It was a mellow Monday on Wall Street — here’s what you missed.

Former high-flying tech names Meta, Netflix, PayPal, and Zoom, have become value stocks as of today…joining the Russell 1000 Value Index.

Speaking of beaten-up growth names, Robinhood shares surged today on rumors of an FTX takeover. More on both stories below. 👇

Here’s today’s heat map.

3/11 sectors closed green, with energy (+2.93%) leading and consumer discretionary (-1.05%) and communications (-0.95%) lagging. 🔻

In macro news, U.S. pending home sales posted a surprise increase in May, up 0.7% MoM (though still down 13% YoY). In addition, Durable goods data showed resilience in manufacturing activity, despite the uptick in financing costs and recessionary fears, though data from the Dallas Fed suggests there is some regional weakness. 🏭

As expected, several banks released filings outlining updates to their shareholder capital plans. We’ll follow up with a comprehensive summary later in the week. 🏦

Russia was pushed into its first default on foreign debt since 1918 as it struggles to access global financial markets. However, G7 leaders are not letting up on their support for Ukraine, saying they will stand with Ukraine “for as long as it takes” and adding additional sanctions on Russia. 💵

Nike beat on the top and bottom lines, with EPS of $0.90 vs. $0.81 expected and revenues of $12.23 billion vs. $12.06 billion expected. $NKE shares fell 3% after hours as investors focused on the company’s ongoing challenges, like high inventory levels and supply chain delays.

Donald Trump’s SPAC $DWAC fell another 9.56% today after the company confirmed it received subpoenas from a federal grand jury. 📉

In airline news, Jet Blue has increased its offer for Spirit Airlines again as the shareholder vote approaches. $SAVE shares rebounded after hours, following today’s 8% loss. ✈️

On the crypto front, hedge fund Three Arrows Capital has officially defaulted on a $670 million loan extended to it by Voyager Digital. ₿

Other symbols active on the streams included: $RDBX (-13.54%), $PBR (+7.58%), $AMC (+13.31%), $BOXD (+3.88%), and $MULN (-10.27%). 🔥

Here are the closing prices:

| S&P 500 | 3,900 | -0.30% |

| Nasdaq | 11,525 | -0.72% |

| Russell 2000 | 1,772 | +0.34% |

| Dow Jones | 31,438 | -0.20% |

Company News

Unlikely Names Join Russell Value Indexes

Every fourth Friday of June, the popular Russell indexes are reconstituted, shaking things up for traders and investors alike. 📋

