Good evening, everyone. Welcome to the Stocktwits Top 25 Newsletter for Week 9 of 2022.

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD), and tracks their performances over time.

Here are your Stocktwits Top 25 Lists for Week 9:

S&P 500

ST Top 25 S&P 500

The ST Top 25 S&P 500 List was nearly perfect in Week 9.

24/25 closed green.

Occidental Petroleum popped off 44.94% and into the top spot on the list.

Schlumberger Limited was the list’s only loser. Check it out on the sinners list below.

Six new freshmen made the list. Their tickers are $KR, $CF, $LMT, $LHX, $ADM, and $NUE.

The Stocktwits Top 25 S&P 500 Momentum Meter raged 12.84% and the S&P 500 fell 1.27%. The gap of 14.11% implies that the entire index underperformed the top companies by a significant amount.

NASDAQ 100

The Big Cap Nasdaq 100

The ST Top 25 N100 List showed strength at the top of the leaderboard.

16 out of 25 stocks registered gains.

Constellation Energy Corp catapulted 16.15% and earned a spot on the list as a freshman. See more on this below.

Marriott International decreased 8.65% and lost its #3 ranking. $MAR is a sinner below.

5 new names appeared on the list. The names include Constellation Energy, Exelon Corp, CSX Corp, AstraZeneca, and O’Reilly Automotive.

The ST Top 25 Nasdaq 100 Momentum Meter spiked 1.33% while the full Nasdaq 100 retreated 2.48%. The differential of 3.81% shows that the best-performing stocks continue to outperform the index as a whole.

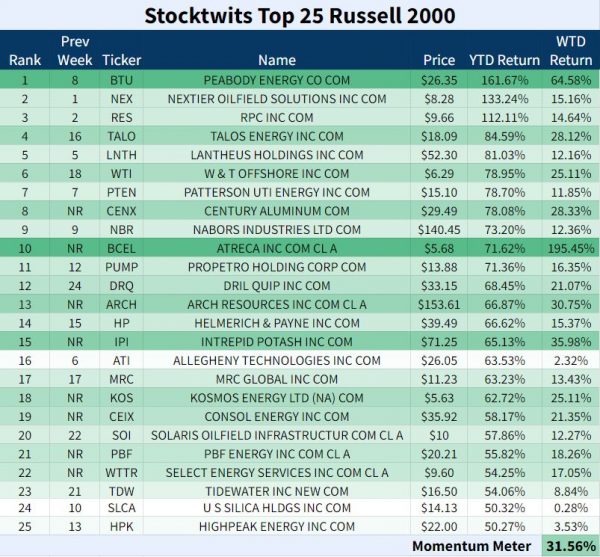

RUSSELL 2000

Small-Cap Russell 2000

The ST Top 25 R2K List’s momentum meter registered a gain of over 31%!

All 25 stocks traded higher.

Atreca Inc accelerated 195.45% this week and turned positive for the year. $BCEL is featured as the Top Dawg below.

Peabody Energy Corp took over the top spot on the list from NexTier Oilfield Solutions. $BTU is up 161.67% YTD.

The list’s Freshmen are $CENX, $BCEL, $ARCH, $IPI, $KOS, $CEIX, $PBF, and $WTTR.

The ST Top 25 R2K Momentum Meter soared 31.56% and the Russell 2000 index erased 1.9%. The top stocks beat the index by 33.46%, showing that the index has been left in the dust.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The ST Top 25 Top Dawg for Week 9, 2022 is #10 R2K – Atreca Inc.

Atreca Inc ascended onto the ST Top 25 R2K List as a freshman ranked 10th. $BCEL was the top performer on all of the lists, leaping 195.45% to four-month highs.

The biotech company blasted off 211.38% on Friday after reporting 4th quarter and FY 21 results.

John Orwin, CEO of Atreca said this about the ATRC-101 therapeutic: “The data continue to show a significant association between activity and target expression, and we’ve now observed a partial response in monotherapy along with a complete response in the pembrolizumab combination cohort.”

$BCEL also announced that it will participate in Cowen’s 42nd Annual Healthcare Conference on Mar 7-9.

Here’s the weekly chart:

$BCEL is up 71.72% YTD.

📈📈📈

The Winners 📈

△ #1 S&P 500 – Occidental Petroleum bumped Mosaic Co out of the top spot on the ST Top 25 S&P 500 List in Week 9. $OXY is now up 93.69% in 2022.

$OXY erupted 12.9% on Monday after buying back $2.5 billion of debt with maturity from 2023 to 2049. The petroleum company cruised to two-year highs as crude oil closed above $100 a barrel at $114.95.

Berkshire Hathaway stated it owns a total of 113.7 million shares of Occidental, including both stock and warrants, in a filing Friday. The total stake accounts for 11.2% of $OXY‘s outstanding shares. Wowza.

Here’s the daily chart:

△ #1 N100 – Constellation Energy Corp claimed the #1 ranking and was the top gainer on the ST Top 25 N100 List.

$CEG broke its three-week losing streak with an 18.16% WTD return.

Constellation Energy stated on Feb 2, that it had finalized the split from its former power generating and competitive energy company, Exelon Corp. $CEG was added to the NASDAQ-100 Index on the same day of the spin-off transaction.

Here’s the daily chart since inception:

$CEG is up 2.31% since completing its separation from Constellation on Feb 2.

△ #15 S&P 500 – The Kroger Company had a terrific showing in Week 9. The supermarket chain climbed 25.94% and closed at all-time highs. The freshman is ranked fifteenth on the ST Top 25 S&P 500 List.

$KR ripped 11.61% on Thursday and flew 7% on Friday following its Q4 earnings and sales beat.

EPS: $0.91 (vs. $0.73 expected) | Revenue: $33 billion (vs. $32.7 billion expected) | Link to Report

Here’s the weekly chart:

$KR is up 30.23% YTD.

📉📉📉

The Sinners 📉

▼ #20 N100- Marriott International got beat by the ugly stick. The global lodging company plummeted 8.65% in Week 9 and gave up its top-3 spot on the ST Top 25 N100 List.

$MAR closed lower 4 of 5 days this week, three of which came on above-average volume. Is there any gas left in the tank for Marriott? Time will tell.

Here is $MAR’s daily chart:

$MAR is now down 3.61% YTD.

▼ #16 S&P 500 – Schlumberger Limited was the only loser on the ST Top 25 S&P 500 List in Week 9. The oilfield services company fell 1.29% and plummeted to #16 from #5 on the list.

$SLB showed signs of life but just couldn’t kick it into gear. The stock chopped around, closing negative three days this week.

Here’s the weekly chart:

$SLB is still up 30.02% in 2022.

See Y’all Next Week 🤙