Welcome to the Stocktwits Top 25 Newsletter for Week 28 of 2022!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 28:

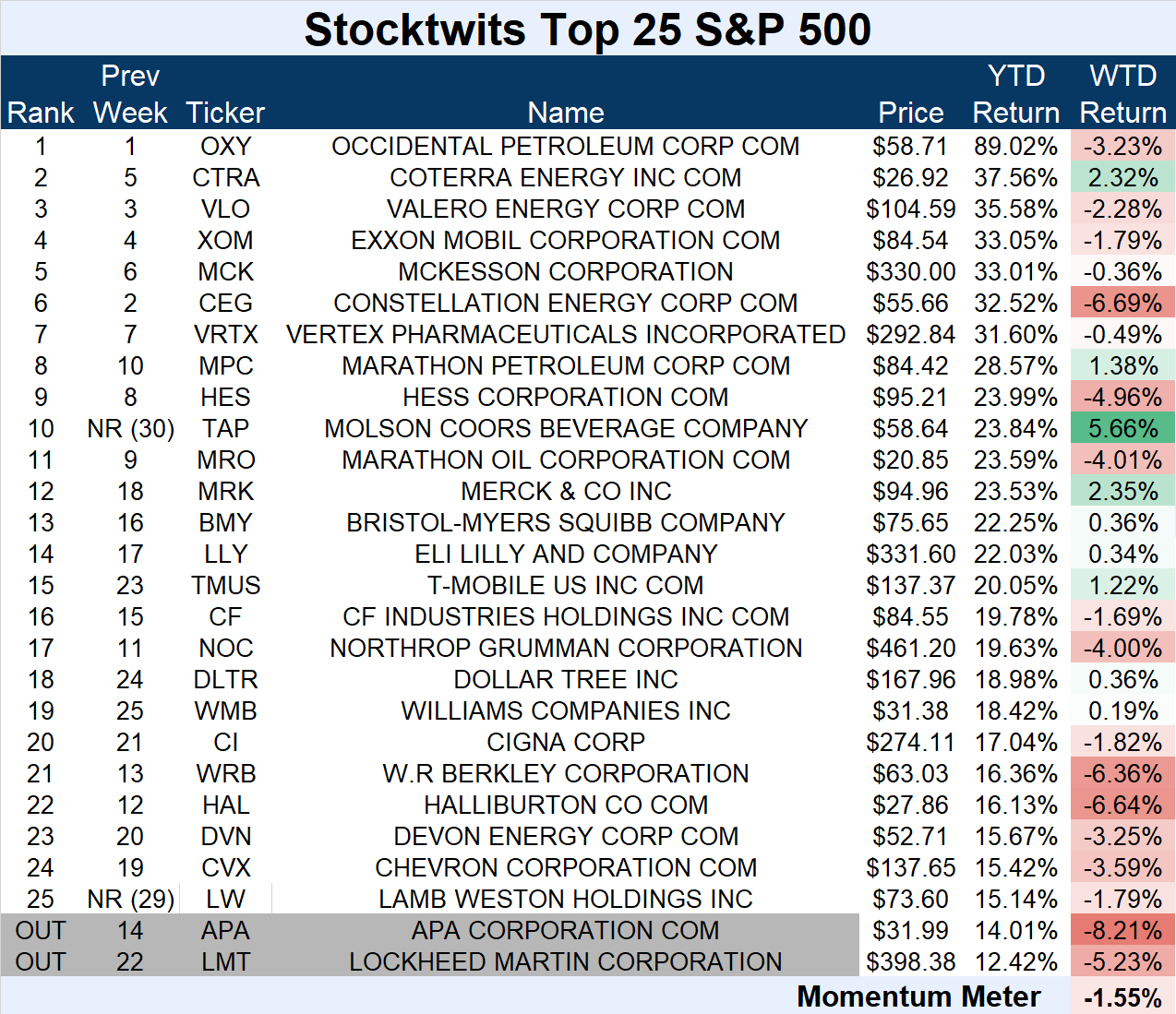

S&P 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (-1.55%) slightly outperformed the S&P 500 index (-1.93%).

