Tale of the Tape

Good evening, everyone. Have a great weekend. 😇

Markets snapped their 3-day losing streak. Nifty and Sensex rebounded from the day’s low to close up +0.5% each. Midcaps and Smallcaps ended flat. 😑

Except for Pharma (-1%), all the other sectors closed higher. IT (+1.5%) gained the most tracking the rally in US tech stocks. Real Estate (+0.9%) and Autos (+0.7%) also pulled back after the recent beating. 📈

Adani Group stocks rallied between 2%-6% after receiving the Supreme Court clean chit. More details below. 🧐

ITC ended FY23 with a bang. But, can it continue this rally? Find out below. 🔥

United Spirits rose +3% on strong Q4 results. InterGlobe Aviation ended flat after turning profitable. Read more below. 📊

Nazara Technologies rallied +9% intraday. Its subsidiary Nodwin Gaming raised $28 million in the latest funding round at a valuation of $325 million; +3x from its previous round. 💸

Portfolio changes! Chriss Wood added Axis Bank and Thermax to India equity portfolio. L&T’s weightage increased by 1%. 👍

Ugro Capital was locked in a 10% upper circuit. Ace investor Ashish Kacholia bought 15 lakh shares (1.6% equity). 💰

Sony – Zee merger likely to be completed by September: Sony CEO ✅

Eicher Motors will invest Rs 250-300 cr to scale up their EV business, according to CNBC. ⚡️

