Tale of the Tape

Good evening everyone. The weekend’s here! 🥳

Sensex (+0.7%) and Nifty (+0.8%) snapped their four-day losing streak. Midcaps (+1.5%) zoomed while Smallcaps (+1%) also saw decent gains. The advance-decline ratio was in favour of the bulls (3:2). 📈

Across sectors, it was a wave of green. Real Estate (+1.6%), Metals (+1.35), FMCG (+1.2%) and Auto (+1%) were the top winners today. 🏆

Ayodhya stocks are seeing BIG interest. Read our top story below to see which companies could benefit the most. 🙏

IndiaMart InterMesh was up 6% after a decent Q3 showing. Ultratech Cement (+2%) gained after an INSANE rise in Q3 profit. More details below. 📊

Zee Entertainment (-6%) was in focus after reports said Sony would take a call on the merger today. 👍

Aarti Industries surged 10% after Emkay Global slapped a ‘buy’ rating on the stock; the brokerage firm sees a 22% upside from current levels. 🚀

Dixon Technologies cracked 3% after reports said the Directorate of Revenue Intelligence searched its Noida plant. 🚨

MapMyIndia gained 2% after securing a Rs 400 cr contract from Hyundai. 💰

Results reaction. Poonawalla Fincorp hit a 52-week high after reporting strong Q3 numbers. Shoppers Stop declined 2% after its Q3 profit plunged 41% YoY. 🤑

Tata Steel (+2%) gained after reports said it would shut two blast furnaces in Port Talbot and cut 3k jobs. ⛔

Here are the closing prints:

| Nifty | 21,622 | +0.8% |

| Sensex | 71,683 | +0.7% |

| Bank Nifty | 45,701 | -0.1% |

Ram Mandir Stocks

Ayodhya stocks are BUZZING. The Ram Mandir is set to open its doors on Monday, but companies are looking to cash in on what will be a MASSIVE tourist and pilgrimage spot. Here’s the lowdown: 🤓

Hospitality/Tourism: Praveg (+68% last month) and Apollo Sindhoori (+48% last month) are two lesser-known stocks. Praveg is a tourism firm known for its ‘tent cities’; it has two near the Ayodhya temple that has seen 75% pre-sold occupancy! Apollo on the other hand is constructing a huge multi-level parking facility in the city with a rooftop restaurant that can seat 1,000 devotees. A more traditional stock that experts say could benefit is Indian Hotels. The firm is building 5 hotels, with around 520 rooms, in and around Ayodhya. 🧳

Travel: IndiGo has started daily direct flights from Mumbai & Delhi to Ayodhya. SpiceJet has launched 3 non-stop routes to the temple city. The Indian Railways is expected to run over 1,000 trains from 25 cities across the country; ka-ching for IRCTC! EaseMyTrip (+22% last month) has launched a special ‘darshan’ package. Thomas Cook (+10% last month) has special Varanasi-Ayodhya-Prayagraj tours that have seen crazy demand. Ayodhya could see 100k visitors per day over the next few months, which is INSANE. ✈️

FMCG: Dabur is setting up marketing zones and branding nearby dhabas with its ‘Hajmola’ & ‘Real’ brands. ITC is pushing to get its products more visibility across kirana stores. Coca-Cola is setting up 50 new vending machines across the city. Reliance Retail is also majorly ramping up the supply of its ‘Independence’ water bottle product. Overall, Ayodhya is looking to be a big gold rush for FMCG firms this quarter. 🥤

Earnings Roundup

Ultratech Cement (+2%) strong Q3 results beat Street estimates! Domestic volumes were up 5% YoY, aiding a decent bump in the top line. Lower fuel costs + raw material prices boosted margins though. This in turn saw Ultratech report its HIGHEST-EVER quarterly profit in a single quarter, which is INSANE. 🤯

Here are its key stats:

- Revenue: Rs 16,740 cr; +8% YoY (vs Est: Rs 16,649 cr)

- EBITDA: Rs 3,254 cr; +39% YoY (vs Est: Rs 3,209 cr)

- EBITDA Margin: 19.4% vs 15% YoY

- Profit: Rs 1,775 cr; +67% YoY (vs Est: Rs 1,739 cr).

“Given the government’s focus on infrastructure growth and the consequent rising demand for urban housing, the cement sector is poised for strong growth in the coming years,” the company said in a statement.

IndiaMart InterMesh was up 5% intraday after reporting okay-ish Q3 results. A strong festive quarter boosted the topline, led by higher wholesale sales of electronics + manufacturing equipment. A big decline in other income however took a toll on the bottom line. Operating margins were flat YoY, which was decent because employee expenses went up in the quarter.

