U.S. and international stocks continue to pare gains after strong runs, with the focus shifting to retail earnings — let’s get you up to speed. 👀

Today’s issue covers Target & Lowe’s earnings, Nvidia’s semiconductor update, and the widening yield-curve inversion. 📰

Check out today’s heat map:

2 of 11 sectors closed green. Utilities (+0.90%) led, and energy lagged (-2.04%). 💚

In U.S. political news, Former President Donald Trump announced his 2024 White House bid. Mitch McConnell won a secret-ballot election to continue leading Senate Republicans. Lastly, the Republicans look to hold a slim House majority as we await the final few results. 🗳️

Bath & Body Works jumped 22% after reporting better-than-expected earnings. 📈

DLocal Ltd. fell 50% after short seller Muddy Waters’ issued a report on the company. 📉

As for crypto, we’ll refer you to our Litepaper’s updated coverage on FTX and the related fallout. ₿

Other symbols active on the streams included: $MMAT (-5.85%), $DWAC (-16.08%), $MMTLP (-9.04%), $MULN (-7.79%), $PHUN (-9.93%), $GLBL (-15.34%), and $SATX (-17.20%). 🔥

Here are the closing prices:

| S&P 500 | 3,959 | -0.83% |

| Nasdaq | 11,184 | -1.54% |

| Russell 2000 | 1,853 | -1.91% |

| Dow Jones | 33,554 | -0.12% |

Yesterday Walmart and Home Depot reported better-than-expected earnings, leaving investors hoping Target and Lowe’s would see similar results.

Let’s find out if they did. 🕵️

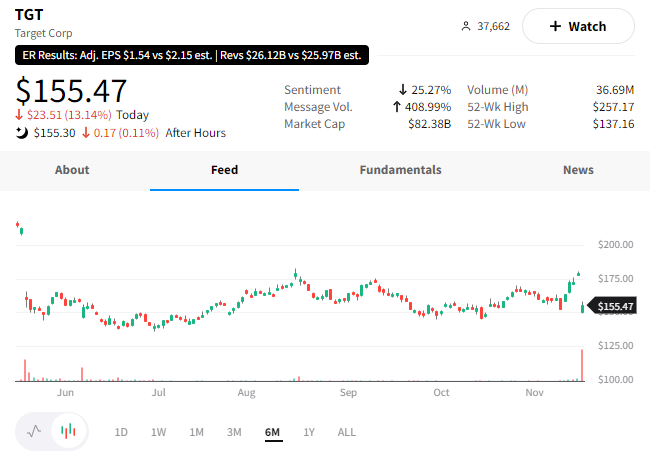

Target’s rough run continued today after the company beat on the top line but missed badly on the bottom line. Its Q3 earnings per share of $1.54 were far below the $2.13 expected, while revenues beat slightly at $26.52 billion (vs. $26.38 expected).

The company had expected to take a profit hit as it cleared out excess inventory, but not this big. Its Q3 profit fell by 50%, driven by promotional pricing and an overall slowdown in sales. 🔻

A significant sales slowdown in October is putting the company on defense. Chief Growth Officer Christina Hennington said, “it was a precipitous decline and, frankly, we’ve seen those trends in the early parts of November as well.”

The inflationary environment and recession fears are causing consumers to pull back. The 2022 trend of spending more on necessities and less on discretionary items continues. Like Walmart, the lower-margin Food and Beverage category was one of Target’s strongest. 🥫

As a result, it now expects a low single-digit decline in comparable sales and an operating margin rate of around 3% for the holiday quarter.

Overall, the company clearly has further work to do in navigating the current environment. Executives acknowledged that, planning up to $3 billion in total cost cuts over the next three years as it aims to improve its operational efficiency after sloppy pandemic growth.

$TGT shares fell 13% on the news as investors worried about the consumers’ health and Target’s ability to position itself properly in the current environment. 📉

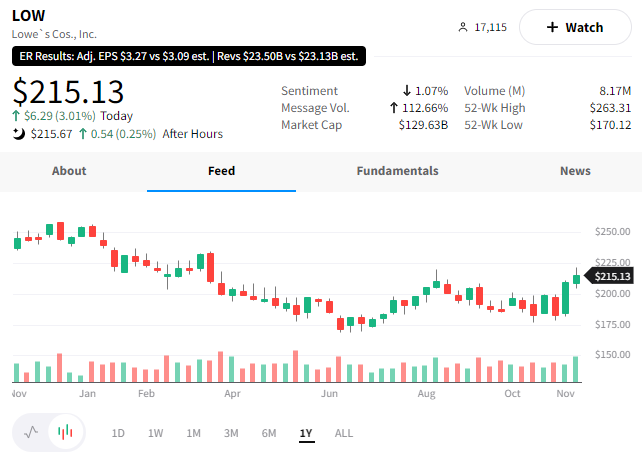

Meanwhile, Lowe’s followed Home Depot’s report by beating top and bottom line expectations.

