Usually, it pays to be fast. But for the last few Fed days, that’s not been the case. Stocks rallied on the Fed’s interest rate decision before reversing lower during Powell’s remarks — let’s recap the day. 👀

Today’s issue covers the Fed’s interest rate decision, why investors are still reluctant about growth stocks, earnings from Robinhood, and more! 📰

Check out today’s heat map:

Every sector closed red. Utilities (-0.97%) led, and consumer discretionary (-3.78%) lagged. 🔻

Internationally, the Ukraine grain export deal is back on track after Russia resumed its role. North Korea fired a record number of short-range missiles in response to South Korea and the U.S. flexing their military muscles. And Europe’s energy crisis continues to hamper its industrial activity. 🗺️

The world’s largest container shipping firm Maersk was down 8% today after a warning of ‘dark clouds on the horizon.’ ⛈️

A day after United Airlines’ pilots rejected a new contract proposal; Delta pilots rejected their agreement ahead of the busy holiday travel season. ✈️

CVS Health rose 2% after beating earnings and revenue expectations while raising its full-year guidance for the second straight quarter. 📈

Paramount Global fell 12% after missing earnings and revenue estimates despite adding 4.6 million Paramount+ subscribers vs. the 3.25 million expected. 📉

Other symbols active on the streams included: $BAND (+41.63%), $MMTLP (-6.89%), $AMD (-1.73%), $MULN (-9.62%), $MMAT (+10.44%), $ENVX (-41.47%), $ABNB (-13.43%), and $DOGE.X (-9.19%). 🔥

Here are the closing prices:

| S&P 500 | 3,760 | -2.50% |

| Nasdaq | 10,525 | -3.36% |

| Russell 2000 | 1,789 | -3.36% |

| Dow Jones | 32,148 | -1.55% |

Policy

The Fed Can’t Get Ahead

The Federal Reserve hiked rates another 75 bps today as its fight against inflation continues. While Fed members and recent economic data largely telegraphed the increase, Powell’s commentary spooked the stock market and other risk assets.

Let’s get into the details. 📝

First, let’s talk about why stocks popped upon the initial release. A red-lined version from Nick Timiraos shows that the Fed not only delivered on its 75 bp hike but also added language suggesting more moderate increases would be ahead. At face value, that’s a slightly more “dovish” tone that we’ve seen from other central banks worldwide over the last month or two.

Fed hikes by 75 basis points.

New sentence in the FOMC statement signals more increases but hints at possibly smaller increments pic.twitter.com/nU13MVg5Sr

— Nick Timiraos (@NickTimiraos) November 2, 2022

Where things ran into trouble during Powell’s press conference. Again we’ll defer to Nick for another excellent summary here, but the critical difference is item #2.

The terminal fed funds rate initially discussed will likely have to rise. And rates will have to stay high for longer because it takes time for policy to work through the economy and have a meaningful impact on inflation. ⏳

The 3 takeaways from Powell's press conference:

1) The Fed could step down to a slower pace in Dec even if inflation data don't improve much

2) If there had been new estimates of the terminal funds rate released today, they would have moved up

3) Not ready to talk about a pause— Nick Timiraos (@NickTimiraos) November 2, 2022

In other words, rates will stay higher for longer. That’s not great for risk assets, especially growth stocks and speculative investments like crypto.

The Fed outwardly acknowledging the lagging effect of policy and baking that into its decisions is a significant change in its communication. Until now, the Fed said it would rely on lagging inflation indicators like the PCE index and continue hiking until the housing and labor markets cooled. 📉

This rhetoric created fear that it’d continue hiking blindly until something broke in the economy. And while it’s not drastically changing that approach, it at least acknowledged the limitations of its policy measures and has outlined a more measured approach for future hikes.

For now, expectations are for another 50 bp hike in December before the pace slows further in Q1.

After today’s ADP payroll report showed 239k jobs added in October and wage increases of 7.7% YoY, all eyes will be on Friday’s nonfarm payroll data to see how tight the labor market remains. In the meantime, it seems the tightening continues, and stocks are not loving it… 👎

Given the interest rate and macro environment look likely to be challenging for the foreseeable future, there’s a lot of reluctance among growth stock investors. You’d think that after 50-60-70% or more declines from their 2021 highs, investors would be rushing to buy some names back at cheaper valuations. But that’s not been the case.