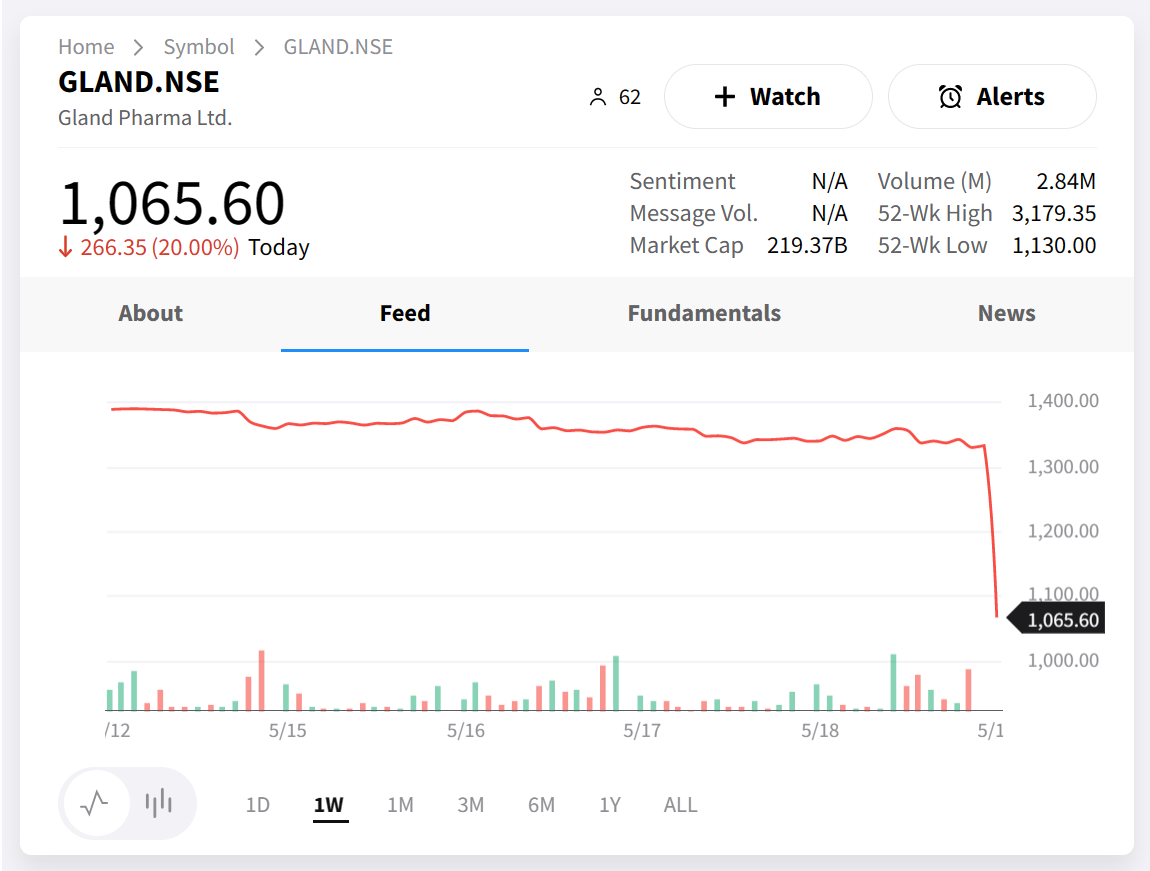

Results reaction. Gland Pharma (-20%) hit a new all-time low. Tata Elxsi rebounded sharply from the day’s low to close +1%. 📉

Here are the closing prints:

| Nifty | 18,203 | +0.4% |

| Sensex | 61,729 | +0.5% |

| Bank Nifty | 43,969 | +0.5% |

Major Relief For Adani

Adani Group stocks rallied between 2%-6% intraday after a Supreme Court-appointed committee said there was no regulatory failure in the allegations raised by Hindenburg Research. ICYMI – Back in January, the US-based short seller accused the Adani Group of stock price manipulation and violation of related party + shareholding rules. 👀

After that, the top court ordered TWO separate probes. It asked SEBI to look into the accusations. It asked an expert committee to determine if SEBI failed in its role as a regulatory watchdog. 💯

What does the committee say and why is it kinda positive for the Adani Group? Firstly, the committee says it’s not possible to conclude SEBI failed in its job. This is because the regulator has done what it could within the power given to it by law. ✅

More importantly, the panel drops hints on the status of SEBI”s probe. The regulator is still investigating, but the committee puts out some fresh info: 🧐

1) On stock price manipulation: It says SEBI didn’t find any pattern of “artificial trading” or “wash trades”. In one patch of trades, the allegedly connected FPIs were in fact, net sellers. 🤷🏻

2) On minimum public shareholding: It says SEBI may have drawn a “blank” and the probe is unlikely to return a conclusive finding if various tax haven authorities don’t play ball. 🔍

3) On related party rules violation: It says SEBI is still collecting data, but that all of the allegedly suspicious FPIs have complied with existing laws. ⚖️

Quote of the day:

“It is this dichotomy that has led to SEBI drawing a blank worldwide, despite its best efforts..The market regulator suspects wrongdoing but also finds compliance with various stipulations…a chicken and egg situation.”

TL;DR: The final word will come from SEBI in August and things can change. But the committee seems to hint that unless a breakthrough happens, it’s unlikely the Adani Group or its foreign investors will be charged with a crime. 😇

Everybody Loves ITC!

ITC ended FY23 with a bang! The last 12 months have been a DREAM RUN for the company. The stock hit Rs 300 last July & then the Rs 400 p/sh-mark in April for the first time ever! The only question is: how much juice is left in the ITC story? Let’s take a look. 📈

First, a Q4 rundown: Strong growth in the FMCG + hotel biz aided top line growth. Its cigarette vertical did well, while the agri-trading biz slumped over commodity headwinds. Decent operating margins led to a sweet 23% YoY jump in net profit to Rs 5,087 cr. 💰

Here’s what’s worked in FY23 and how it ties into the future bull case:

1) The company weathered the FMCG storm of high inflation + weak rural sales very well. A lot better than most of its peers like Dabur in fact. This puts ITC in a good place when market conditions improve as they are now! 💯

2) Hotel biz revenue currently is at 1.7x pre-pandemic levels. Business + leisure travel is up and Covid is a thing of the past. This means the LONG-talked-about demerger could finally happen and unlock a lot of value. 💸

3) ITC’s core cash cow of cigarettes has been helped by a mostly stable tax regime over the last couple of years. A small price hike earlier this year did nothing to dent the stock price. Experts hope this will continue, allowing ITC to chip away at the illegal cigarette market. 🚬

TL;DR: Many of ITC’s key challenges are no longer a thing. And despite its recent rally, ITC is trading at a mostly inexpensive price-to-earnings (P/E) ratio of ~22x. Brokerage firm Sharekhan has a price target of Rs 485, +15% from current level. 🚀

