Stocks and bonds continued their declines from yesterday while the U.S. Dollar retained its safe-haven status — let’s see what you missed from the day. 👀

Today’s earnings-focused issue covers the two sides of payment processing, what sent DoorDash shares from crashing to $DASHing, and another Chinese stock that’s turning heads. 📰

Check out today’s heat map:

4 of 11 sectors closed green. Energy (+1.86%) led, and technology (-2.96%) lagged. 🟢

In economic news, the Bank of England raised rates by 75 bps and warned that the country would face a two-year slump. The ISM non-manufacturing PMI showed services growth slowed to its lowest in 2.5-years. And the S&P global composite PMI showed that U.S. private sector activity fell again in October as firms slowed their price increases to boost demand. ⚠️

Growth companies continue to announce layoffs as they prepare for a prolonged economic downturn. Headline layoffs included Lyft (-13%), Opendoor (-18%), Stripe (-14%), Chime (-12%), Twitter (-50%), and Morgan Stanley (TBD). ❌

In crypto news, Coinbase reported third-quarter earnings and revenue that missed analyst expectations. Its shares fell 8% ahead of the report but pared losses after hours. Meanwhile, Fidelity is opening commission-free crypto trading to retail investors. Well, free, except for the 1% execution spread. And digital asset platform Bakkt agrees to buy Apex Crypto for up to $200 million. ₿

Other symbols active on the streams included: $ORGN (+0.38%), $MMTLP (+9.67%), $ROKU (-4.57%), $MULN (-16.05%), $STEM (+1.62%), $MASK.X (+44.95%), and $DOGE.X (+1.43%). 🔥

Here are the closing prices:

| S&P 500 | 3,720 | -1.06% |

| Nasdaq | 10,343 | -1.73% |

| Russell 2000 | 1,780 | -0.53% |

| Dow Jones | 32,001 | -0.46% |

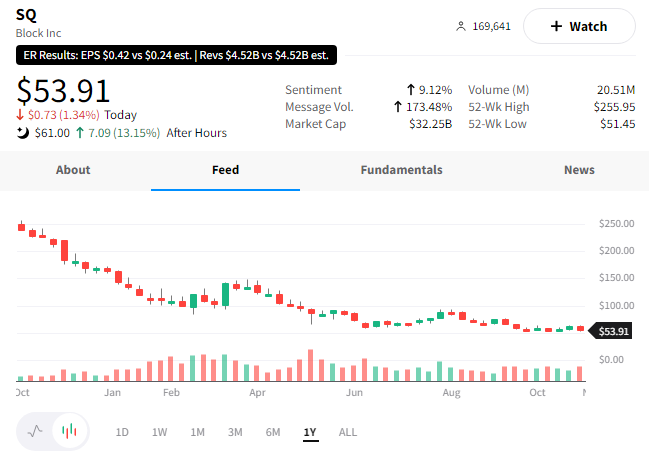

It pays to be a shareholder of Block today. Meanwhile, PayPal shareholders are paying the price for holding shares through earnings.

Let’s take a look at how these financial services companies fared.

First, let’s start with Block, formerly known as Square.

The company reported better-than-expected earnings and revenue. Its adjusted earnings per share of $0.42 bested expectations of $0.23. Meanwhile, revenues of $4.52 topped estimates of $4.49 billion.

The company also shared some numbers from its core business units. Its Cash App business saw a 51% YoY rise in gross profit, while its Cash debit card users rose 40% to 18 million people. Square’s point-of-sale business also saw gross profit grow 29% YoY. 📈

Investors were happy that the company did not experience the macro slowdown that has hit other payment companies already. However, given the current commentary surrounding the global economy, many expect that to catch up to them eventually.

Still, $SQ shares are popping 13% after hours.