There were two major changes to the list this week.

Molson Coors Beverage Company (+5.66%) and Lamb Weston Holdings (-1.79%) joined the list.

They replaced APA Corporation (-8.21%) and Lockheed Martin (-5.23%).

In action similar to last week’s, energy and materials stocks suffered losses again while defensive areas like consumer staples and health care held up best.

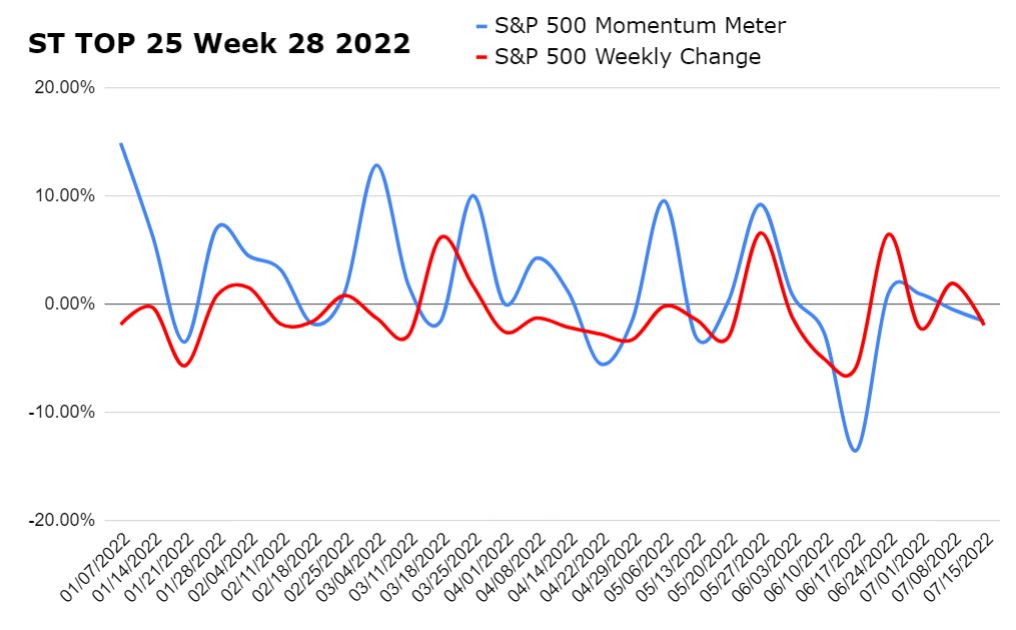

Check out how the momentum meter has performed vs. the S&P 500 index this year:

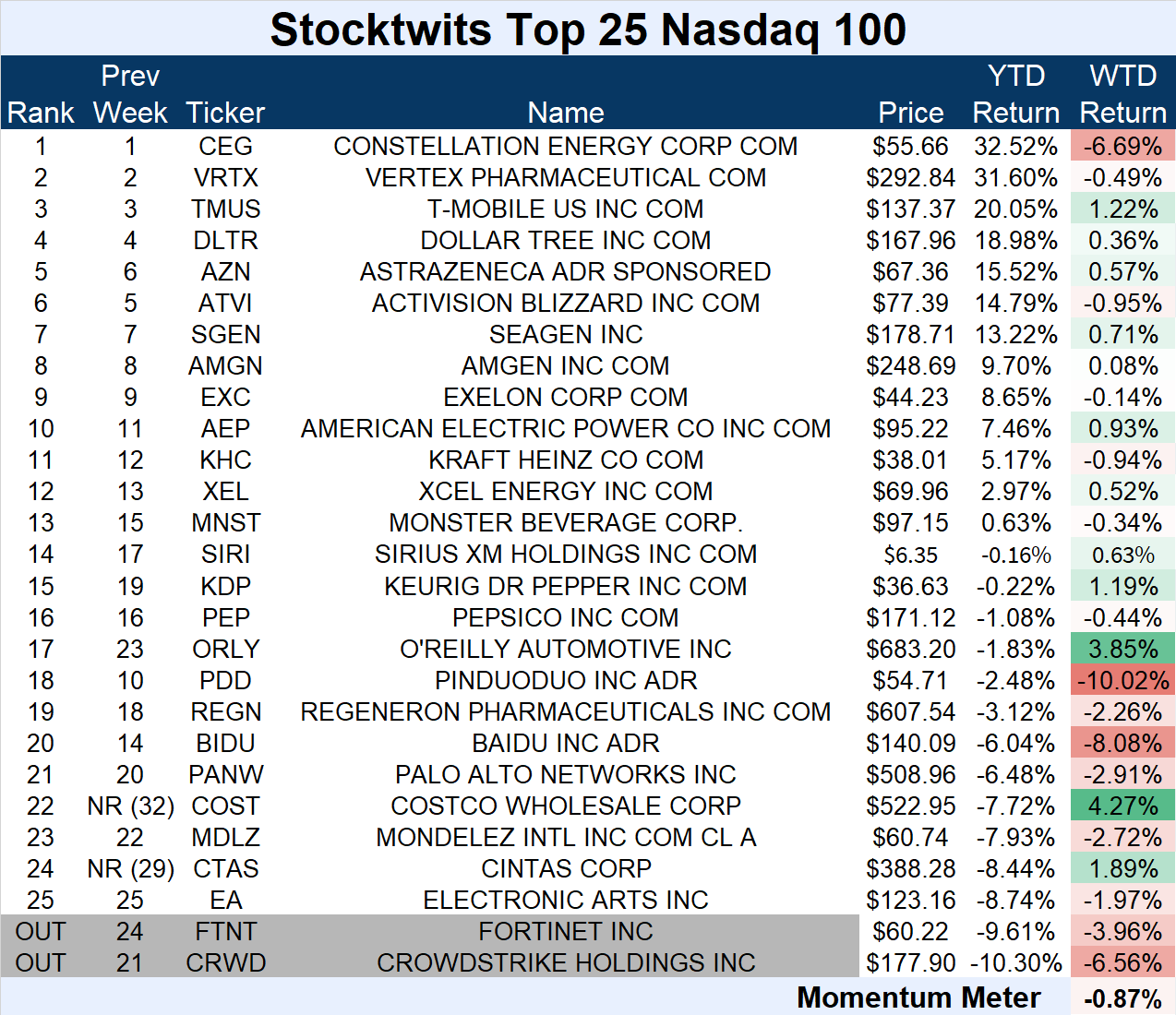

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (-0.87%) slightly outperformed the Nasdaq 100 index (-1.17%).

There were two major changes to the list this week.

Costco (+4.27%) and Cintas Corp. (+1.89%) joined the list.

They replaced Fortinet (-3.96%) and Crowdstrike Holdings (-6.56%).

Outside of that, Chinese stocks Pinduoduo (-10.02%) and Baidu (-8.08%) dropped several places each as that segment of the market sold off.