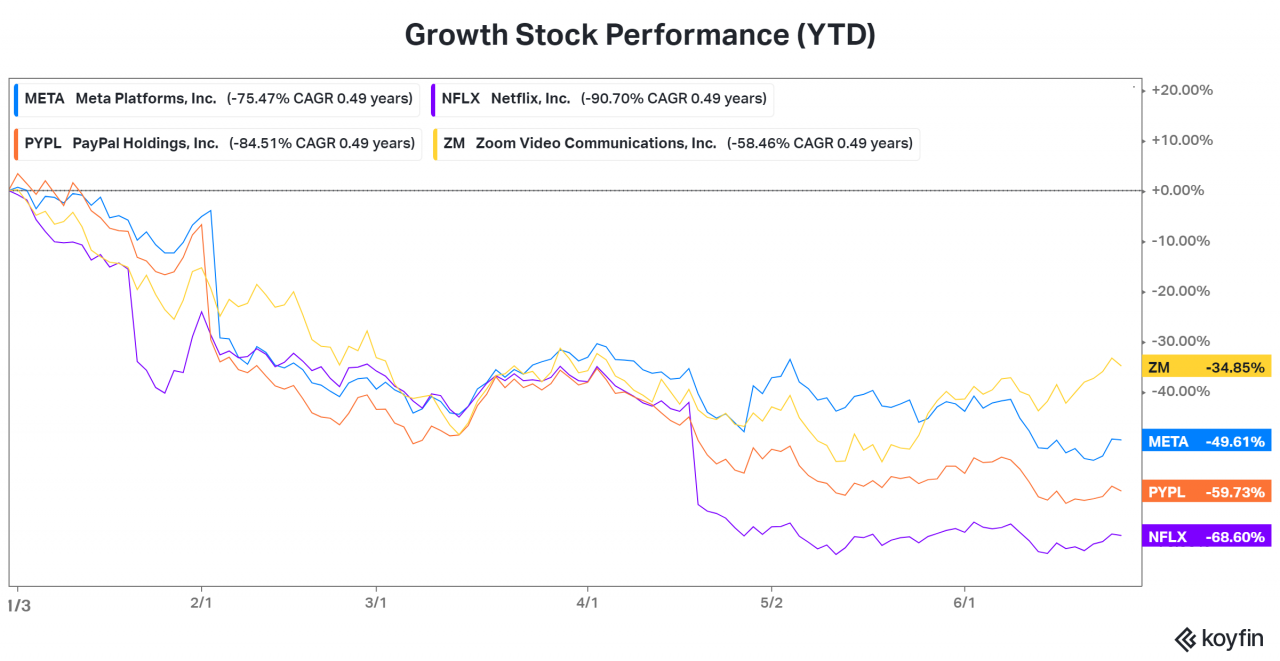

Among this year’s rebalance, one of the most significant changes was the shift of Meta, Netflix, Paypal, and Zoom from the Russell 1000 Growth Index into the Russell 1000 Value Index. 🐌

These high-flying tech names have cooled significantly, with shares plummeting year-to-date and over the last year. 🥶

As interest rates rose over the last year, companies like these faced a double whammy.

Higher interest rates made financing their growth more expensive, and it reduced the multiple that investors were willing to pay for their earnings. 📉

As a result, you saw their businesses slow and stock prices re-rated to the downside as investors moved the capital to more cyclical or “value” areas of the market like financials, industrials, materials, etc.

These stocks have been hammered and now have lower price-to-book and growth values, so they’ve met the index provider’s “value index” specifications. 📊