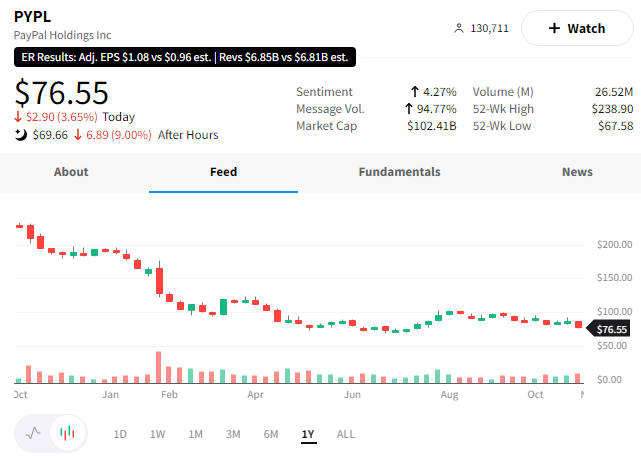

$PYPL shares did not fare as well, falling nearly 13% today despite the company beating earnings and revenue estimates. 📉

Earnings per share of $1.08 beat the $0.96 expected, while revenues of $6.85 billion beat estimates of $6.82 billion.

Looking forward, PayPal raised its EPS guidance for the full fiscal year, citing “ongoing productivity initiatives.” But what’s hitting the stock is its Q4 revenue estimate falling short of the $7.74 billion expected at $7.38 billion.

As we’ve seen with many other companies this week, forward guidance has been key. And right now, any missteps are being punished by investors. 👎

On that same note, we have to mention two other popular tech companies cratering after hours. Twilio ($TWLO) and Atlassian ($TEAM) are down big after issuing weaker-than-expected guidance. 🔻

Company News

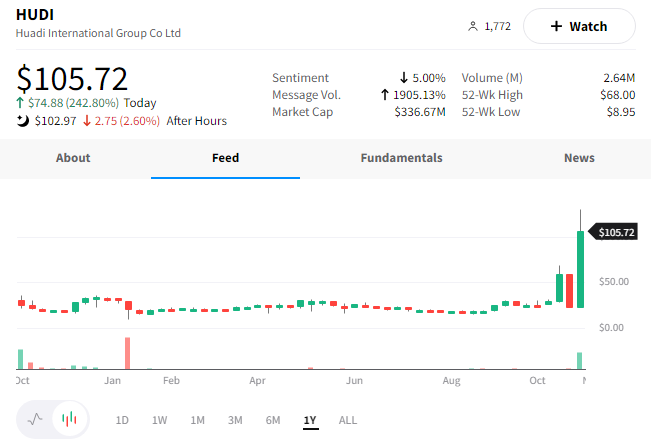

Huadi Heck Did That Happen?

It’s been a little while since a strange, low-float Chinese company rallied triple digits. But fear not, another one has popped up. 📈

Its name is Huadi International Group, and it’s a China-based micro-cap company in the business of industrial stainless steel products. While its products are used in various industries, the company’s exposure to China’s real estate market has been of major concern for investors.

Today shares of $HUDI rallied over 240% after announcing a strategic plan to utilize its industrial stainless steel production capabilities for anode materials. For us laymen, those materials are key to battery development. Diversifying its business away from a struggling sector and into the red-hot electric vehicle and alternative energy space has excited many people.

And it’s been able to move so fast because of its low float and lack of Wall Street coverage. That’s also why it’s incredibly risky. ⚠️

Whether or not it will face the same fate as its peers earlier in the year remains to be seen. Investors are likely still trying to determine whether the business pivot is the company pandering to shareholders. Or if the plan is actually viable over the long term.

Either way, the massive move has caught traders’ attention. Expect this one to be on people’s radars in the days and weeks ahead. 👀

Earnings

From Crashing To $DASHing

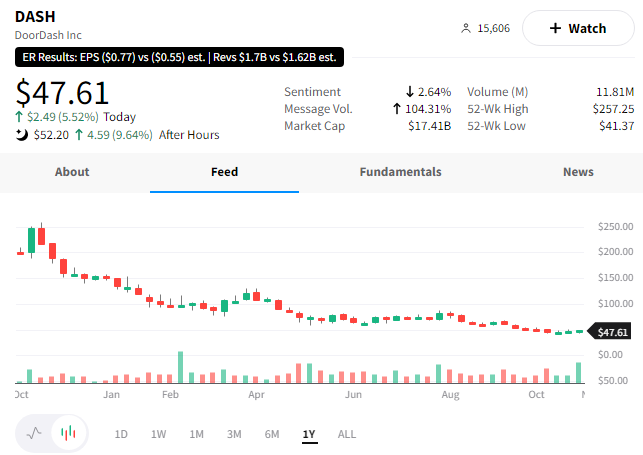

It’s been a rough time for growth stocks, but DoorDash delivered a surprise for its investors today.