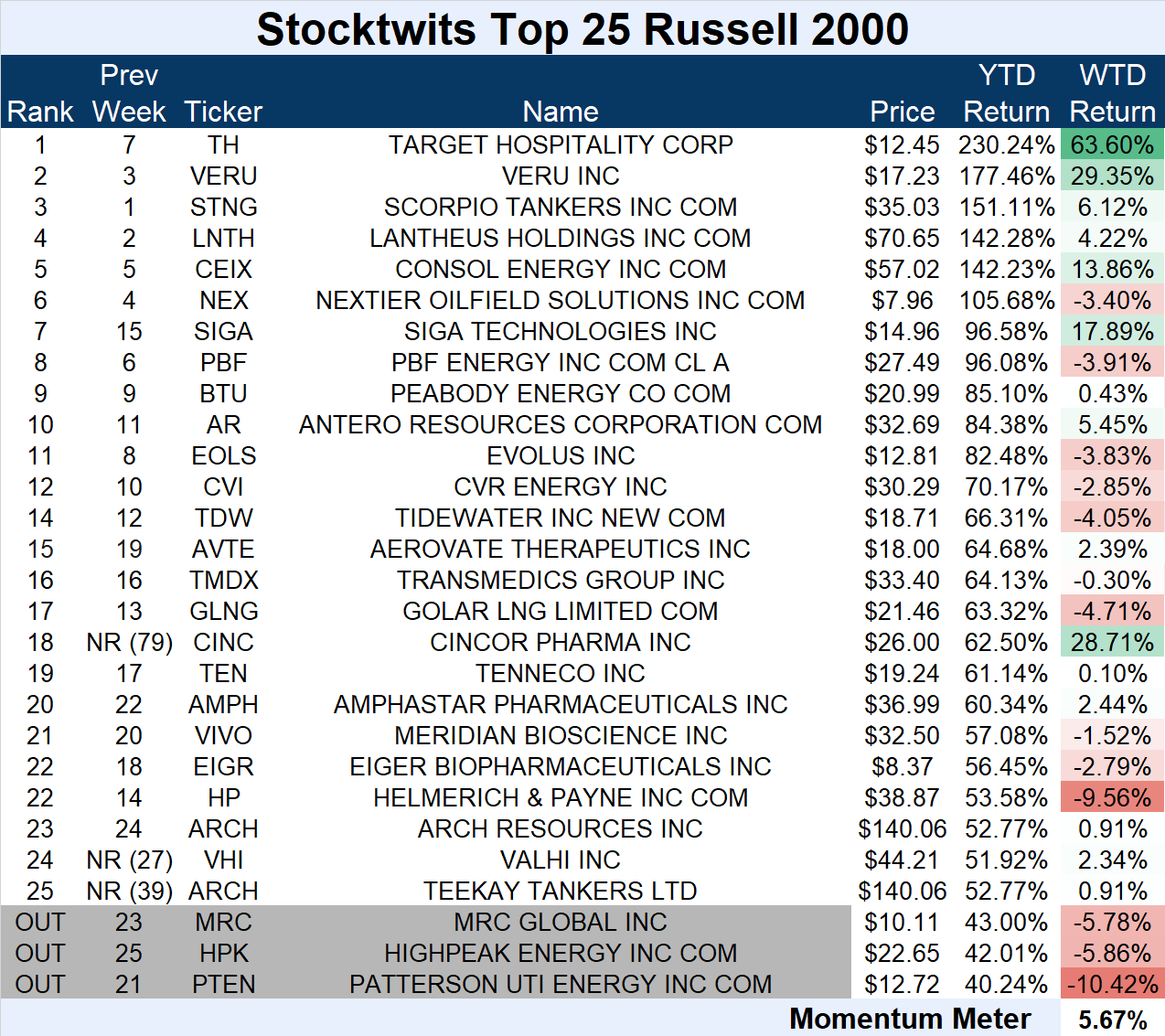

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+5.67%) significantly outperformed the Russell 2000 index (-1.41%), driven by several outliers to the upside.

There were three major changes to the list this week.

Cincor Pharma (+28.71%), Valhi Inc. (+2.34%), and Teekay Tankers (+0.91%) joined the list.

They replaced MRC Global (-5.78%), Highpeak Energy (-5.86%), and Patterson-UTI Energy (-10.42%).

Target Hospitality Corp. (+63.60%) was the top winner for the second week in a row, propelling itself to #1.

Meanwhile, Biotech companies continued their strong showing, as Veru popped 29.35% and Cincor Pharma rose 28.71%.

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

The Top 25 lists’ Top Dawg was Target Hospitality Corp. for the second straight week, as the stock rallied an additional 63.60%.

As discussed last week, the stock initially popped on positive earnings and a new government contract worth at least $575 million. This week the rally continued after the company received analyst upgrades from S&P Global (which raised its outlook to positive) and Oppenheimer (which raised their price target from $9.00 to $18.00 and maintained their outperform rating).

With roughly 33 million shares traded, this week was the stock’s second highest volume week (in terms of shares) and highest notional value traded.

The stock also managed to close at a new all-time high.

$TH is up 230.24% YTD.

See Y’all Next Week 🤙