Here’s its Q3 report card: 📊

- Revenue: Rs 305 cr; +22% YoY

- EBITDA: Rs 86 cr; +22% YoY

- EBITDA Margin: 28% vs 28% YoY

- PAT: Rs 82 cr; decline of 27% YoY

One sour note, that experts highlighted, the net addition of paying subscribers (suppliers) dropped to 1,826 in the December quarter vs 2,064 in the Sept quarter. The management noted that it was looking to “drive deeper penetration of paying customers across cities”.

Movers and Shakers

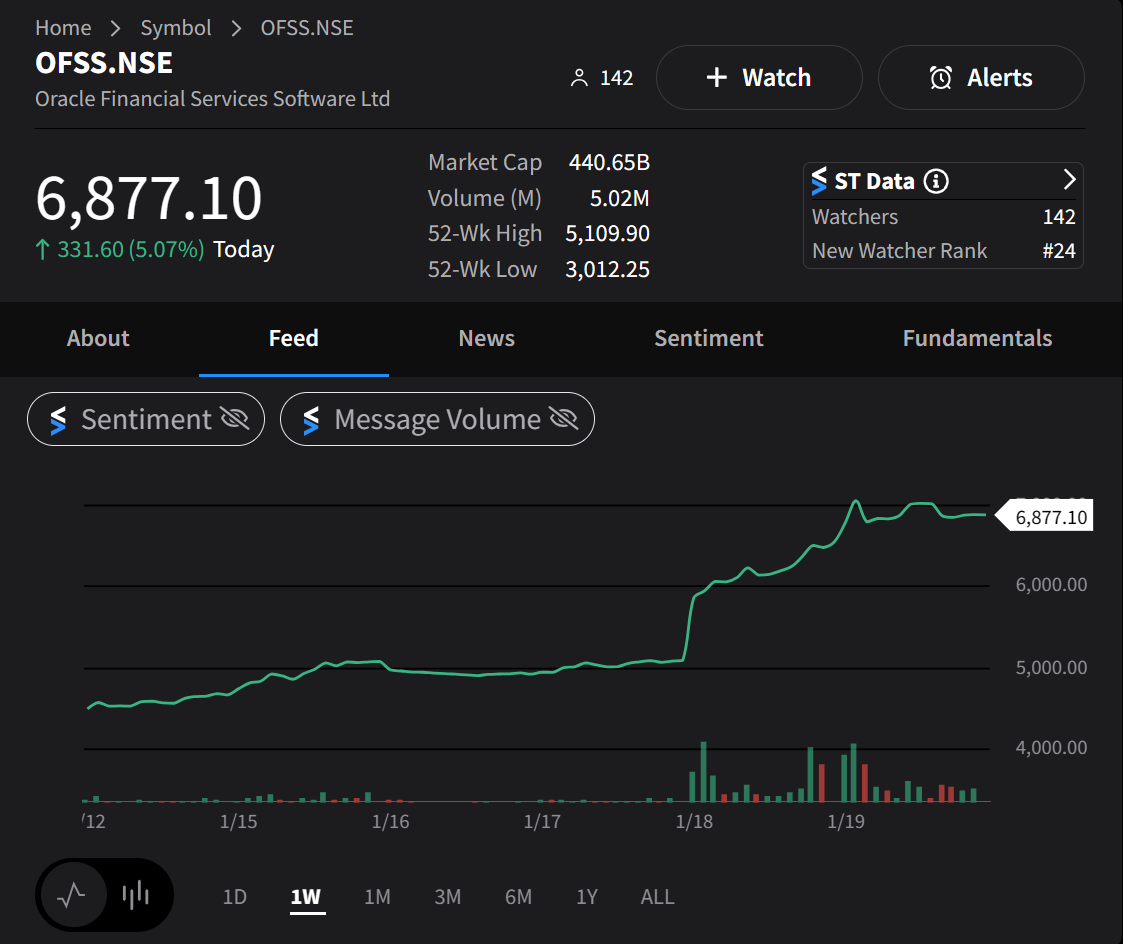

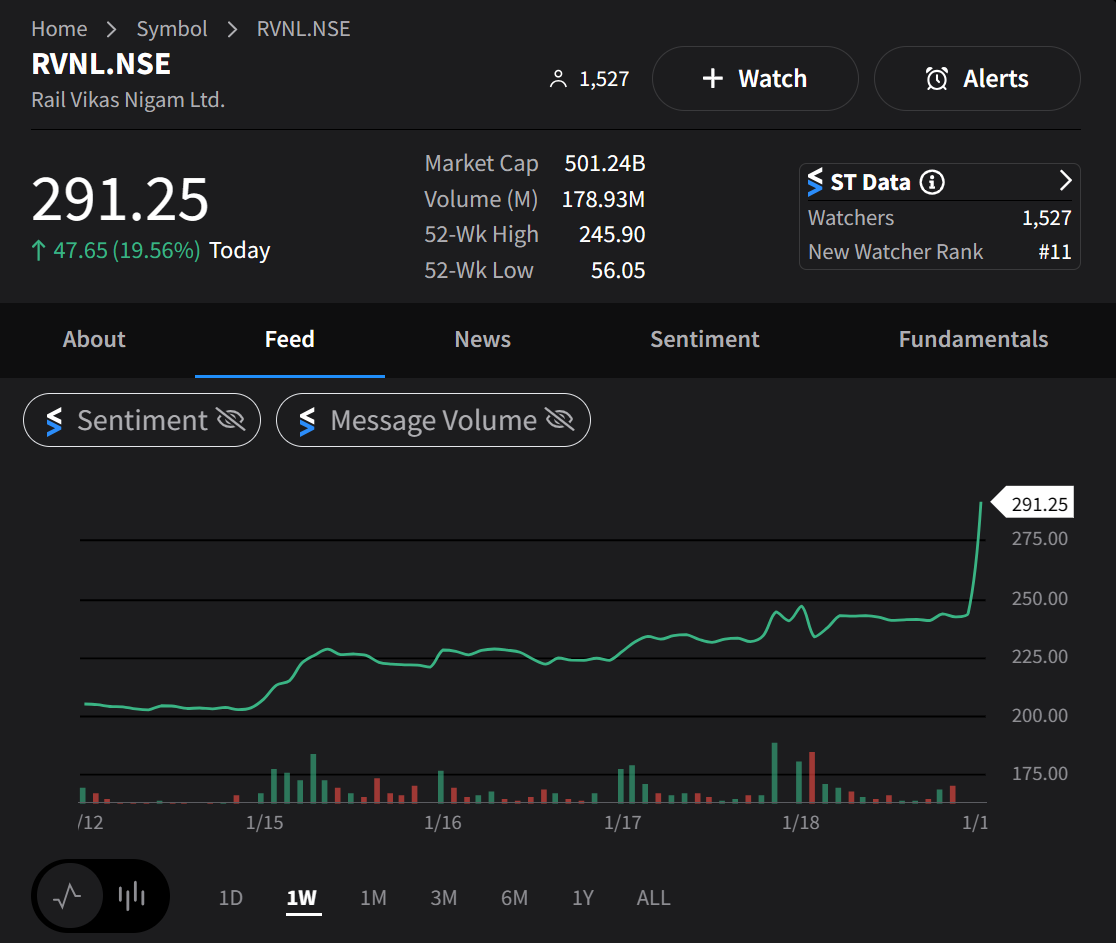

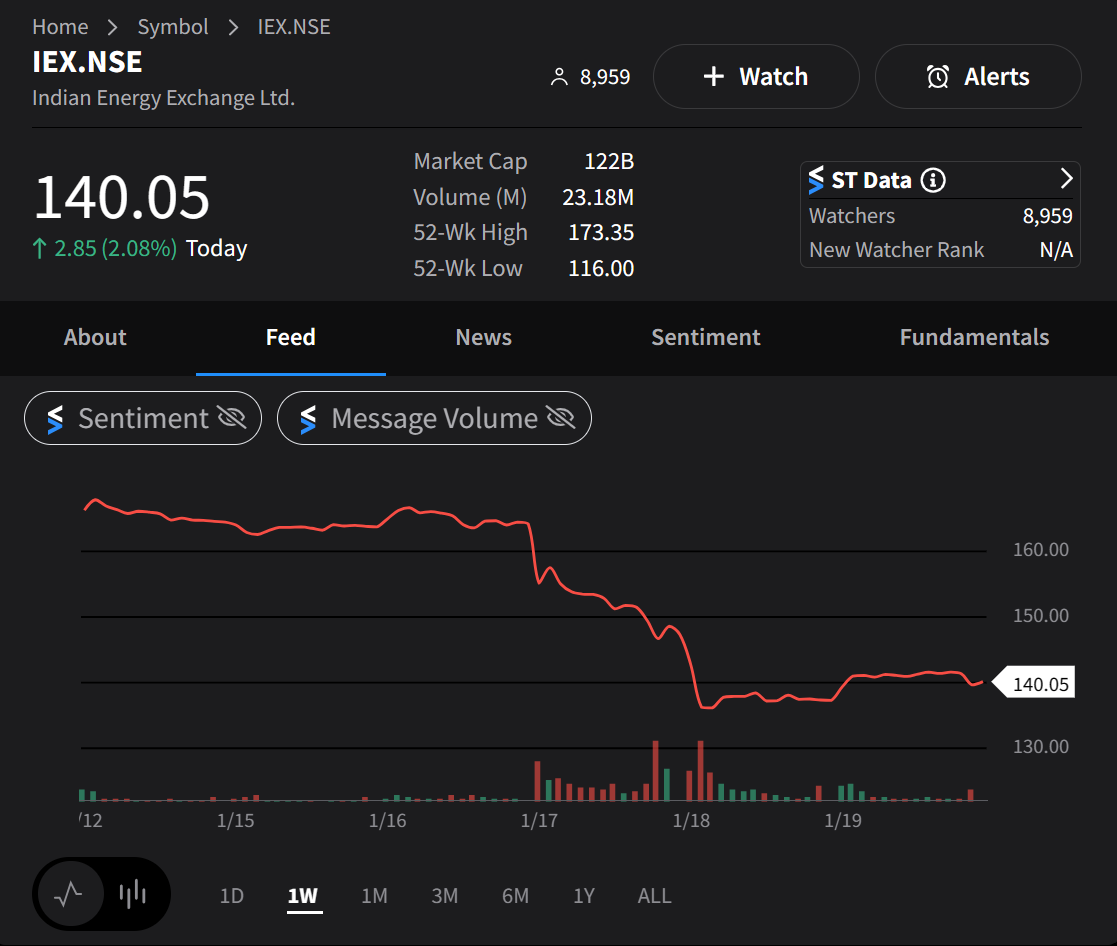

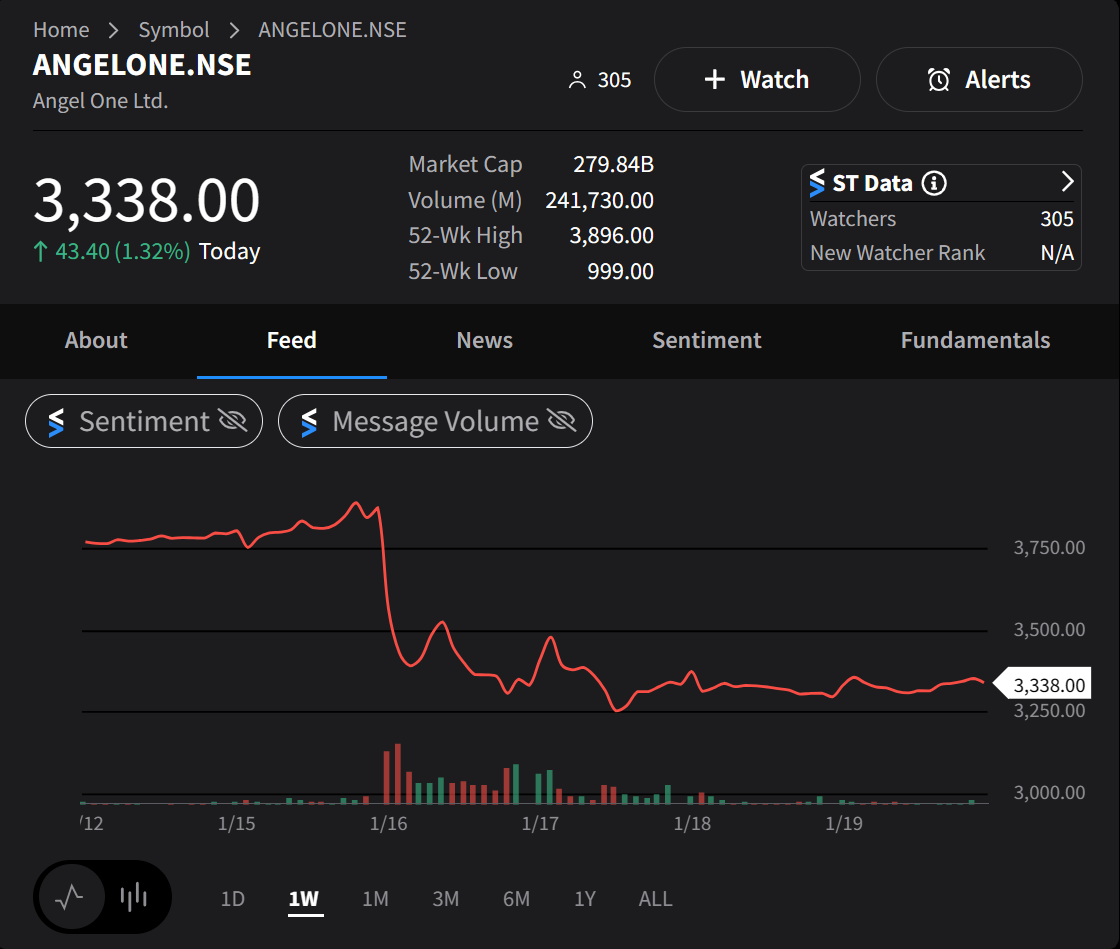

Here’s a look at this week’s top NSE500 movers. Oracle Financial Services took the pole position after rallying +48%. 🥇 RVNL (+41%) hit a new all-time high. IEX (-14%) had the worst week since June 2023. Angel One (-12%) snapped its 5-week gaining streak. 📉 Check out their charts below: