You can always count on the market to be surprised by things it shouldn’t be surprised by. 🤦

The Federal Reserve has been prepping the market with strong language for weeks, and inflation data remains stubbornly high. All of that pointed to today’s 75 bp hike and several more before the end of the year.

So, what’s changed? Not a whole lot, but let’s read between the lines as we always do.

The first significant change was to the Fed’s “Dot Plot,” which shows that 12 of 19 FOMC members expect the Fed Funds rate to be between 4.50% and 5.00% by the end of 2023. Additionally, its projections show an expected rate range of 4.25%-4.50% before the end of 2022.

If their projections are correct and inflation remains high, another 75 and a 50 bp hike are coming in the next three months. 🔺

The second significant change, which isn’t really a change, is that the Fed is throwing out the potential for a “soft landing.” While most of us discarded that idea after seeing the labor market strength and stickiness of inflation, it appears the market still had some hope left in it.

That hope is no more. 👎

Jerome Powell is waging a full-on war against inflation, and his two targets are the labor market and housing. He cannot, and will not, stop until prices meaningfully progress back towards 2%. That means unemployment will rise and housing prices will fall (or so the Fed hopes) in the coming quarters. Historically, that’s not great for risk assets like stocks or crypto either.

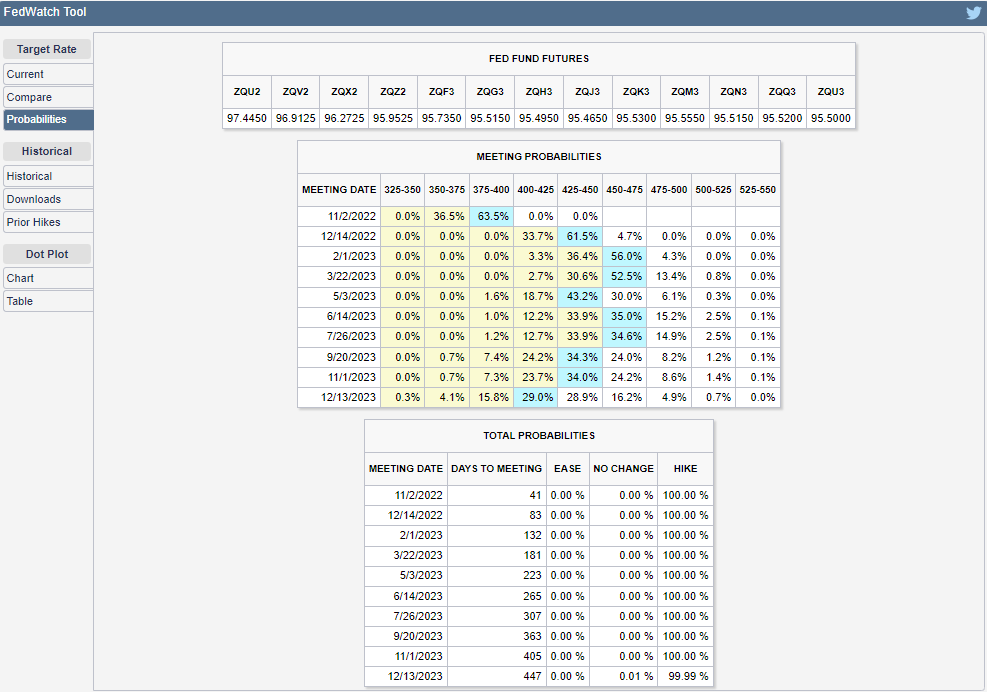

In the meantime, here’s a look at the CME FedWatch Tool, which shows the market’s projections for future hikes/cuts. After today’s meeting, it looks like the market is readjusting its expectations for more hikes through early 2023 and just one cut. To put that in perspective, over the summer, the market had been projecting rate cuts as early as Q1 2023.

What’s going to happen is anyone’s guess. That’s what we’re all doing here. But it appears the market is finally waking up to the idea that things could get worse before they get better. 😬