It can either be Friday, or we can have stocks close green; we don’t make the rules — here’s what you missed on the fifth straight Friday of losses. 👀

Today’s issue breaks down big bank earnings, job cuts at Beyond Meat, and more! 📰

Check out today’s heat map:

Every sector was red, with energy (-3.73%) and consumer discretionary (-3.71%) leading lower. 🔻

In economic news, China’s consumer prices rose by 2.8% YoY in September, the most in over two years. Singapore avoided recession in Q3, growing 4.4% despite its central bank tightening. 🌏

Here in the U.S., consumer spending was flat in September as inflation and recession fears hamper confidence. Along those lines, the Conference Board quarterly survey of business leaders showed that nearly every CEO (99% of those surveyed) is bracing for a recession in the next 12-18 months. 😮

Kroger confirmed rumors today that it is indeed planning to buy Albertsons in a nearly $25 billion deal set to shake up the U.S. retail and grocery industries. Both stocks were down around 8%. 🤝

Pour one out for Harvard University this weekend, as its endowment lost money for the first year since 2016. Tumbling global markets caused it to lose 1.8% in the fiscal year that ended June 30th, leaving the total endowment with *only* $50.9 billion. 😭

In crypto news, Uniswap raised a $165 million Series B round which values the company at $1.66 billion. The U.S. Financial Accounting Standards Board (FASB) decided that companies can use “fair value” to account for their crypto holdings. And scam victims are looking to hold Coinbase responsible, claiming the exchange didn’t protect them. ₿

Other symbols active on the streams included: $MMTLP (-10.52%), $MMAT (-2.32%), $TOP (-73.47%), $DWAC (-4.43%), $ILAG (+23.76%), $AVCT (-11.54%), $RLMD (-4.25%), and $TSLA (-7.55%). 🔥

Here are the closing prices:

| S&P 500 | 3,583 | -2.37% |

| Nasdaq | 10,321 | -3.08% |

| Russell 2000 | 1,682 | -2.66% |

| Dow Jones | 29,635 | -1.34% |

Earnings

Banks Earnings Were A Mixed Bag

Today, several of the U.S.’s largest banks kicked off earnings season as they always do.

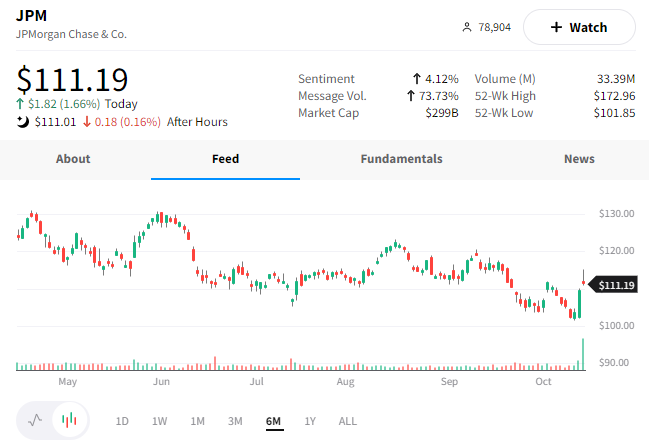

Starting with consumer banking, JPMorgan Chase topped earnings and revenue estimates. 📈

Its adjusted earnings per share of $3.12 were above the $2.88 expected, and revenues of $33.49 billion beat the $32.1 billion expected.

Earnings were down 17% YoY due to an $808 million increase in loan loss reserves, and a 24 cent per share hit related to losses on investment securities. Revenue growth of 10% YoY was driven by an increase in its net interest income, which rose 34% YoY. Higher interest rates and a growth in its loan book helped net interest income top analyst expectations by over $600 million.

While the consumer side of the business is holding up well, the investment banking side fell 47% in the quarter as the deal environment dries up. Meanwhile, trading revenue rose 8% amid the higher volatility and trading activity.

Overall, the biggest bank in the U.S. continues to paint a cautious picture of the economy. This matches the rhetoric CEO Jamie Dimon has shared throughout the year.

While $JPM shares enjoyed a nice pop today, they’re fresh off 52-week lows along with many of its banking-sector peers.

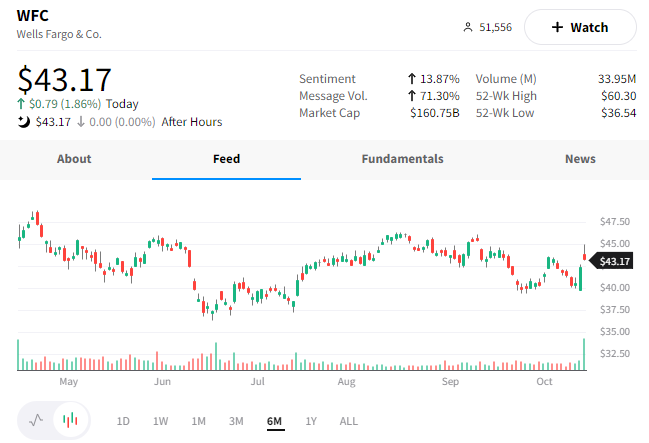

Similarly, Wells Fargo beat on the top and bottom lines. Its adjusted EPS of $1.30 and revenues of $19.51 billion came in ahead of the $1.09 and $18.78 billion expected. 💪

Like JPMorgan, it increased its loan loss reserves by $784 million given the less favorable economic environment. Meanwhile, it also suffered operating losses of $2 billion related to litigation, customer remediation, and regulatory matters. Although this is not a surprise for analysts who know the company is still working on cleaning up its act.

