Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 6 of 2022.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 6:

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 List was nearly perfect in Week 6.

23/25 closed green.

Energy stocks led the list as oil closed positive for the eighth week in a row.

Baker Hughes blasted 9.6% as the list’s top gainer. It’s a winner below.

Three new freshmen made the list. The companies are Baker Hughes Co, Mosaic Co, and ViacomCBS Inc.

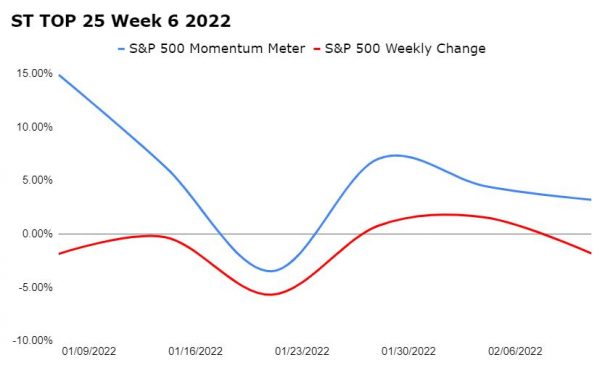

The Stocktwits Top 25 S&P 500 Momentum Meter increased 3.20% while the S&P 500 dipped 1.82%. The 5.02% difference confirms that top companies continue to outpace the full index.

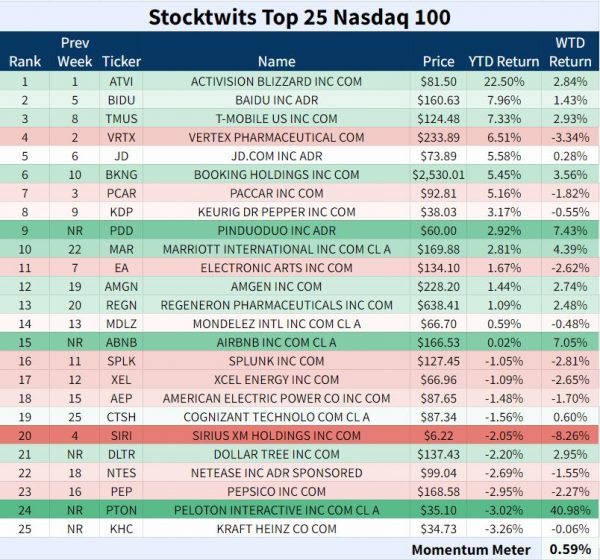

NASDAQ-100

The Big Cap Nasdaq 100

The ST Top 25 N100 List managed to hang in the green.

13 out of 25 stocks registered gains.

Peloton claimed Top Dawg honors and a spot on the list as a freshman.

5 new names appeared on the list. The stocks include $PDD, $ABNB, $DLTR, $PTON, and $KHC.

The ST Top 25 Nasdaq 100 Momentum Meter rose 0.59% while the full Nasdaq 100 decreased 3%. The 3.59% difference shows that the best-performing stocks remain ahead of the index as a whole.

RUSSELL 2000

Small-Cap Russell 2000

The ST Top 25 R2K List was popped off in the sixth week.

24 of 25 stocks closed higher.

Consol Energy expanded 29.38% and earned a spot on the Winner’s list.

Oil States International was the list’s only loser, falling 0.74%.

The list’s Freshmen are $ECOL, $CEIX, $HPK, and $CRS.

The ST Top 25 R2K Momentum Meter surged 13.08% and the Russell 2000 index jumped 1.39%. The top stocks had an 11.69% advantage, indicating that the index as a whole is losing steam.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 6, 2022 is #24 N100 – Peloton Interactive.

Peloton had its strongest week ever, soaring 41% to four-week highs.

$PTON popped 20.93% on Monday and raged another 25.3% on Tuesday after updating its board.

The exercise equipment company appointed Barry McCarthy to replace John Foley as CEO of the company while also slashing ~ 2,800 workers to boost sales and regain investor trust.

Here’s the weekly chart:

$PTON is down 3.02% YTD.

📈📈📈

The Winners 📈

△ #12 R2K – US Ecology Inc claimed the 12th spot on the ST Top 25 R2K List as a freshman in Week 6.

The emergency and disaster response services company was the strongest performer on all of the list’s with a 73.11% weekly gain.

$ECOL leaped 67.73% on Wednesday after Republic Services agreed to acquire the company for $2.2 billion including net debt of $0.70 billion.

Weekly chart:

Jeff Feeler, CEO of US Ecology said: “The combination of our companies provides a platform to accelerate our common strategy of providing a full complement of environmental solutions to better our world.”

$ECOL is up 47.15% YTD.

△ #25 R2K – Carpenter Technology Corp debuted on the ST Top 25 R2K List this week as a freshman. The steel industry company took the 25th ranking.

$CRS registered gains on four days this week in route to a 32.92% gain. The stock ticked higher after being upgraded to Overweight from Neutral by JPMorgan, who also lifted the price objective to $52 from $52.

JPMorgan’s confidence in Carpenter Technology strengthened as a result of the firm outlining its prospective profit opportunity at a conference earlier this week.

Here’s the daily chart:

$CRS is now up 32.68% in 2022.

△ #20 S&P 500 – Baker Hughes Company clambered 9.6% to three-year highs as the ST Top 25 S&P 500 List’s top stock.

$BKR finished green for the third consecutive week as Russia tensions heightened. The conflict at Ukraine’s border could potentially lead to problems involving Europe’s natural gas pipeline.

Daily chart:

$BKR is now up 21.11% YTD.

📉📉📉

The Sinners 📉

△ #20 N100 – Sirius XM Holdings sank sixteen rankings from #4 to #20 as the largest loser on the ST Top 25 R2K List in Week 6.

$SIRI began the week on a strong note, but washed away the gains with deep red days on both Thursday and Friday.

In other news, SiriusXM reported its vast programming plans for Super Bowl LVI week. Listeners on SiriusXM will be able to catch various broadcasts of the game, a Super Bowl LVI pop-up channel, and a combination of sports and entertainment content.

Here is $SIRI’s weekly chart:

$SIRI is down 2.05% YTD.

▼ #24 R2K – Oil States International shrank 0.74% and was the only loser on the list. The oil company fell from #17 to #24 on the ST Top 25 R2K List.

Opposite to Sirius XM above, Oil States started the week off with back to back negative sessions. The oil company held firm and recouped nearly all of the losses in the week;s end.

$OIS is slated to report earnings after the close on Feb 16. We’ll see what’s in store…

Here’s the daily chart:

$OIS has gained 34.21% in 2022.