It’s a summer Sunday, and we’re leaving Monday’s problems for tomorrow.

But, let’s at least recap and look to the week ahead.

What Happened?

🤪 Stocks had another volatile week, clawing their way back to a slight loss as the market’s five-week trading range continues.

🤩 This week’s Stocktwits Top 25 report was very similar to last week, though there were some significant outliers in the Russell 2000 list.

💰 Earnings season kicked off this week with the banking sector. The nation’s largest bank, JPMorgan, missed earnings as it wrote off bad debts and increased its loan loss reserves, raising the market’s concerns about the health of consumers and the overall economy. On the other hand, Citigroup’s earnings surprised to the upside, driving a major rally in the sector on Friday. Additionally, strong numbers from Taiwan Semiconductor eased some of the market’s fears about a significant slowdown in the semiconductor industry.

🥵 Inflation was in focus after U.S. headline Consumer and Producer Prices surged to new cycle highs. The core numbers, which exclude energy and food prices, decelerated again, but the scorching hot headline number drove the market to begin pricing in a 100 bp hike at the Fed’s July meeting. Nevertheless, the record inflation numbers continue to bite into consumers’ pocketbooks, keeping sentiment quite pessimistic.

💬 After the market’s reaction to the inflation numbers, several Fed governors began talking the market down. Late in the week, three of them essentially said that they prefer a 75 bp rate hike at the July 26th-27th meeting and that the Fed should avoid overreacting to any single data point.

💵 Amid the market volatility, the safe-haven U.S. Dollar continued to make new highs, reaching parity (a 1:1 exchange rate) with the Euro for the first time since 2002. The strong U.S. Dollar is having a major effect on global markets. After a rapid decline in the Yen, Japan’s government is beginning to worry about the currency’s position in the global economy.

📉 In sector-related news, Chinese internet stocks had a rough showing this week, and some market participants interpret that as a sign of more pain to come for stocks as an asset class.

✈️ Airlines were trending after American Airlines said it expects to report its first pretax quarterly profit since 2019. Meanwhile, Delta Airlines saw a weaker-than-expected profit as costs rose. But, more importantly, the company’s capacity numbers reiterated that the industry is struggling to hire and train enough staff to keep up with demand.

🌍 In international news, inflation expectations in the European Union and several other countries hit new highs this week, setting their central banks up for more rate hikes. Many of these countries are also slashing their growth forecasts as a result. Chna’s property market troubles are spreading as homeowners boycott mortgage payments and try to get their savings out of banks.

🤝 Meanwhile, President Biden made a trip to the Middle East to tackle several issues; however, it doesn’t appear he secured commitments for more oil production. Also, a preliminary agreement has been reached between Russia and Ukraine on food exports, opening three ports.

🗳️ Additionally, the Italian president rejected Prime Minister Mario Draghi’s resignation as political tensions in the country heated up. Meanwhile, the Sri Lankan president has fled to Singapore and sent his resignation by email. It’s been a rough couple of weeks for government leaders around the globe.

₿ Crypto prices rebounded late in the week with stocks and are continuing their relief rally over the weekend. In crypto company news, rumors about Coinbase’s health are flying after the company terminated its U.S. affiliate program. In addition, NFT marketplace OpenSea is laying off 20% of its staff, and Voyager Token rallied in hopes that the company will be able to collect some assets from bankrupt hedge fund Three Arrows Capital.

🔥 Several names were on the Stocktwits trending tab for a good portion of the week, including $EVFM, $MULN, $TWTR, $LKNCY, $TSLA, and $DWAC.

🛎️ P.S. if you’re an options trader that wants to help us improve the Stocktwits Portfolio feature and potentially qualify for a $150 American Express gift card, fill out this brief 2-minute survey!

Those are the major stories from the week. And here are the final prints:

| S&P 500 | 3,863 | -0.93% |

| Nasdaq | 11,452 | -1.57% |

| Russell 2000 | 1,744 | -1.41% |

| Dow Jones | 31,288 | -0.16% |

Bullets

Bullets from the Weekend

❌ Shopify joins other tech companies in cutting hiring plans. Amid the tech selloff and weaker market conditions, Shopify is joining the slew of companies reducing their headcount and hiring. The company confirmed it had not rescinded internship offers but is reducing the number of fall interns it takes on as it reduces staff across the board. Ottawa Business Journal has more.

🏭 Virgin Galactic is building a manufacturing facility in Arizona. The company plans to open a new factory in Mesa, Arizona. The facility is scheduled to be late operational by late 2023 and will perform the final assembly of the company’s new Delta-class spaceplanes. More from Space News.

🏦 Australia’s ANZ is close to buying Suncorp’s banking arm. In what could be Australia’s banking deal in over a decade, Australia and New Zealand Group (ANZ) is nearing a deal to buy the banking unit of insurer Suncorp Group. The unit is estimated to be worth roughly 5 billion Australian dollars, and expectations are that ANZ will pay a premium to close the deal. The Suncor news comes days after reports that ANZ is in talks to buy software company MYOB group. BusinessTimes has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

Eyes will be on this week’s global central bank interest rate decisions/commentary ahead of the Federal Reserve’s July meeting on the 26th-27th. In addition to the above, check out this week’s complete list of economic releases.