The company continues to divest a large part of its mortgage operations. Home lending revenue fell 52% YoY, and originations were down 59% YoY.

On the positive side, it saw a 28% jump in banking revenue due to stronger treasury management results and a 29% rise in commercial real estate revenue due to higher rates and loan balances. Similar to JPMorgan, its net interest income increased by 36% due to higher rates and loan balances.

$WFC shares rose 2% in a tough tape but sit in the middle of a longer-term trading range.

The banks performing worst in the current environment are those with larger investment banking/investment management businesses and less consumer banking exposure.

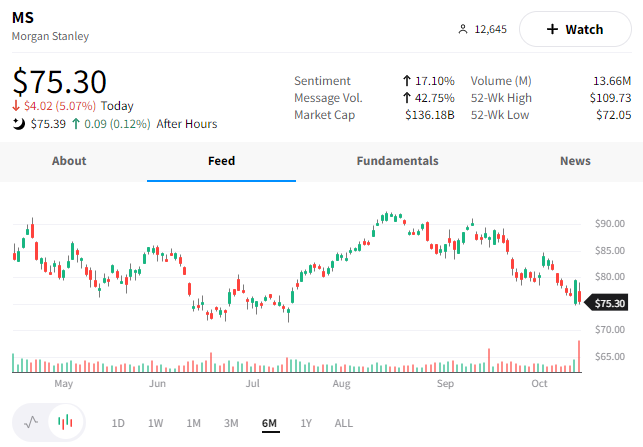

One of those is Morgan Stanley, whose earnings and revenue missed expectations. Its adjusted EPS of $1.47 and revenue of $12.99 billion were both below estimates of $1.49 and $13.3 billion.

The company saw investment banking revenue fall 55% YoY and investment management revenue fall by 20%. 😬

Shares of $MS fell by 5% today as investors digest the impact of a slowdown in its core businesses.

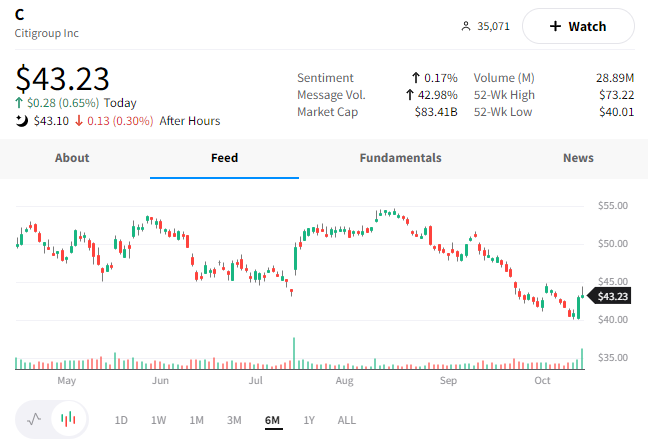

Citigroup is a mix of consumer business and investment banking, so it’s not surprising that it reported mixed results.

The bank beat on revenue ($18.51 billion vs. $18.25 billion) and earnings but saw its net income fall 25% YoY. An increase in loan loss reserves and the slowdown in investment banking activity proved a double whammy for the global bank.

Personal banking was a bright spot, with revenue rising 10% YoY. Meanwhile, fixed income revenue missed expectations, while equities revenue beat. 👍

$C shares closed slightly higher on the day.

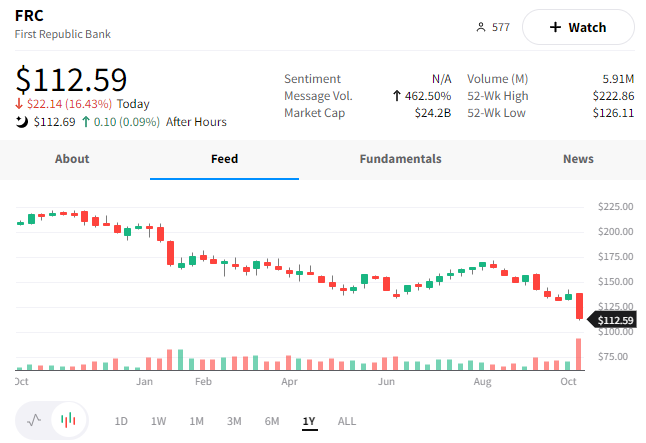

Lastly, we must mention First Republic Bank, which was absolutely demolished. The regional bank reported better-than-expected earnings but missed on revenues. 😨

Most importantly, the company said its net interest income is running about 4bps behind its forecast for growth of 2.75%. In this industry, that’s one number you cannot afford to miss. 🚫

As a result, investors sent $FRC shares down 16% to their lowest level since October 2020.