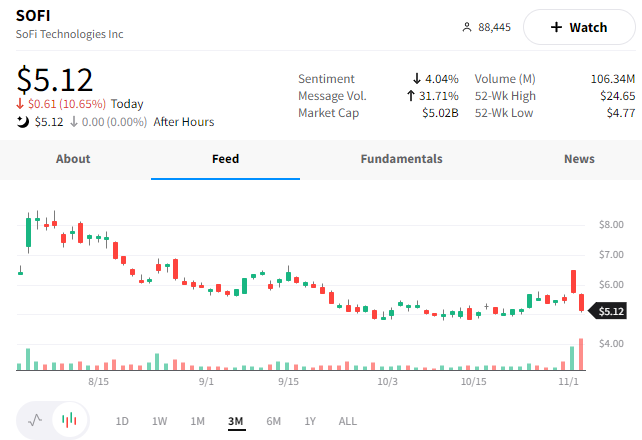

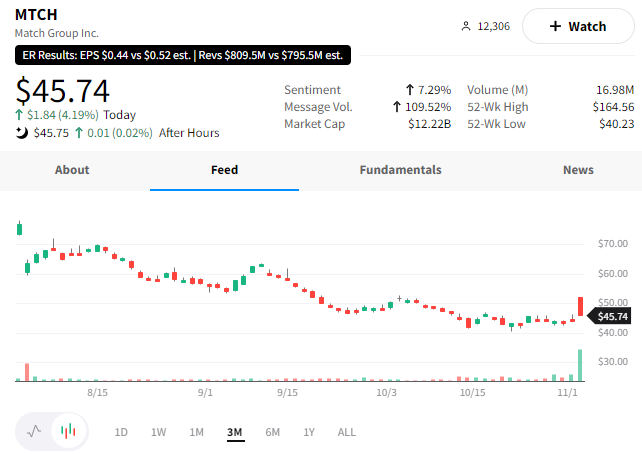

SoFi Technologies and Match Group are good examples from the last few days.

SoFi reported a decent quarter, topping revenue estimates and a loss slightly below expectations before Tuesday’s open. The stock rallied more than 20% initially but faded throughout the day to close up 5%. Today, the selling continued, with shares falling another 11%!

Meanwhile, Match Group experienced similar action today after reporting better-than-expected earnings and revenues.

The stock was initially up nearly 20% before fading throughout the day, closing up 4%

Bears will say that both of these companies also reported soft guidance for the coming quarters, which is understandable. But at the very least, they’re taking actions to get back on track and are inching closer to analyst estimates each quarter. That’s gotta count for something…right?

Apparently, not in this environment.

And don’t get us started with the growth stocks that continue to miss and/or reduce guidance. The market continues to punish them ruthlessly.

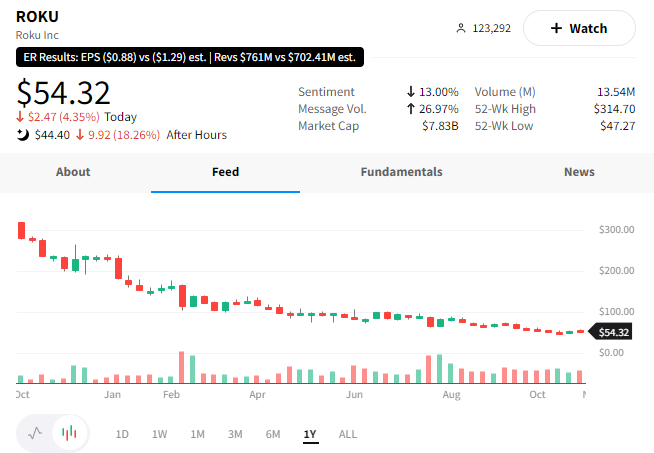

A good example from today is Roku, which fell another 18% after hours. Despite beating current-quarter revenue and earnings estimates, its weak revenue guidance and a larger adjusted EBITDA loss spooked investors. The company expects ad budgets to degrade along with consumers’ discretionary spending, hence the weaker guidance.

With central banks continuing to tighten as the global economy heads toward recession, can we really blame investors for wanting to steer clear of these stocks? As history suggests, valuation is not a catalyst on its own. And right now, the bigger-picture trends around liquidity and economic growth remain major headwinds for growth stocks worldwide.

And with headlines about companies ranging from Apple to Opendoor to Chime all slashing headcounts or freezing hiring to prepare for an upcoming recession, it’s no surprise investors are a little trigger-shy after a year-plus of buying dips that kept on dipping.

When that will change remains to be seen. But for now, the environment remains very difficult for growth stocks and investors alike.