Earnings Roundup

United Spirits (+3%) gained after r Q4 results beat Street estimates. Volumes grew +10% over the previous year led by a higher share of premium products. Fun fact: sales of high margin Prestige & above category rose +23% YoY, which is a POSITIVE. But, higher glass and raw material prices kept operating margins under pressure. 🍻

Here is its report card:

- Revenue: Rs 2,493 cr; -3% YoY (vs Est: Rs 2,349 cr)

- EBITDA: Rs 337 cr; -21% YoY

- EBITDA Margin: 13.5% vs 17% last year

- Net Profit: Rs 204; +7.4% YoY (vs Est: Rs 171 crore)

The company, whose brands include Johnny Walker, had a mixed FY23. While demand remains strong, a cool-off in key raw material prices like glass and extra neutral alcohol (ENA) will be key for margin improvement. ✅

United Spirits is +2% over the past year.

Interglobe Aviation returned to profitability in Q4! Strong air travel demand boosted top line growth. FYI – the airline operated at a peak of 1,815 flights daily during Q4. High ATF prices remained a concern. Here are its key numbers: ✈️

- Revenue: Rs 14,160.6 cr; +77% YoY

- EBITDAR: Rs 2966.5 cr vs Rs 172 cr last year

- EBITDAR Margin: 21% vs 2.1% last year

- Net Profit: Rs 919 cr vs net loss of Rs 1,682 cr

Big Picture: High fuel costs and forex volatility pushed Indigo into losses for the first half of FY23. Strong post-Covid demand countered that in the second half. Key triggers include how IndiGo benefits from Go First’s bankruptcy & deals with competition from new players like Akasa Air. 🥇

