Tale of the Tape

Good evening everyone! Welcome back to the market of stocks. 👋

Continued IT sector buying left the Sensex and Nifty higher by +1% each. Midcaps (+0.7%) and Smallcaps (+0.4%) also saw decent gains. The advance-decline ratio was evenly split. 🤼

Most sectors ended in the green. IT (+1.8%), Oil & Gas (+1.7%), Pharma (+1%) and Banks (+0.9%) led the rally today. Metal (-0.4%) stocks were the sole loser. 📉

The IT party continues with Wipro and HCL Tech. Read our top story below. 💯

Should Tata Consumer be spending Rs 7,000 cr on these two acquisitions? More details below. 🔍

BHEL gained 3% after winning a Rs 15,000-cr contract from NLC India. 💰

Dixon Technologies slumped 3% after Goldman Sachs downgraded the stock. 👎

Zomato cracked 4% after 4.5 cr shares exchanged hands in a mega block deal; the buyer and seller are not immediately known. 👀

Results reaction. PCBL (+3%) gained after its Q3 net profit jumped 53% YoY. Just Dial (+2%) hit a 52-week-high after its Q3 topline jumped 20% YoY. 📊

Metropolis Healthcare (+3%) gained after clarifying its role in the Delhi Mohalla clinic scam. 😇

Here are the closing prints:

| Nifty | 22,097 | +0.9% |

| Sensex | 73,327 | +1.1% |

| Bank Nifty | 48,158 | +0.9% |

Blockbuster IT Earnings

The IT sector has been on a roll this Q3! The good times continue with both Wipro (+6%) and HCL Technologies (+3%) surging. Wipro had an okay-ish performance that slightly beat Street estimates, while HCL absolutely KILLED it in what should be a weak quarter. 📊

But it’s the promise of a bottoming out and an upturn that has markets excited. Here are the deets on their Q3 report card. 💯

Wipro: First, the not-so-great stuff. A 4.4% YoY drop in the top line (Rs 22,205 cr) and 12% YoY drop in profit to Rs 2,694 cr. That said, operating margins (16%) contracted less than expected. Also, total deal wins in the quarter stood at $3.8 billion. This is similar to what it reported in the Sept quarter and came in HIGHER than Infosys’s $3.2 billion TCV. Finally, strong bullish management commentary lifted sentiment. The commentary has also convinced investors that the worst is over for its key consulting vertical. 💪

HCL: The company put up a good show this quarter, beating all analyst estimates. Its top line grew +6% QoQ in constant currency times. Both revenue and profit grew YoY at 6%+. Operating margins also expanded to 19.8% QoQ. The company was also the ONLY firm out of the ‘top 4’ to report an INCREASE in headcount (+3,818 freshers). Others are reporting a decline, while some like Infosys have stopped all campus hiring this year. That said, the only sour notes were a narrowing of its FY24 revenue guidance (5%-5.5% vs 5%-6% earlier). 👌

Big Picture: Yes, people are really excited to get into large cap IT stocks now. And there’s no doubt there’s a little FOMO for those who hadn’t gotten in. But most experts say wait another quarter to decide whether you want to take the plunge.🤓

A Tasty Deal?

Tata Consumer Products announced two new acquisitions worth 7,000 cr. The company will buy Capital Foods for Rs 5,100 cr. PS – Capital Foods owns Indo-Chinese brands like Ching’s Secret. Tata also said it would acquire FabIndia-backed Organic India for Rs 1,900 cr, which focuses on herbal tea, supplements and organic food. ☕️

Acquiring solid brands over trying to build a new one is the current market playbook. On paper, both these deals are a good fit. Tata Consumer has been slowly losing market share in its core ‘tea’ segment. This is due to increased competition from HUL and local rivals. Organic India’s business is a good way to plug gaps in the tea biz and lure premium customers. 📈

Capital Foods is also a solid win: it has key products in instant noodles, powders and sauces. FYI – if you go by reports, Tata Consumer beat out Nestle and ITC to acquire this company. Tata doesn’t have strong products in this category, so it fills out a neat empty space for the firm and also gives it a seat at the ‘big kids’ table. 😎

Despite this though, the stock was down 1% today. This was partly due to profit-booking (the stock was up 3% on Friday). But also because the fine print is becoming clearer and there are a few problems. 🔍

What are the sore points? For starters, the deals will require significant borrowings of Rs 5,000 cr. As Ambit Capital points out: This will be arranged via rights issue which would lead to equity dilution and impact return ratios. 👎

For Organic India, there are valuation concerns. The deal is being done at 35-40x FY26 EBITDA. On top of this, over 40% of its current revenue comes from the US market, which is not exactly a high-growth area. A lot will depend on how Tata can scale up both brands in the years ahead. 📊

