Tale of the Tape

Hiya everyone. 👋

Lingering bank sector weakness left the Sensex (-0.4%) and Nifty (-0.5%) in the red today. Midcaps (-0.1%) and Smallcaps (-0.2%) saw slightly less selling pressure. The advance-decline ratio was in favour of the bears (3:2). 📉

It was a mixed-bag kinda day for sectors. NBFCs (-1%), Banks (-0.8%) and Metals (-0.8%) took a hit today. Meanwhile, Pharma (+1%), Real Estate (+0.7%) and Oil & Gas (+0.6) stocks ended in the green. 😇

This luxury retailer smallcap stock could see a 30% upside from current levels. Read our top story below. 💎

LTIMindtree (-11%) collapsed after a disappointing Q3. Meanwhile, Tata Communications was up 6% on a good Q3 show. 📊

Tata Motors (+2%) was in focus. Global brokerage firm Nomura sees a +17% upside from current levels. 📈

NHPC dropped -3%. The GOI will sell 25 cr shares (3.5% equity); the floor price is set at Rs 66 p/sh, down -7% from current levels. 👎

Sanghi Industries cracked 10% after its cement supply pact with Ambuja raised profitability concerns. 👀

Persistent Systems (+1%) will consider the proposal of a stock split on January 20. ✂️

Aarti Industries (+5%) won a Rs 6,000-cr chemical supply deal with a multinational conglomerate. Welspun Corp (+5%) hit a new all-time high after winning a Rs 3,000-cr order. 💰

Shakti Pumps (+4%) will raise Rs 200 cr through the QIP route. 👍

Results reaction. ICICI Prudential (-5%) hit a 52-week low after awful Q3 results. South Indian Bank rallied +9% after its profits tripled in Q3. 🤑

Here are the closing prints:

| Nifty | 21,462 | -0.5% |

| Sensex | 71,186 | -0.4% |

| Bank Nifty | 45,713 | -0.8% |

Earnings Roundup

LTIMindtree CRASHED 10% intraday after its meh Q3 results missed Street estimates. Weak client spending kept its top line flat QoQ in CC terms (0.7% vs 2% estimated). While its manufacturing vertical was up 20% QoQ, the all-important BFSI biz contracted by 1.6% QoQ. The company’s EBIT margin also missed estimates, impacted by wage hikes and wider furloughs than were expected. 😣

FYI – LTIMindtree’s management commentary was also weak, aggravating the bearish sentiment around the stock. CEO Debashis Chatterjee said: “ We expect Q4 performance to remain similar to the current quarter.” 📉

Here are its key stats:

- Revenue: $1.08 billion; +0.7% QoQ (vs Est:$1.15 billion)

- EBIT Margin: 15.4% vs 16.3% QoQ

- PAT: Rs 1,169 cr; +1% QoQ (vs Est: Rs 1,193 cr)

The only silver lining was that deal wins came in at $1.5 billion for Q3; +21% YoY. The only problem? Moist experts don’t count on this anymore as fewer contract wins translate into hard cash. The proof is in the pudding: LTIMindtree announced that it would delay its 17%-18% operating margin goal by a few quarters. 🚨

Tata Communications was up 6% after reporting decent Q3 results that beat Street estimates. A 28% YoY jump in its data services vertical pushed up the top line. A one-off licence tax expense, however, ended up taking a hit on the bottom line, which otherwise would’ve been pretty decent. 👍

Here is its Q3 report card:

- Revenue: Rs 5,633 cr; +24% YoY

- EBITDA: Rs 1,134 cr; +5% YoY

- EBITDA Margin: 20.1% vs 23.8% YoY

- PAT: Rs 45 cr vs Rs 394 cr YoY

CEO AS Lakshminarayanan said: “We are pleased to report another quarter of robust growth as data revenue crossed the Rs 4,000 crore mark with digital services contributing 45 per cent… We remain confident about our medium-term ambitions.”

Stocktwits Specials

Want to know the latest updates on Polycab? We’ve researched and analysed the latest news, fundamental analysis, and technical analysis, so you don’t have to. In less than 5 minutes, we’ll walk you through 5 updates about Polycab you must know – whether you currently own this stock or are considering buying.

Good Times Keep Rolling

Ethos Ltd has been KILLING it lately. The stock is up more than 2x over the last year, with some analysts believing the party’s just getting started. Here’s what you need to know: 🤓

For the unaware, Ethos is one of India’s biggest luxury & premium watch retailers. As of FY23, it had a 20% market share in the luxury segment and 13% in the premium watch segment. It currently caters to over 60+ brands, including Rolex, Omega, Breitling, Frederique Constant and Ulysse Nardin. FYI – ace investors Sunil Singhania and Mukul Agarwal continue to own stakes in Ethos (1.2% and 2.3%); they’ve been owners since the IPO. 💯

What’s popping? The company has made two big bets. In May 2023, it bought the 280-year-old Swiss brand ‘Favre Leuba’. For a luxury retailer, exclusive brands are a no-brainer. For Ethos, exclusive brands command 2x usual gross margins (35%-40%). These brands also currently contribute to 30% of sales, which the company wants to increase. Separately, it’s also been taking baby steps to get into other luxury segments such as luggage (Rimowa) and jewellery (Bvlgari and Messika). ⌚

Its second bet is the foray into the ‘certified pre-owned (CPO) luxury watch’ market. It accounted for 6% of FY23 sales. CPO watches require lower working capital cycles, which means a higher capital return (20%+ vs 15%). While CPO may seem contrary to why customers make luxury item purchases, it’s a good ‘first buy’ for newly affluent customers. 🚀

