Good evening, everyone. Welcome to the Stocktwits Top 25 newsletter for Week 31 in 2021.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD). Our goal is to track the winners and losers over time.

Here are your Stocktwits Top 25 lists for Week 31:

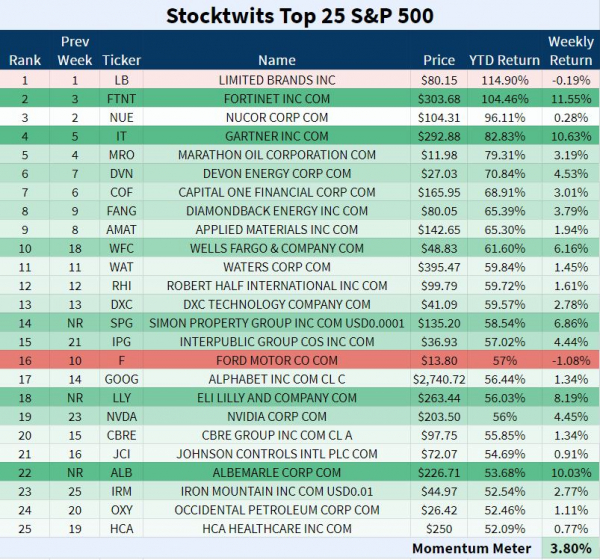

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 list traded higher for the third week in a row.

23 of 25 names closed positive.

The list was filled with strong moves fueled by earnings. Gartner Inc and Albemarle Corp are both Winners below.

Nucor Corp and Fortinet Inc swapped spots again. $FTNT is now ranked #2 and $NUE is #3.

Three Freshmen debuted on the list. The tickers are $SPG, $LLY, $ALB.

The Stocktwits Top 25 S&P 500 Momentum Meter increased 3.8% while the S&P 500 gained 0.94%. The 2.86% differential in favor of the top stocks shows the leading stocks outperformed by a solid amount.

Nasdaq-100

ST Top 25 Nasdaq 100

The ST Top 25 N100 is a lot greener than last week.

22 names registered gains.

Moderna moved 17% higher and was the list’s biggest gainer. $MRNA is the Top Dawg below.

$EBAY faltered for the second straight week. The e-commerce company is a Sinner below.

Four Freshmen made the list. The companies are Moderna, Atlassian Corporation, Marvell Technology, and Regeneron Pharmaceuticals.

The ST Top 25 Nasdaq 100 Momentum Meter rose 2.06% in Week 31 while the full Nasdaq 100 climbed 1%. The 1.06% difference proves the top stocks were stronger than the top full index by a bit.

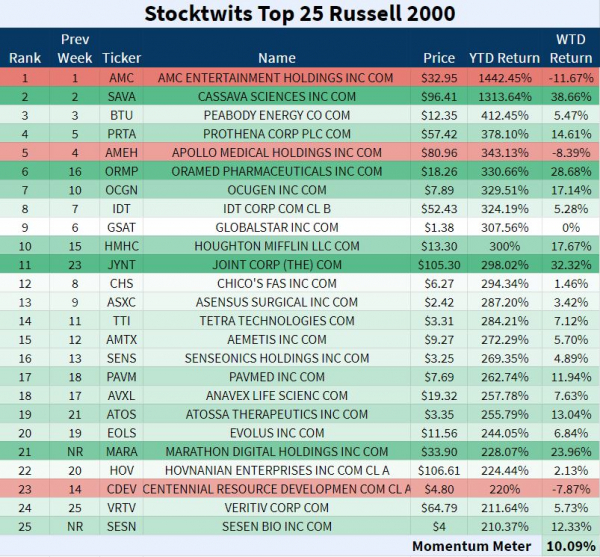

Russell 2000

ST Top 25 Russell 2000

The ST Top 25 R2K list bolted back in Week 31.

21 of 25 names traded higher.

Joint Corp reported killer earnings and earned a spot on the Winners list below.

$SAVA soared 38.7%, $ORMP ascended 28.7%, and $MARA grew 24%.

$MARA and $SESN were the list’s Freshmen.

The ST Top 25 R2K Momentum Meter launched 10.09% and the Russell 2000 index rallied 0.97%. The 9.12% differential suggests top stocks were far stronger than the full index.

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 31, 2021 is #1 N100 – Moderna Inc.

Moderna marched 17% in Week 31 and stole the #1 spot on the ST Top 25 N100 list from Applied Materials.

The biotech and pharmaceutical company closed positive for the fourth straight week after reporting Q2 results. Here are the stats:

EPS: $6.46 vs $6.01 est

REV: $4.35B, +6,463% YoY

$MRNA is up 296% YTD and closed at all-time highs.

The Winners 📈

△ #4 S&P 500 – Gartner Inc rose 10.6% and gained one spot on the ST Top 25 S&P 500 list.

$IT accelerated 10.8% on Tuesday after the company beat on the top and bottom lines while raising its full-year outlook.

Here are the details:

EPS: $2.24 vs $0.51 est

REV: $1.2B, +20% YoY

Here’s the weekly chart:

$IT is up 82.8% YTD.

△ #11 R2K – Joint Corp jumped 32.3% and improved 12 spots on the ST Top 25 R2K list.

$JYNT spiked 15.2% and into new highs on Friday after the company exceeded earnings expectations. The franchisor of chiropractic clinics is still on track to open 1,000 clinics by the end of 2023.

Here’s the full report.

$JYNT is up 298% YTD and closed above the $100-level for the first time on Friday at $104.52.

△ #22 R2K – Albemarle Corp appeared on the ST Top 25 S&P 500 list this week as a Freshman. The chemical manufacturing company earned the #22 ranking.

$ALB beat Q2 expectations and boosted its full-year profit forecast Wednesday after the close. The stock ascended 5.7% on Thursday and added 3.7% on Friday.

Here’s the weekly chart:

$ALB is up 53.7% YTD and sits at all-time highs.

The Sinners 📉

▼ #19 N100 – eBay is still on the Sinners list. The company slid 10 spots lower from #10 to #19.

$EBAY closed negative from Tuesday to Friday while the rest of the N100 was climbing to highs. A clear divergence.

Here’s the daily chart:

$EBAY will report earnings next Wednesday, August 11, 2021.

▼ #1 R2K – AMC Entertainment fell 11.7% and opened up the door for Cassava Sciences in the YTD performance race.

$AMC traded negative four out of five days this week heading into its earnings report. The movie theatre chain will release Q2 earnings on Monday after-the-close.

$AMC is still up 1,442% YTD.

See Y’all Next Week 🤙