Interglobe Aviation is +36.5% over the last year

Movers and Shakers

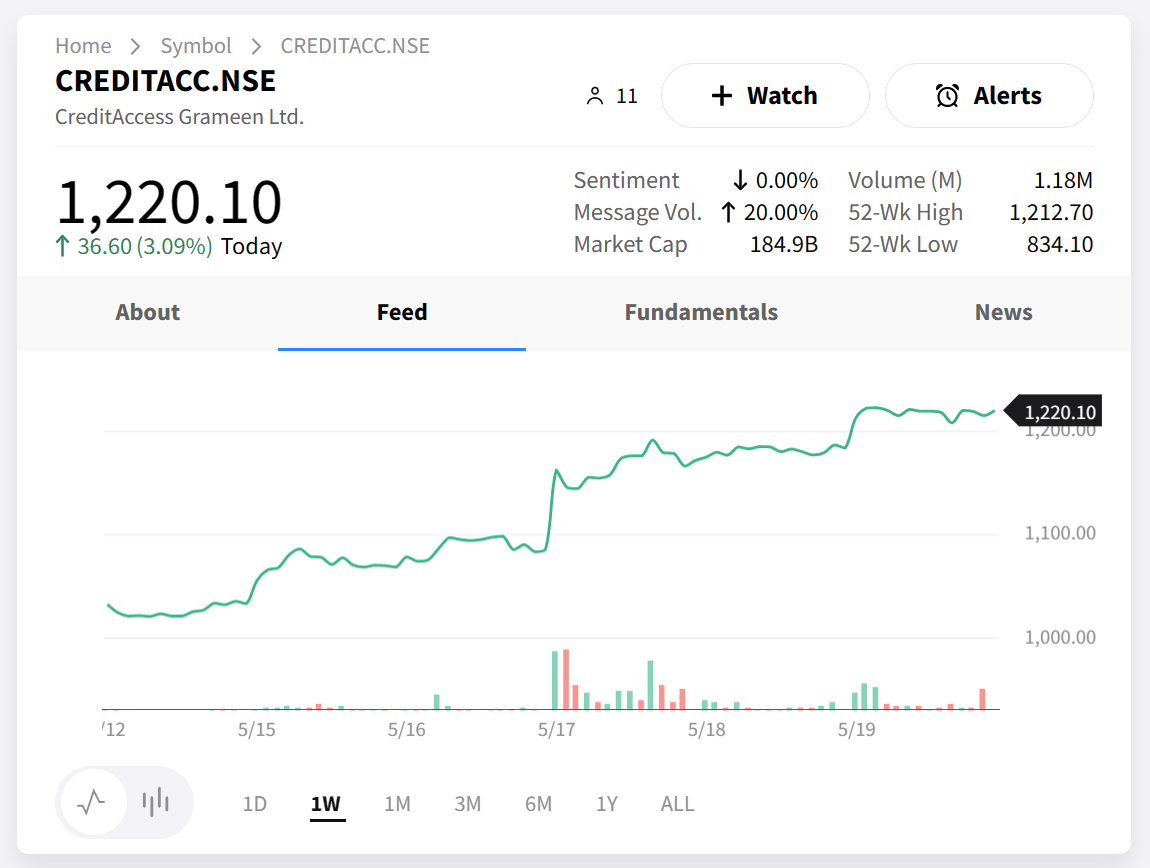

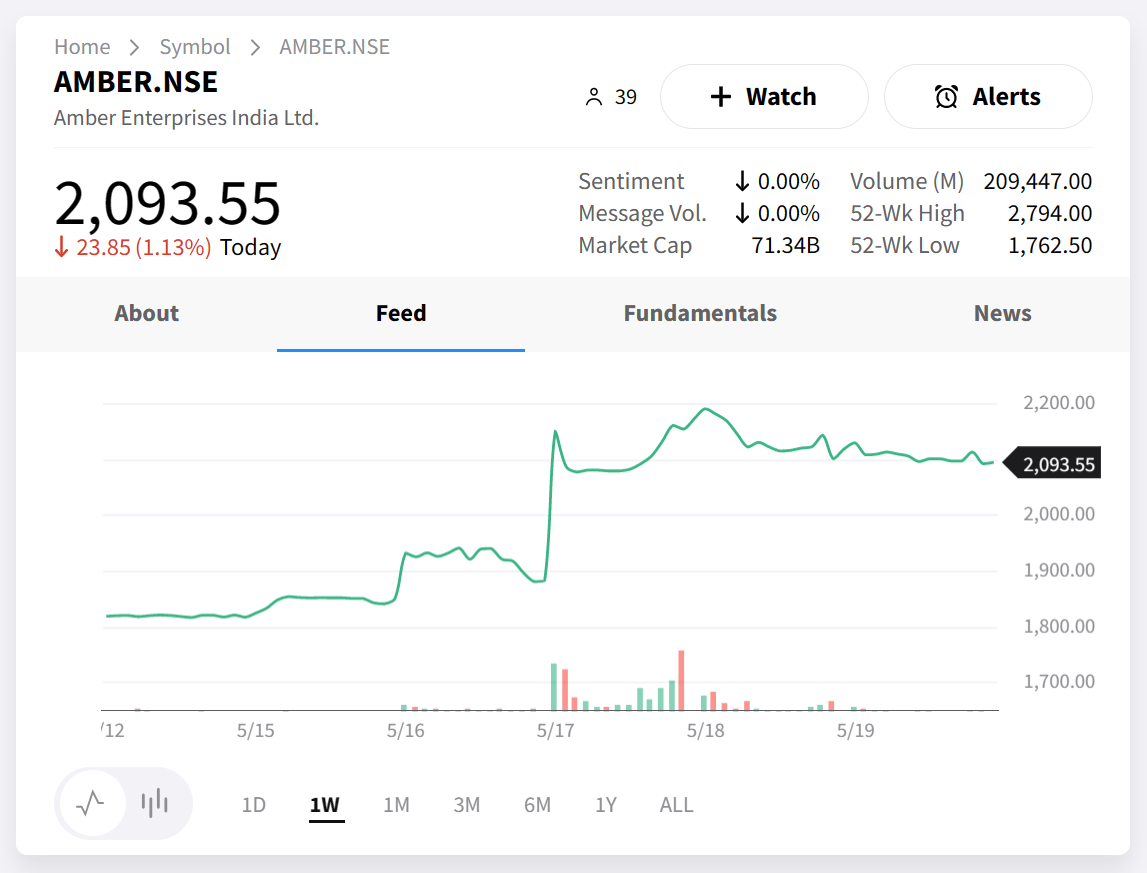

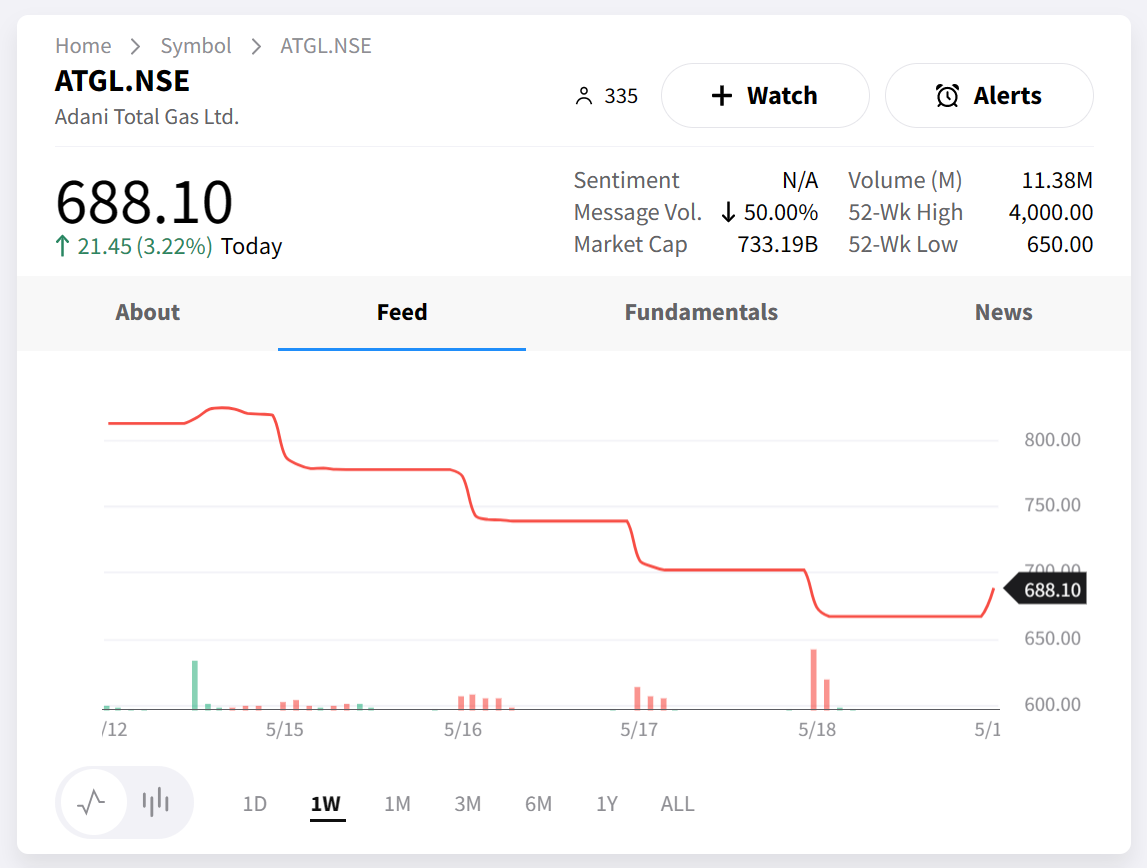

Here’s a look at this week’s top Nifty 500 movers. CreditAccess Grameen took the pole position after rallying +18%. 🚀 Amber Enterprises (+15%) gained the most in a single week since Feb 2021. Gland Pharma crashed -22% on weak Q4 results. Adani Total Gas (-16%) hit a new all-time low. 📉 Check out their charts below:

Earnings Highlights

- Gland Pharma: Revenue: Rs 785 cr; -29% YoY | Net Profit: Rs 79 cr; -73% YoY

- Tata Elxsi: Revenue: Rs 838 cr; +23% YoY | Net Profit: Rs 202 cr: +26% YoY

- PNB: Net Interest Income: Rs 9,499 cr; +30% YoY | Net Profit: Rs 1,159 cr; +6x YoY

- Vinati Organics: Revenue: Rs 503 cr; +4% YoY | Net Profit: Rs 115 cr; +14% YoY

- RateGain: Revenue: Rs 183 cr; +70% YoY | Net Profit: Rs 34 cr; +3x YoY