Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 7 of 2022.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

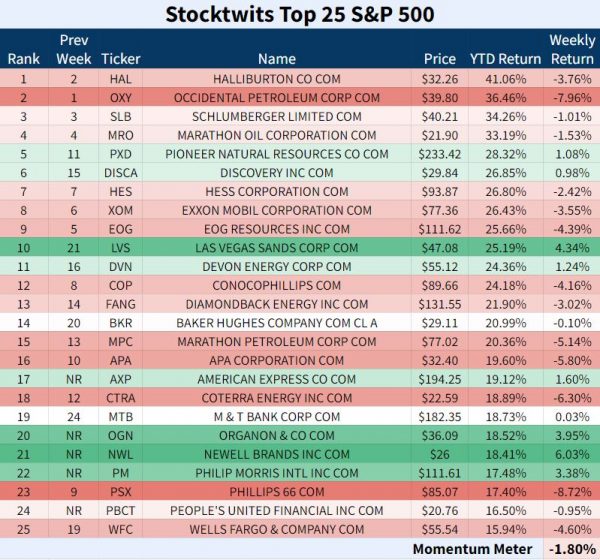

Here are your Stocktwits Top 25 Lists for Week 7:

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 List was the only loser in week 7.

16/25 closed red.

Energy pulled back for the first time in three weeks. Halliburton Co took over the top spot on the list from Occidental Petroleum.

Newell Brands bounced 6.03% as the list’s top gainer. It’s a winner below.

Five new freshmen made the list. The companies are American Express, Organon & Co, Newell Brands, Philip Morris, and People’s United Financial.

The Stocktwits Top 25 S&P 500 Momentum Meter decreased 1.80% and the S&P 500 dipped 1.58%. The 0.22% difference shows the full index had a slight advantage over top stocks.

Sponsored

8 Electric Vehicle Stocks to Own Now

Are you ready for the EV revolution?

Well, today you have the chance to get the names of 8 EV stocks, handpicked by an analyst who has beaten Warren Buffett over a 15-year period.

Louis Navellier found Apple at $1.49Ö Oracle at 51 cents… and Microsoft at 38 cents…

Now he has named 8 of his favorite EV plays in a free report

NASDAQ 100

The Big Cap Nasdaq 100

The ST Top 25 N100 List’s momentum meter remained green.

10 out of 25 stocks registered gains.

Kraft Heinz took the Top Dawg honors and the second spot on the list. Read more below.

2 new names appeared on the list. The stocks include Micron Technology and O’Reilly Automotive.

The ST Top 25 Nasdaq 100 Momentum Meter increased 0.25% while the full Nasdaq 100 fell 1.71%. The differential of 1.96% proves that the best-performing stocks continue to outperform the index as a whole.

RUSSELL 2000

Small-Cap Russell 2000

The ST Top 25 R2K List was the strongest in Week 7.

12 of 25 stocks closed higher.

Karyopharm Therapeutics surged 40.70% and earned the top spot on the list.

MRC Global took the twelfth spot as a freshman. More on this below.

The list’s Freshmen are $MIRM, $MRC, $FOSL, $BCRX, $ATCX, $CBT, and $BLBD.

The ST Top 25 R2K Momentum Meter popped 4.52% and the Russell 2000 index lost 0.95%. The top stocks outperformed the index by 5.47%, indicating that the index as a whole is losing pace.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 7, 2022 is #2 N100 – Kraft Heinz Co.

Kraft Heinz Co isn’t the typical, high-flying Top Dawg, but it got the job done in Week 7. $KHC climbed 10.74% this week, marking its best weekly performance since April 6, 2020.

The food giant surged 5.6% on Wednesday after smashing earnings and sales estimates. To offset rising raw material and shipping expenses, the company will continue to boost the pricing of its snacks and condiments.

EPS: $0.79 (vs. $0.62 expected) | Revenue: $6.7 billion (vs. $6.65 billion expected) | Link to Report

Here’s the weekly chart:

$KHC is up 7.13% YTD.

📈📈📈

The Winners 📈

△ #21 S&P 500 – Newell Brands blasted off 6.03% in Week 7 and entered the ST Top 25 S&P 500 List as a freshman. $NWL is now ranked 21st.

The global consumer goods company continued higher after last week’s stellar earnings reaction. $NWL surpassed earnings and sales forecasts while upgrading its earnings projections.

Here’s the daily chart:

$NWL is up 18.41% YTD.

△ #7 N100 – Airbnb doubled its ranking on the ST Top 25 N100 List, moving up from #15 to #7 in the seventh week of 2022.

Airbnb shares accelerated 3.65% on Wednesday after fourth-quarter profits and sales beat expectations, including first-quarter guidance. Revenue grew 78% YoY.

EPS: $0.08 (vs. $0.04 expected) | Revenue: $1.53 billion (vs. $1.45 billion expected) | Link to Report

Here’s the daily chart:

$ABNB is now up 5.05% in 2022.

△ #12 R2K – MRC Global gained 24.07% and closed at eight-month highs. The freshman is ranked 12th on the ST Top 25 R2K List.

$MRC finished green for the third consecutive week on the back of a spectacular earnings report. The supply-chain solutions company reported a surprise profit of $107 million while revenue grew 18.5% YoY.

Here’s the full report.

Daily chart:

$MRC is up 40.12% in 2022.

📉📉📉

The Sinners 📉

△ #2 S&P 500- Occidental Petroleum plummeted 7.96% in Week 7 and gave up its top spot on the ST Top 25 S&P 500 List.

$OXY finished negative for the first time in three weeks as energy stocks endured selling pressure.

Occidental Petroleum is set to report first-quarter earnings next Thursday, Feb 24.

Here is $OXY’s weekly chart:

$OXY is still up 36.46% YTD.

▼ #23 N100 – Pinduoduo Inc was the biggest loser on the ST Top 25 N100 List, losing 6.62%.

$PDD dropped fourteen rankings from #9 to #23 this week as Chinese tech stocks were hit by another wave of selling. Stay tuned to see if Pinduoduo can turn it around in Week 8.

Here’s the daily chart:

$PDD is down 3.89% in 2022.

See Y’all Next Week 🤙