Earnings

All Good In The $HOOD

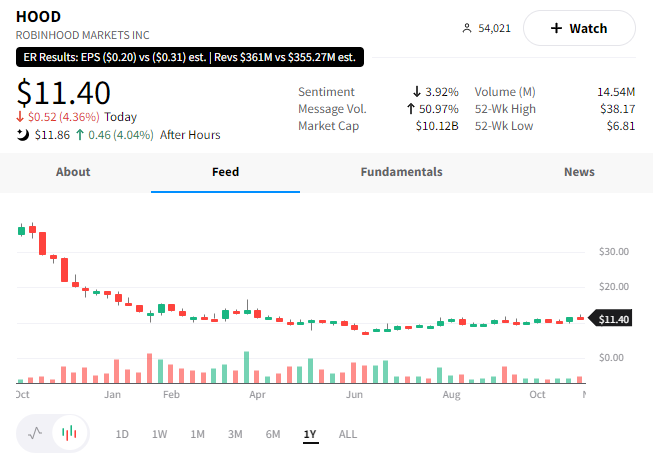

Speaking of beaten-down growth stocks, Robinhood reported earnings today! 📝

The company’s diluted earnings per share of ($0.20) beat expectations of ($0.27), while revenues of $361 million beat expectations of $357.7 million. The brokerage’s net interest revenue drove the results, rising 73% to $128 million due to rising interest rates.

Its cryptocurrency transaction revenue fell 12% to $51 million as the “crypto winter” continues. On the other hand, equity trading ticked up 7% QoQ to $31 million, and options trading revenue was $124 million. Meanwhile, its quarterly monthly active users fell well short of the 13.74 million expected, at 12.2 million.

Transaction revenue is attempting to stabilize at $208 million, down from $266 million last year but up from last quarter’s $202 million. However, like other growth darlings, the company continues to cut costs and prioritize profitability amid the weaker environment. 💵

The initial reaction from investors was positive, with $HOOD shares rising 4% and erasing their intraday losses. We’ll have to see how it holds up in the coming days or if it faces a similar fate as the growth stocks discussed above.

Bullets

Bullets From The Day:

🏭 Ford hit by supply chain issues again in October. The automaker’s sales slumped 10% in October as supply chain issues delayed shipments to dealers. October was the second straight month of YoY declines after several double-digit increases. In addition, the company’s sales were far below the industry’s average for the month, putting its full-year target at risk if things don’t pick up. CNBC has more.

🏦 Can global banks save Hong Kong’s ‘hub’ status? Officials in Hong Kong and China are trying to build the city’s reputation as a global financial hub after several years of COVID lockdowns cratered its economic activity. It recently reported a 4.5% YoY decline in GDP growth, signaling that it still has a lot of work ahead of it in restoring confidence and economic activity. Officials touted the city’s connection to China on top of its global integration to woo financial firms back. More from Reuters.

🗳️ Vanguard to give retail investors more voting power. Scrutiny has grown over large asset managers who have massive voting power in many of the globe’s largest companies. As a result, Vanguard is leading the way in launching a new program designed to give individual investors in its equity index funds more options on how the asset manager will cast its votes. The company will test the strategy early next year. And with it currently helping oversee voting policies for about 30 million investors, this move will likely force its competitors to consider similar actions. Bloomberg has more.

💊 CVS, Walmart, and Walgreens reach U.S. opioid settlement. The three companies have agreed to pay $13.8 billion to resolve thousands of U.S. state and local lawsuits accusing the pharmacy chains of mishandling opioid drugs. The government plans to disburse the funds back into affected communities to help combat the epidemic. While some details still need to be worked out, the trend of large companies settling opioid-related cases continues. More from Reuters.

📰 Human-curated Facebook news stories are a thing of the past. However, curating the news is more difficult than Meta anticipated. Three years after first introducing a curated news section for publishers, the company has confirmed it’s ditching humans and will rely on algorithms for Facebook News in all markets where it’s available. As it deprioritizes this feature, it will shift its focus toward building tools and features related to the creator economy. TechCrunch has more.

Links

Links That Don’t Suck:

☕ Caffeine during pregnancy linked to shorter kids

📆 Chick-fil-A’s four-day weekend experiment for workers

✋ Vornado pumps brakes on Gov. Kathy Hochul’s Penn Station project

🔍 Some companies opt for lame loophole under NYC’s new pay transparency law

👃 Mouse study suggests a surprising link between nose-picking and Alzheimer’s

🏈 Washington Commanders owners are exploring a potential sale of the NFL team

🦴 Shocking 439-million-year-old “shark” forces scientists to rethink the timeline of evolution

☄️ ‘Planet killer’ asteroids nearly a mile long detected after being hidden by the sun’s brightness