Stocktwits Spotlight

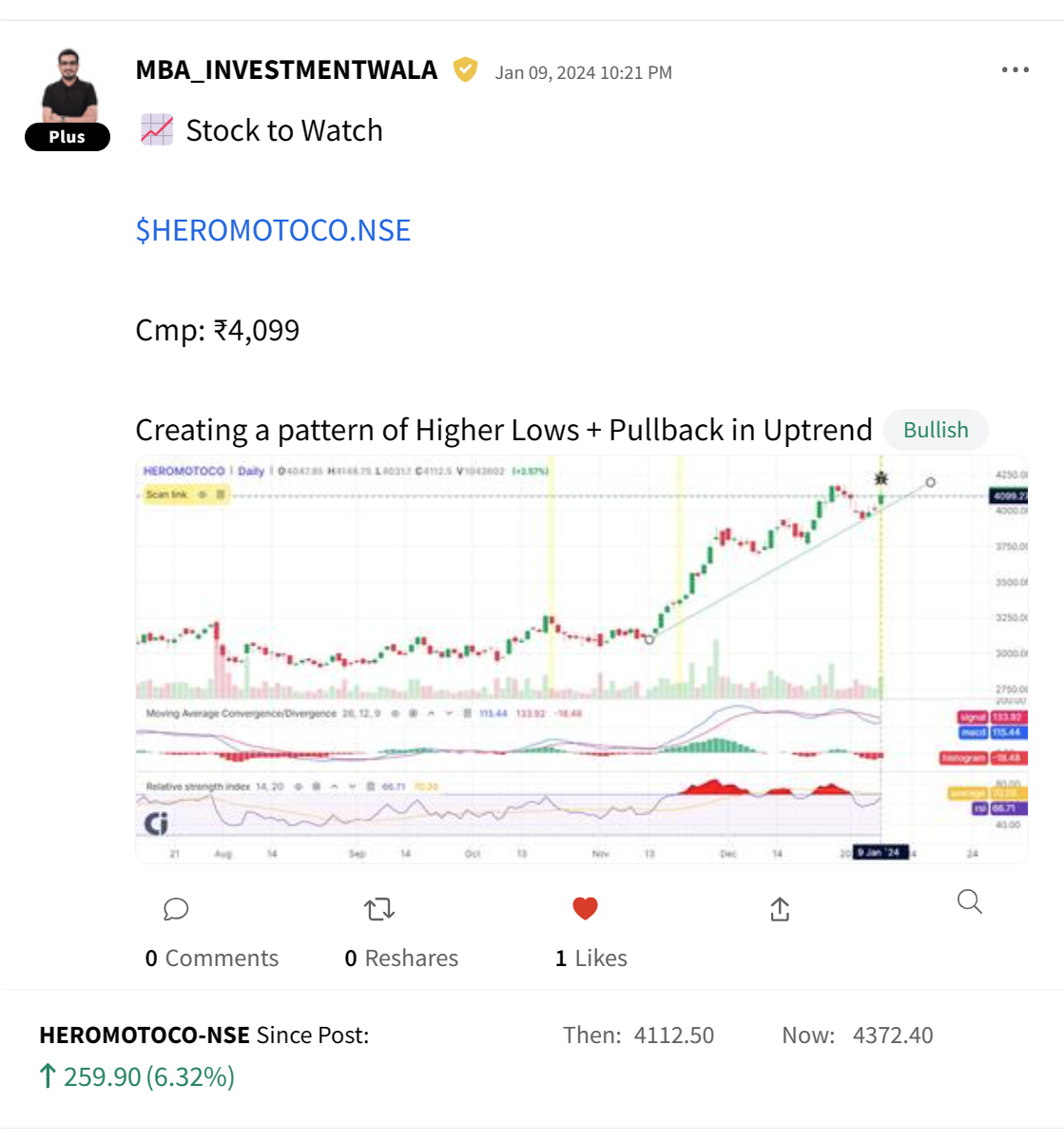

Scooters and motorcycle makers are in high demand. MBA_INVESTWALA’s top pick from the space is Hero MotoCorp. Follow him for more awesome trading insights and add $HEROMOTOCO.NSE to your watchlist and track the latest from our community.

Links That Don’t Suck

💯 5 Winning Stocks to benefit from Ayodhya Ram Mandir Opening

🤔 Is the Sony-Zee merger slowly morphing into a hostile takeover?

🚫 Google pulls Binance, other global crypto apps from India store

👩🏻❤️👨🏻 Anant Ambani & Radhika’s Pre-Wedding Invite Is Out & We Low-key Wish We Could Go

⚽️ Premier League transfers: The strikers who could (realistically) be January targets