Smallcaps (-0.6%) witnessed a deeper correction. The advance-decline ratio (1:2) remained in favour of the bears. 🐻

Except for Banks (+0.4%) and NBFCs (+0.2%), all the other sectors closed in the red. FMCG and Metals were the top losers; down 0.9% each. 📉

HUL (-4%) was the top loser on Nifty despite solid Q3 results. More details below. 🧐

M&M will invest Rs 10,000 cr to set up an EV plant in Pune. 🏭

Sun Pharma (-1%) will acquire US-based Concept Pharma for $576 million. 💊

Vedanta will sell its international Zinc operations for $3 billion to Hindustan Zinc. 💰

Dr. Lal Path Labs hit a 6-month low. Kotak Institutional Equities sees a 20% downside from current levels. 🚨

BHEL received a Rs 300 cr order from Gujarat State Electricity Corporation. ⚡

Cryptos traded mixed. Bitcoin and Ethereum rose +1%. Solana, Matic and Doge traded with minor cuts. ✌️

Here are the closing prints:

| Nifty | 18,027 | -0.4% |

| Sensex | 60,621 | -0.4% |

| Bank Nifty | 42,506 | +0.4% |

Earnings Roundup

HUL’s Q3 results beat Street estimates. Volumes grew 5% over the previous year vs -0.9% for the entire FMCG industry. That’s insane! Growth was broad-based with the flagship Home Care segment registering a 32% YoY growth. Lower input costs plus price hikes boosted operating margins. Here are its key stats: 📊

- Revenue: Rs 15,228 cr; +16% YoY (vs Est: Rs 14,780 cr)

- EBITDA: Rs 3,537 cr; +8% YoY (vs Est: Rs 3,445 cr)

- EBITDA Margin: 23.2% (vs Est: 23.3%)

- Net Profit: Rs 2,505 cr; +12% YoY (vs Est: Rs 2,440 cr)

So, what explains the sharp 4% drop in HUL’s stock price? For those who don’t know, HUL is a subsidiary of UK-based Unilever Plc. HUL pays a fixed % of its total turnover as a royalty to Unilever Plc to use its trademark, technology and corporate logo. 💸

HUL, along with its Q3 results, approved increasing this royalty payment from 2.65% currently to 3.45% in phases over the next 3 years. This will have a direct impact on the company’s bottom line, which is a NEGATIVE! Domestic brokerage firm Prabhudas Lilladher estimates the hike in royalty charges will result in a 3% drop in earnings per share (EPS). The risk of another hike after 5 years (the previous contract was for 10 years starting Jan 2013) also hurt sentiment. Double yikes!! 👎

HUL is +13% in the past year. 📈

Star Investor Portfolio

Hey, guys. Today we’re going to check out the top 3 holdings of billionaire investor Vijay Kedia. 💯

- Tejas Networks: Kedia holds a 2.3% stake in Tejas Networks valued at nearly Rs 200 cr. This is the top holding in his portfolio. Tejas Networks is India’s largest telecom equipment manufacturer. They design and sell high-performance optical and data networking products used by telecom service providers, utilities, Govt and defence companies. Tejas is debt free and has given a +30% return in the past year. 📡

- Vaibhav Global: Kedia holds a 2% stake in Vaibhav Global worth Rs 95 cr. Vaibhav Global is a leading fashion retailer with a presence in +30 countries. The majority of their revenue (70%) comes from the jewellery segment and the balance 30% from fashion. Fundamentally speaking, their sales and net profit have grown at 16% and 10% CAGR in the past 10 years. They have a +20% Return on Equity (ROE) and rich dividend payout history. The stock has nearly halved in the past year. 💎

- Elecon Engineering: Vijay Kedia holds nearly 22 lakh shares or a 1.9% stake in the company. Founded in 1951, Elecon Engineering is one of Asia’s largest manufacturers of industrial gears and material handling equipment. Core sectors like power transmission, ports, cement, and industrial metals use their equipment. Elecon has a solid financial track record. Its profits have grown at a 69% CAGR in the past 5 years and have a decent +15% return on equity (ROE). The stock is +95% in the past year. 🚀