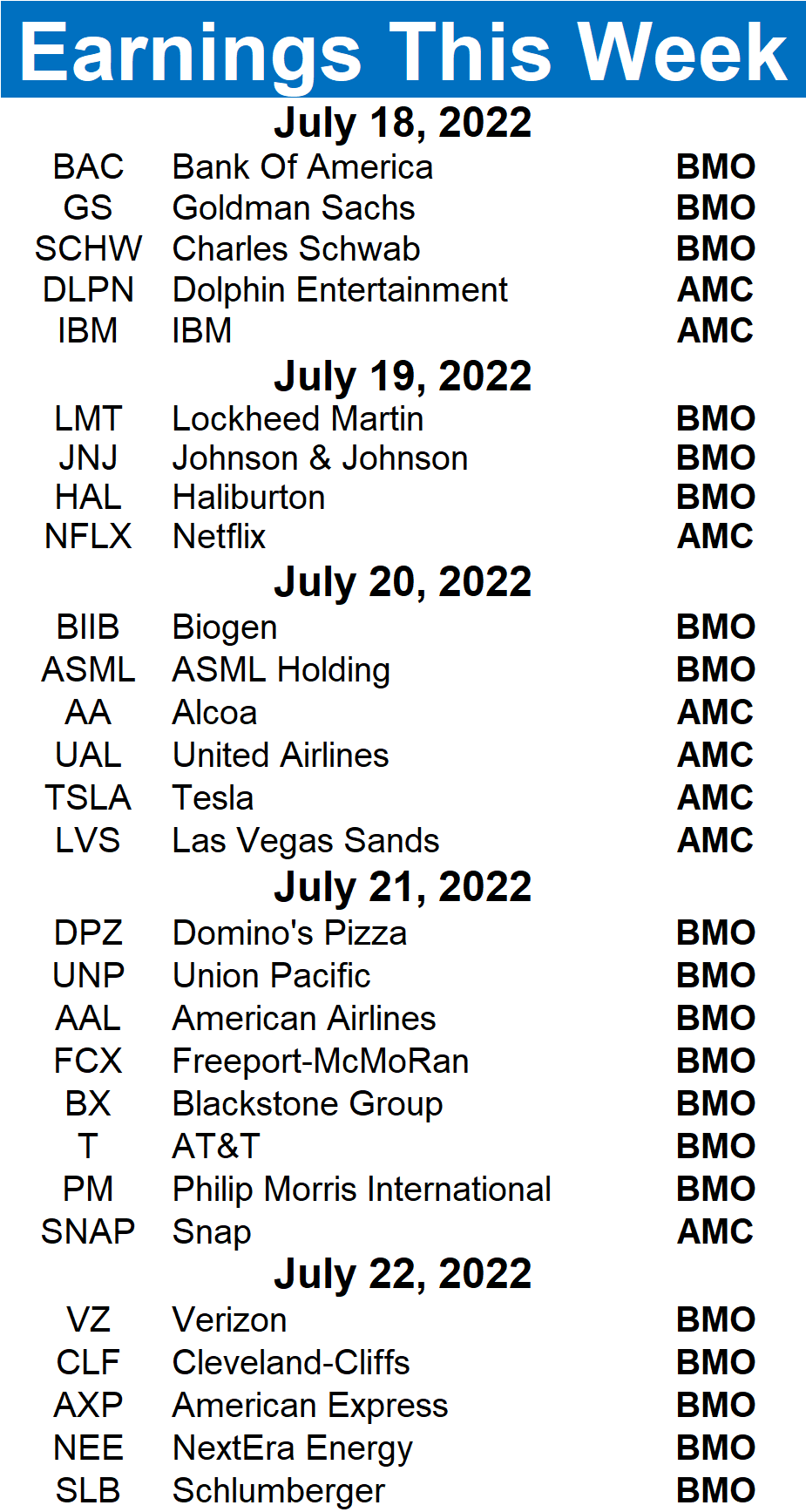

Earnings This Week

194 companies report this week as earnings season heats up. Several tickers you may recognize are $BAC, $NFLX, $TSLA, $SNAP, and $CLF.

Above is a quick summary. Check out the full Stocktwits earnings calendar to see the other names reporting this week.

Links

Links That Don’t Suck:

⚾ Juan Soto rejects what would have been the largest contract in baseball history

☕ Starbucks mulls selling its U.K. operations, The Times reports

🤔 The size of the millennial generation is to blame for sky-high inflation, strategist says

👀 Stunning photos of July’s supermoon from around the world

⚖️ Elon Musk seeks to block Twitter request for expedited trial

🚨 Mexico arrests drug lord Caro Quintero, wanted for killing U.S. agent

😮 Lawsuit claims that Skittles are ‘unfit for human consumption’

🤖 Perceptron: AI that solves math problems, translates 200 languages, and draws kangaroos

🍦 Everywhere you can get free & cheap ice cream on Sunday’s “National Ice Cream Day”