The food delivery company reported better-than-expected sales and total orders but missed earnings.

Its loss per share was $0.77 vs. the $0.60 expected. Revenues of $1.7 billion beat the $1.63 billion expected. Meanwhile, total orders rose 27% to 439 million, beating estimates of 433 million.

Investors were concerned that the food delivery business would slow as inflation pressures consumers’ discretionary income. Especially since many restaurant chains have reported weaker sales, especially from lower and middle-income consumers who are trading down or skipping dining out altogether. 🥡

However, the company anticipates consumer spending will remain strong in the current quarter. It’s projecting gross order volume of $13.9-$14.2 billion, higher than Wall Street’s view of $13.73 billion.

Shares of $DASH popped 15% today on the news. As we’ve discussed, investors remain hesitant to jump back into growth stocks. So we’ll just have to wait and see if today’s move is the start new trend or yet another head fake. 🤷

Bullets

Bullets From The Day:

🚴 Peloton rises 8% despite falling short of expectations. The company missed on the top and bottom lines, with revenue falling 23% YoY. Executives believe the turbulent macroeconomic environment will continue to weigh on demand, issuing guidance for the current quarter of $700-$725 million in sales, well short of the $874 million analysts expected. While the numbers aren’t yet where they need to be, the company is driving back towards its goal of breakeven free cash flow. CNBC has more.

💉 Vaccine maker earnings need a boost as sales outlooks fall. Shares of Moderna fell 5% before clawing back to breakeven intraday following its weaker-than-expected earnings report. The Covid vaccine maker joins its peers in reducing its guidance as vaccine demand falls. The company expects the annual global market for Covid vaccines to be similar to flu shots in the future, which means it needs its other products in development to deliver future growth. More from CNBC.

♨️ Starbucks rises after earnings and revenue come in hot. The coffee chain beat expectations, driven by higher spending in its U.S. stores. Net sales rose 3.3%, and global same-store sales increased 7%, driven by the strength of U.S. same-store sales growth at 11%. Active memberships in its loyalty program also rose 16% to nearly 29 million people. Covid restrictions in China and other markets hampered International performance, though same-store sales fell less than the 7.1% expected (-5%). CNBC has more.

📺 Warner Bros. reports an unexpected Discovery. Shares of the media giant fell 11% after its revenue missed analyst expectations, and a $0.95 per share loss reflected a weakening macroeconomic environment. Like other media giants suffering from increased competition and a slowdown in advertising revenue, the company has been taking severe cost-cutting measures. However, it expects restructuring efforts to take until the end of 2024 to complete. In addition, the company’s merged HBO Max and Discovery+ service will come this spring. More from CNBC.

🛑 Nikola crashes 11% after putting the brakes on production guidance. The electric vehicle maker’s loss per share and revenue beat analyst expectations, but shares fell drastically after the company reduced its production targets for the full year. Executives also declined to provide guidance for 2023, citing uncertainty around the timing and costs of its planned factory expansions. Based on today’s price action, investors see the report’s bad aspects as more pressing than the good. CNBC has more.

Links

Links That Don’t Suck:

🌕 Beaver blood moon lunar eclipse 2022: everything you need to know

☕ Folgers, a throwback coffee brand in a time of nitro lattes, wants to be cool

🌋 Record-breaking Hunga Tona volcanic plume might have warmed Earth’s climate

♻️ PepsiCo, Nestle, Coca-Cola, and other major brands to plunder plastic sustainability goals