Movers and Shakers

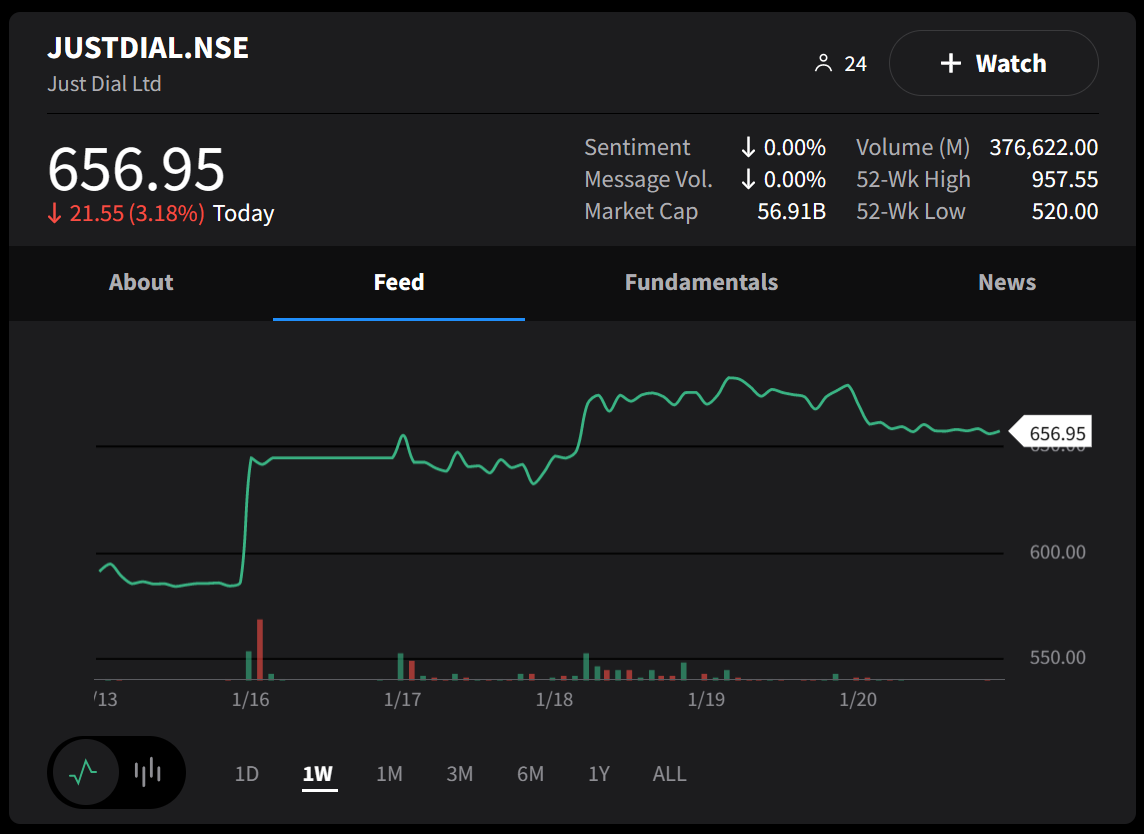

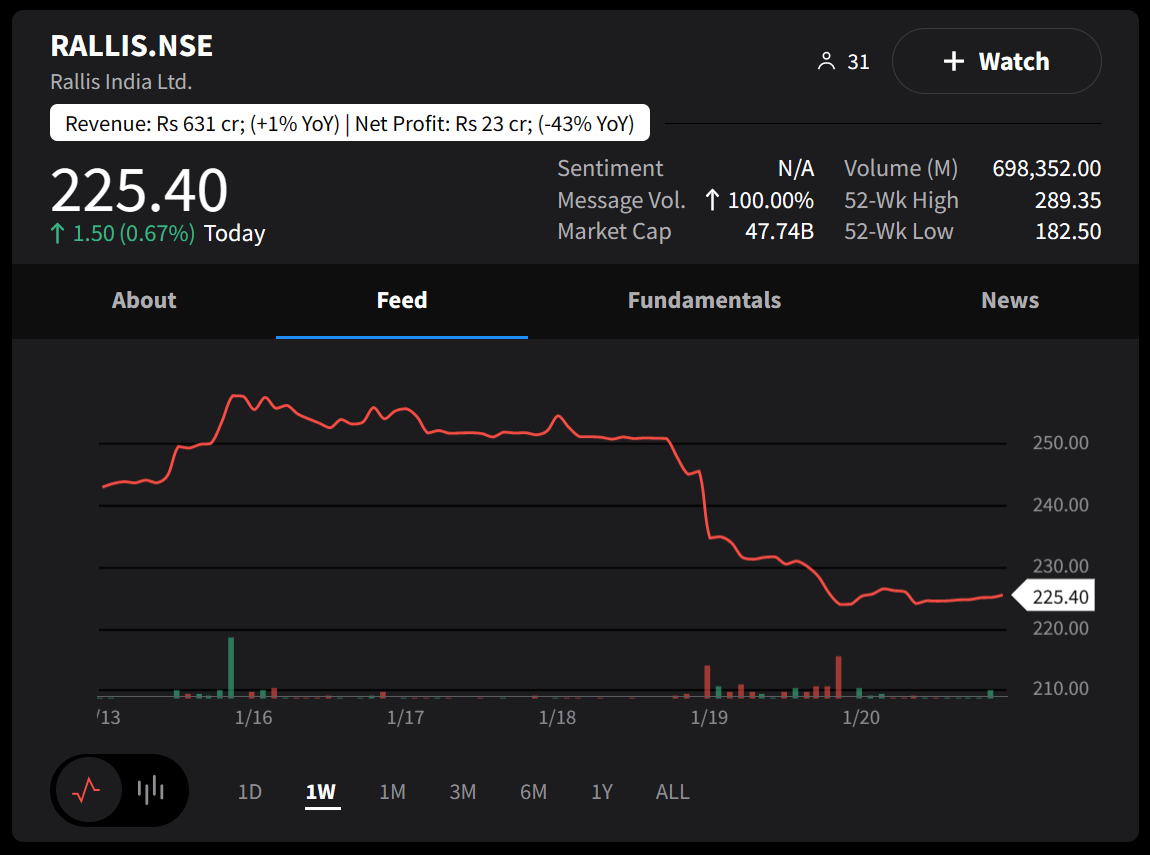

Here’s a look at this week’s top Nifty 500 movers. Just Dial took the pole position after gaining +12%. 🏅 Swan Energy (+11%) hit a new all-time high. Nykaa (-14%) closed down for a third straight week. Rallis India tanked 13% on weak Q3 results. 📉 Check out their charts below:

Earnings Highlights

- Coforge: Revenue: Rs 2,056 cr; (+24% YoY) | Net Profit: Rs 228 cr; (+24% YoY)

- L&T Technology Services: Revenue: Rs 2,048 cr; (+21% YoY) | Net Profit: Rs 304 cr; (+22% YoY)

- Indiamart InterMesh: Revenue: Rs 251 cr; (+34% YoY) | Net Profit: Rs 113 cr; (+61% YoY)

- PVR: Revenue: Rs 941 cr; (+53% YoY) | Net Profit: Rs 16 cr;

- Atul: Revenue: Rs 1,268 cr; (-8% YoY) | Net Profit: Rs 105 cr; (-32% YoY)

Calendar

Links That Don’t Suck

💪 Infra, FMCG could outperform market in FY-24: Nilesh Shah

💰 Microsoft To Invest ₹16,000 Cr To Set Up 3 More Data Centres In Telangana

🦈 Apart From Aman Gupta’s BoAt, All Shark Tank India Judges Are Apparently Drowning In Losses

⚽ Transfer Centre LIVE! All the latest deals, moves and rumours from the January transfer window