Company News

Beyond Meat Continues Its Cuts

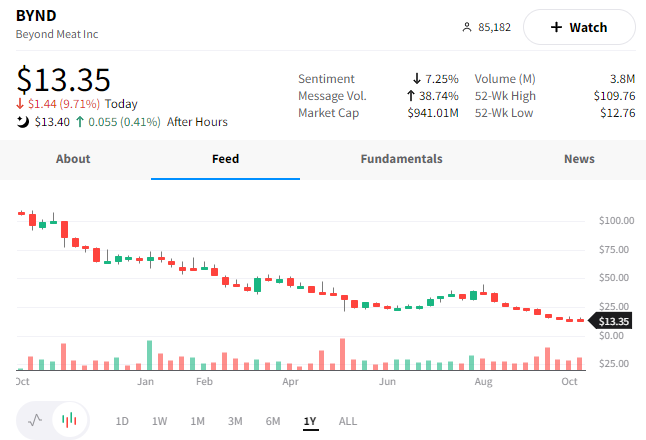

The struggles at Beyond Meat continue.

Today, the company drastically cut its revenue outlook for the second time due to slowing demand for faux meat as consumers look for chapter options in the current inflationary environment.

Like other growth companies struggling to deliver results, they’re now focusing on cost-cutting to achieve profitability. It’s cutting roughly 200 jobs this year, resulting in about $39 million in cost savings over the next twelve months. 💰

Accompanying the job cuts is a shakeup among its executives. Its finance chief Philip Hardin is leaving at the end of the month. And its operations head Doug Ramsey left the company shortly after it suspended him for allegedly biting a man’s nose.

Overall, most investors still don’t believe the turnaround story. $BYND shares fell another 10% today to fresh all-time lows in what appears to be a “death by 1,000 cuts” situation. 😬

Bullets

Bullets From The Day:

⏪ FTX founder reverses course on his political contribution comments. The crypto billionaire is backing down from his May comment suggestions he could spend $1 billion or more in political races through the 2024 election. He says his remarks were sloppy and inconsistent, stating that once you get your message to voters, the additional funds and messaging have a diminishing return. Others speculate that the recent downturn in crypto markets has impacted his ability, or desire, to contribute as much politically. After all, he and his firms have acted as a lifeline to many companies during the recent “crypto winter.” CNBC has more.

☢️ Drilling for the worst possible scenario. NATO is starting drills with B-52 bombers to prepare for a nuclear event. The organization unveiled its annual nuclear exercise called “Steadfast Noon,” which practices deploying U.S. nuclear bombs based in Europe. The drills come as tensions with Russia continue to heighten, though NATO said the Wester drills were not prompted by the recent rhetoric. NATO spokesperson Oana Lungescu said, “This exercise helps ensure that the alliance’s n nuclear deterrent remains safe, secure, and effective.” More from Reuters.

❌ SurveyMonkey parent announces layoffs. Momentive Global laid off 11% of its workforce this week as it looks to streamline its focus and align resources to its top priorities. The cuts affect multiple divisions, including business development, customer support, recruitment, and sales. In February, Zendesk terminated its proposed $4.1 billion acquisition of Momentive, which has since seen its stock fall more than 60% to new all-time lows. Given the “get acquired” plan appears off the table, the company will have to cut costs and find its way to profitability in the coming quarters. TechCrunch has more.

🏘️ A slowing real estate market continues to hit the industry. The real estate valuation technology company Clear Capital is laying off 27% of its staff just months after freezing hiring. The reduction primarily impacted its operational team and was a last resort, according to CEO Duane Andrews. However, he also noted that no guarantees that further cuts won’t be made. Rising interest rates and a slowing global economy have halted real estate activity in its tracks, forcing many companies in the industry to scale back after years of rapid expansion. More from TechCrunch.

📉 The worst returns in 100 years. The traditional 60/40 stock/bond portfolio could be heading for its worst annual return in about a century. Even 25/25 portfolios that hold equal parts cash, commodities, stocks, and bonds have fallen 11.9% in 2022, its worst drop since 2008. On the bright side, history shows that weak short-term returns mean higher long-term returns. If nothing else, that historical context can help us ease the sting of looking at our red portfolios for the rest of the year… Reuters has more.

Links

Links That Don’t Suck:

🎥 Robbie Coltrane, Hagrid actor in ‘Harry Potter’ franchise, dies at 72

📰 Rupert Murdoch explores reuniting Fox and News Corp

📺 Cartoon Network is not dead, says Warner Bros. — but its future is uncertain

🧫 Brain cells in a lab dish learn to play Pong — and offer a window onto intelligence

🏥 A global epidemic of cancer among people younger than 50 could be emerging