Big Picture: Experts say the number of ‘affluent’ Indian customers will double to 10 crore by 2027. The luxury watch market stood at 24% of the overall market in FY20 and is projected to grow to 30% by FY27. So, the opportunity here is big for Ethos. FYI – Axis Securities has a target price of Rs 3,050 p/sh; +30% from current levels! 🔥

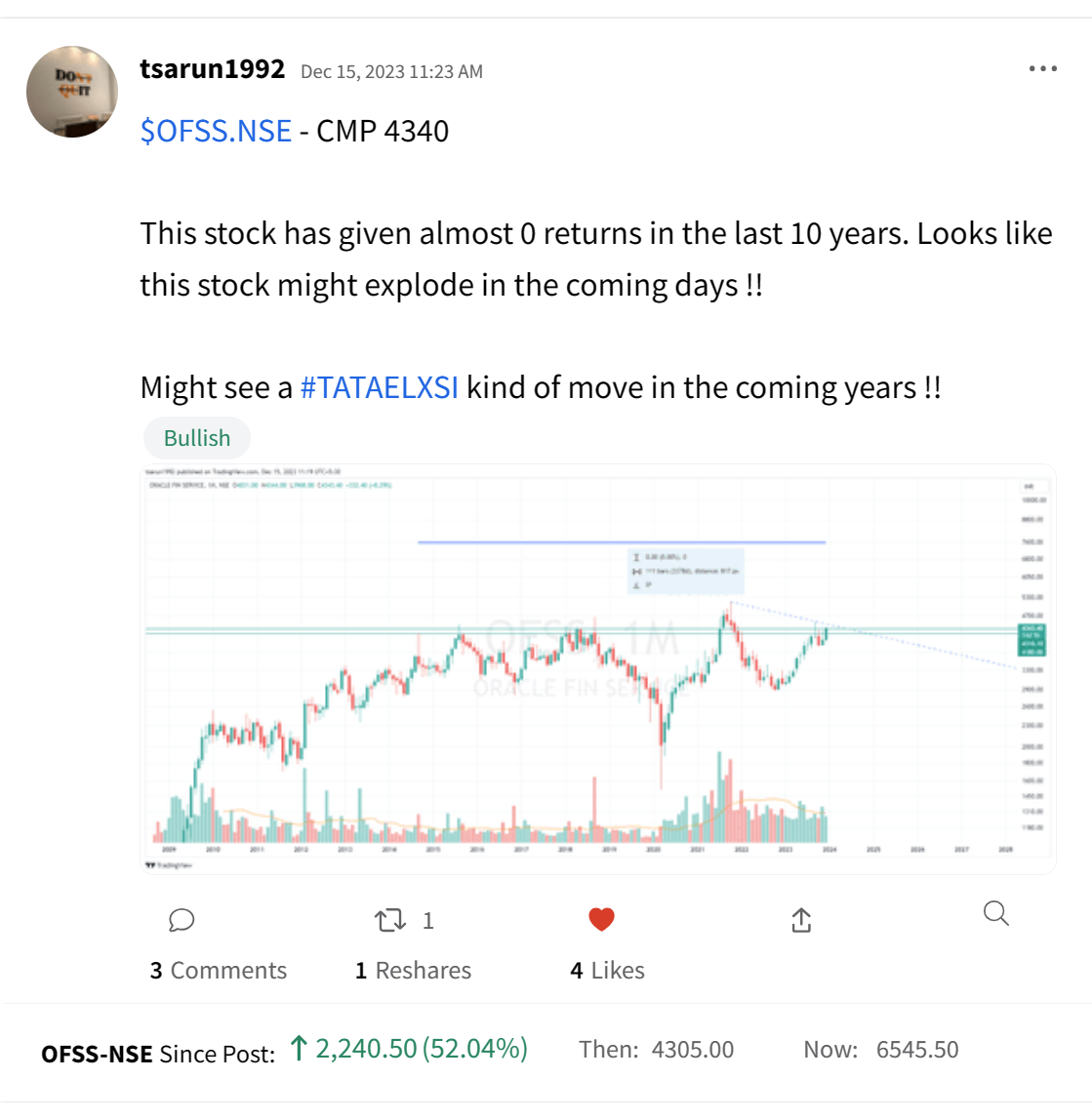

Stocktwits Spotlight

Breakout alert! Oracle Financial Services rallied +28% intraday today. Huge shoutout to Arun for spotting the key levels well before today’s move. Follow Arun for more awesome trading insights and add $OFSS.NSE to your watchlist and track the latest from our community. Here’s the link:

Disclaimer: Arun T S is not a SEBI registered advisor and you should not construe any information discussed herein to constitute investment advice. Consult your financial advisor prior to making any actual investment or trading decisions.

Links That Don’t Suck

💯 Polycab Share Crash – Down 21% | polycab share latest news |

🚨 Expect a deeper correction; not buying anything at this point of time: Dipan Mehta

📲 The Galaxy S24 Ultra is smarter, pricier, and just as big as ever

🏏 RECORD ALERT! India now feature in shortest completed Test & longest T20I in history, both in Jan 24

😋 NIT Engineer Builds Automated Momo-Making Machine, Earns Rs 25 Cr a Year

🧑💼 The No. 1 phrase to use in a job interview to sound confident and capable