Good evening. It’s May 5, 2022.

So much for a Fed rate rally, huh? The markets took a fat L today, just a day after the U.S’s most powerful macroeconomic force made the decision to raise rates by 0.50%.

Indexes have lost their post-FOMC gains, plus more, in trading today. And crypto? Well, it’s not faring too well either.

In fact, CNBC feels emboldened enough to have a primetime “special report” about the markets. Where have they been since… [checks watch] January? (And for you growth traders, we know, it has been more like a year of absolute Dotcom-esque conditions out there.)

Get a load of this…

We’ll keep this portion short today, since we’ve got a healthy amount of content to get over today. After all, these closing prints kind of speak for themselves:

| S&P 500 | 4,146 | -3.56% |

| Nasdaq | 12,317 | -4.99% |

| Russell 2000 | 1,871 | -4.04% |

| Dow Jones | 32,997 | -3.12% |

Though the market reacted kindly to news about the Federal Reserve’s 50 basis point hike yesterday, that kindness has not lasted into Thursday.

Markets erased yesterday’s gains, and more, in trading today. Both stocks and crypto were down across the board — and to make matters worse, today was one of the busiest earnings days of the quarter. Over 479 tickers were expected to hand in their work today.

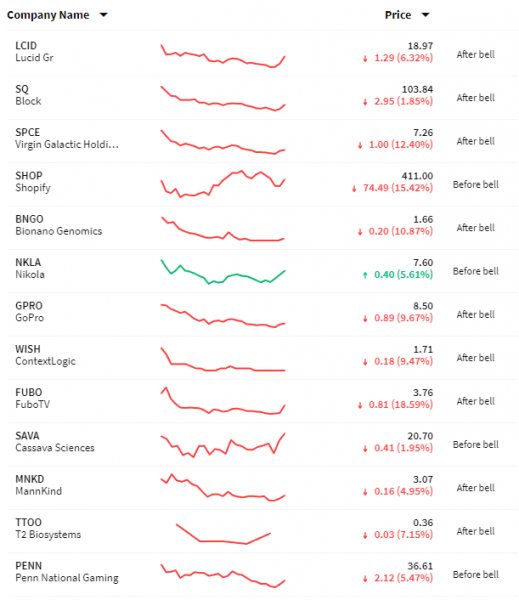

Unfortunately for them, there was little to look forward to. Simply pulling charts wouldn’t do the depth of these losses much justice, so we’ve decided to screencap the Stocktwits earnings calendar in all its red majesty:

You might have picked out a few all-stars awash in today’s downside. Many of those high-profile names suffered the wrath of puzzled bulls in the streams today, with $LCID (-6.2%), $SQ (-1.4%), and SHOP (-14.9%). Though not listed in the above screenie, Cloudflare took a massive haircut, -28% in the day.

However, there was two prominent winners: Nikola booked a +5.6% cumulative gain on the day, and OpenDoor Technologies also was lucky enough to report its own gain — up +4.4%. It’s not much to call a scrappy single-digit gain much of a “win”, but in a market where many players dropped by high single-digits and even meaningful double-digits, investors will take anything they can get.

$SPCE stock didn’t exactly take a rocket ride after Virgin Galactic issued its first-quarter 2022 fiscal report, it seems. After already shedding -9% on a day when the stock market was in a state of free fall, the company immediately lost an additional -4% within just minutes of its earnings release being published.

This was a highly anticipated earnings event, so as you might have expected, the community lit up the Virgin Galactic stream with a balance of praise and criticism for the space tourism start-up. The bullish and bearish signs were in full display, but judging by the initial share-price dump, it seemed that the bears had the upper hand.

Naturally, Virgin Galactic’s press release accentuated the positive elements while leaving the skeptical investor to read between the lines to cherry-pick the negative data points. The company’s main bullet point was that Virgin Galactic’s ticket reservations remained strong, with 800 counted for the first quarter. That’s not too shabby, considering the company just announced the opening of ticket sales to the general public on Feb. 15.

The company also touted a beefy balance sheet, cash and cash equivalents totaled $1.22 billion as of Mar. 31. That’s certainly encouraging, but the bears also have plenty of ammunition for their case against the company. Specifically, Virgin Galactic sustained a net earnings loss of $93 million in Q1 2022. That’s an improvement compared to the year-earlier quarter’s $130 million net loss, but it’s still a deep fiscal hole for Virgin Galactic to dig out of if profitability is the goal.

An equally useful bottom-line metric, adjusted EBITDA, reveals that Virgin Galactic may be moving in the wrong direction. The company recorded adjusted EBITDA of -$77 million, which is obserably worse than the year-earlier quarter’s adjusted EBITDA of -$56 million.

What might have irked investors the most, though, was Virgin Galactic’s forecasted second-quarter 2022 free cash flow, which the company expects to be in the range of -$80 million to -$90 million. This prediction doesn’t exactly bolster the bulls’ strong-balance-sheet argument.

However, figures and numbers aside, Virgin Galactic is readying up for its next VSS Unity test space flight, which is expected to take place sometime in Q4 2022. Beyond that, the company anticipates launching commercial service in Q1 2023. This timeline has moved back after a slew of crashes and regulator complaints, but if the company can atone for its past transgressions, maybe the company’s ample customers will be able to board a Virgin Galactic flight this time next year.

In order to get there, though, they’ll need cash and time — there’s no shortage of the former in this market, but the latter is more limited for all of us.

After a punishing year for the at-home fitness company Peloton, the company is reportedly looking to sell nearly a fifth of its business in an effort to absolve themselves of near-term financial headwinds.

According to the Wall Street Journal, the company is perusing the catalog of industry giants and private equity firms alike in their search. Such a deal might not pan out, but new money might help the downtrodden pandemic-era giant find its way in a post-pandemic world.

The company was once valued at over $50 billion, but has come down to a valuation just north of $5 billion this week. Amidst that reversion, the company has replaced its CEO, cut thousands of jobs, and employed the service of a management consulting company. One activist investor said that hiring [the management consulting company] was an admission of failure.

The company’s new CEO, Barry McCarthy, indicated his desire to create a more digital-first fitness brand, rather than a hardware giant. Such a move would position the company as a subscription software service for the gym. McCarthy has led as a financial officer at Netflix and Spotify before accepting this role, two inflation-punished businesses with a lot of headwinds fighting them.

He might know quite well that the road ahead looks bleak without swift changes. At this stage in the game, Peloton‘s turnaround is looking very bleak.

$PTON was down -11% today, trending in the top ten tickers on Stocktwits.

Links

Links That Don’t Suck:

🎥 Ludwig Confronts the CEO of YouTube

✈️ This Aircraft Flew Two Hours Without Controls

🥈 Luna Foundation Becomes Second Largest Corporate Holder of Bitcoin

🚆 Luxury Overnight Sleeper Train from Scotland to England

🌬️ $649 Dyson Fan vs. $15 Walmart Fan: The Hard Truth

🎵 Artist Puppet Has Released His New Album, “New York Family.” It’s Like If Owl City Made Punk Rock.

*this is a sponsored post