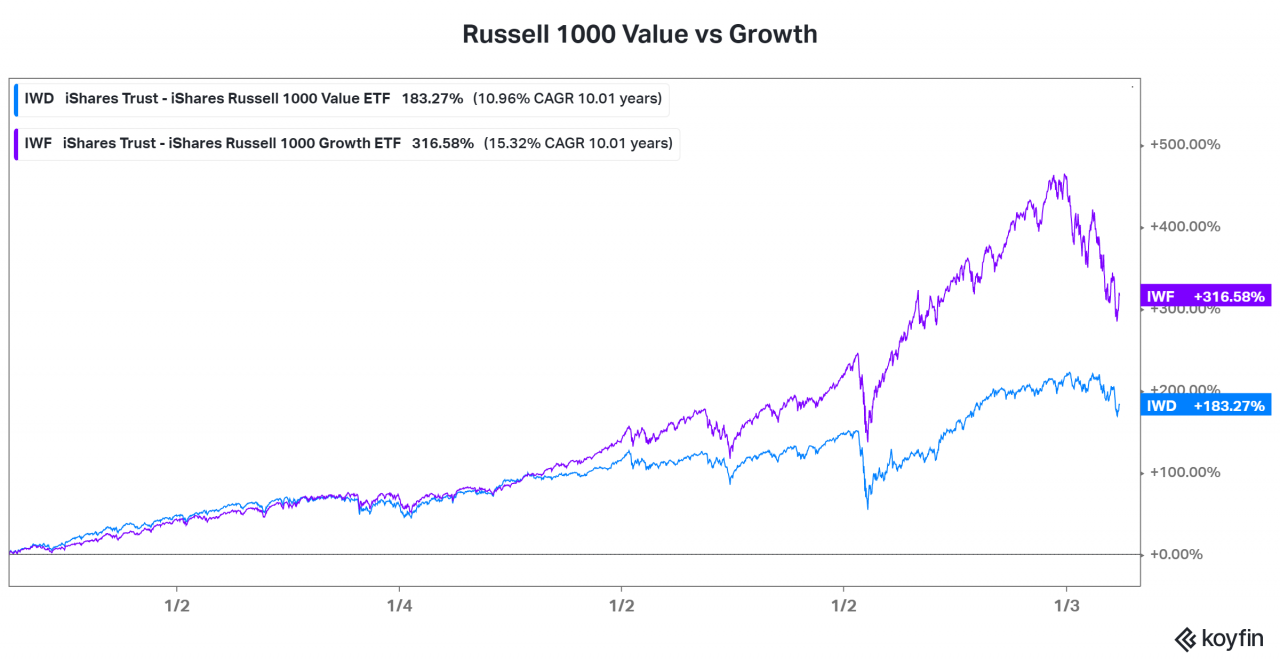

The last decade has been all about growth stocks, but value stocks have outperformed on a relative basis over the last year or so. Whether or not that continues remains to be seen, but this shakeup in index constituents is worth paying attention to.

You can read the full summary of this year’s reconstitution here. 👀

Sponsored

Providing Quality Pet Food and Shareholder Value

This article’s GIF essentially represents FTX Founder and CEO Sam Bankman-Fried pulling up to every struggling company right now. 😏

The highly-capitalized crypto exchange has been on a shopping spree amid the market turmoil, providing cash-strapped firms with a lifeline…for a price. 🏷️

Last week, FTX agreed to provide crypto lender BlockFi with a $250 million revolving credit facility and then started talks to acquire part of the firm just days later.

Additionally, Bankman-Fried’s quantitative trading firm Alameda provided Voyager Digital with $500 million. 💰

Now, rumors are flying that the company is considering a takeover of Robinhood, which has fallen from a $60 billion valuation last August down to $7 billion today. 📉

FTX diversified its business into stock trading just last month, so making a meal of a struggling competitor doesn’t seem that far-fetched.

$HOOD shares were up 14% in the regular session but fell 5% after hours following FTX’s denied any M&A talks with the company.

Whether a deal comes to fruition remains to be seen. What’s clear is that rumors will likely stick around as long as FTX continues to throw its weight around. 💪

Bullets

Bullets From The Day:

💻 Siemens to buy U.S. Software company Brightly. The German engineering group Siemens is buying Brightly Software from private equity owner Clearlake Capital in a deal worth $1.5 billion. The acquisition will help the company expand its “software as a service” (SAAS) offering and hopefully achieve its growth targets. Read more from Reuters.

🏗️ China Evergrande faces a winding-up lawsuit. Troubles for China Evergrande Group continue after an investor filed a winding-up petition against the property developer because it failed to honor an agreement to repurchase shares the investor bought in FCB. Reuters has more.

⚠️ Nato puts troops on high alert. The alliance will be putting 300,000 troops at high readiness in response to Russia’s invasion of Ukraine. Additionally, its military forces in the Baltic states and five other frontline countries would be increased “up to brigade levels.” Jens Stoltenberg said this move would represent “the biggest overhaul of our collective defense and deterrence since the cold war.” More from The Guardian.

Links

Links That Don’t Suck:

📈 Check out IBD’s interactive guide to investing in electric vehicles*

💰 ‘Top Gun: Maverick’ becomes the first $1 billion Tom Cruise film

🦠 Incredible virus discovery offers clues about the origins of complex life

💸 Credit Suisse found guilty in cocaine cash laundering case

🌕 New double crater seen on the moon after mystery rocket impact

🥧 Cinnabon launches its ‘first ever’ non-cinnamon baked good

👓 Italian eyewear billionaire Leonardo Del Vecchio dies at 87

💉 Drug reduces mutant protein that can lead to fibrosis in rare genetic liver disease

*this is a sponsored post