The company’s adjusted earnings per share of $3.27 exceeded the $3.10 expected. Meanwhile, revenues of $23.48 billion topped estimates of $23.13 billion. 📈

Driving the results was strength in its professional and do-it-yourself home improvement segments. While many expected the housing market slowdown to affect its business, the company said rising rates hadn’t impacted its customer base, who tend to have fixed-rate mortgages and equity in their homes. Those two factors help buoy investment and renovation spending. 💪

Investors are also concerned about the overall level of economic uncertainty. CEO Marvin Ellison acknowledged those challenges but reiterated, “We’re not seeing the negative impacts of inflation.”

And as a result, the company raised its full-year earnings outlook while lowering the top end of its revenue outlook slightly. $LOW shares rose 3% on the news. 👍

So far, retail’s biggest players continue to paint a mixed picture of the consumer’s health and the overall economy. We’ll hear from more companies later this week. But overall, this remains a key area of concern for investors through the end of the year. 📆

Earnings

Nvidia’s Mixed Results

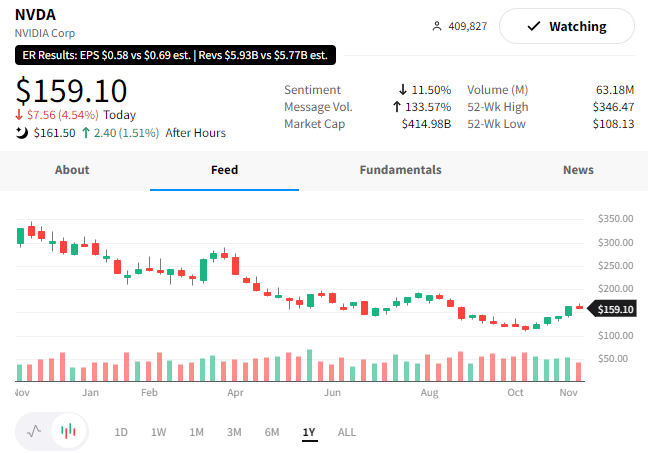

Semiconductor stocks have rebounded sharply over the last few weeks. But have their earnings improved enough to beat their lowered expectations?

Let’s see what Nvidia had to say.

On the earnings front, adjusted earnings per share of $0.59 missed expectations of $0.69. An inventory charge drove the profit miss due to China’s low demand for data center chips. 🔻

Nvidia’s revenue of $5.93 billion beat the $5.77 billion expected. And while gaming revenue continues to struggle with tough pandemic comps, its data center business saw a 31% YoY increase to $3.83 billion. Driving that demand growth was U.S. cloud service providers and consumer internet companies. Automotive growth of 86% YoY was also a nice kicker, though it remains a tiny portion of the business at $251 million in sales.

Looking ahead, the company expects fourth-quarter revenue of $6.00 billion, just shy of the $6.09 billion consensus view. It continues to adjust to macroeconomic conditions, which are impacting several of its major business lines.

Overall, the after-hours move in $NVDA shares reflects the company’s mixed results. While investors are certainly happy it’s no longer missing estimates by a wide margin, they also recognize the bar was set pretty low. As investors look for signs of a semiconductor cycle trough, we’ll have to see what the coming quarter brings. 🤷

Our main focus today is the further inversion of the yield curve. But first, let’s cover the economic data that came out today. 📝

On the housing front, the National Association of Homebuilders index showed sentiment fell for the eleventh straight month to the lowest level since June 2012. As the housing market cools, builders are stepping up their incentives to entice buyers and close deals.

After years of strength in the sector, they’re now facing headwinds on both sides of the equation. Prices of their completed homes are moderating, but the components of their building costs remain elevated. 🏘️

October’s retail sales came in at +1.3% vs. the +1.0% expected, with strength in auto sales offsetting weakness in general merchandise. Meanwhile, import prices fell 0.4% MoM in October, marking the fourth straight monthly drop. Export prices also fell 0.4% MoM, vs. the 0.8% decline in September.

As the economic data cools, the market’s expectations for a recession continue to grow. As a result, the 10-year 3-month treasury curve continues to widen, hitting its lowest level since 2007. 📉

Meanwhile, Federal Reserve members point to further rate hikes before any “policy pause” can occur. And overseas, the European Central Bank says it will do ‘whatever is necessary’ to get inflation to 2%. That’s likely why the Eurozone is expected to sink into recession within the coming months, with economists warning “it will not be shallow.”

Will the U.S. follow suit with a recession of its own? Only time will tell…but the yield curve is certainly projecting it will. ⌛

Bullets

Bullets From The Day:

🔋 Panasonic strikes a major battery component deal. Under the multibillion-dollar battery component deal, battery recycling company Redwood Materials will supply high-nickel cathode to Panasonic Energy beginning in 2025. Currently, Panasonic imports all of the cathode material used to produce battery cells at its Nevada plant. However, as the company expands to Kansas with a $4 billion plant, its need for these critical materials will continue to grow. CNBC has more.

💰 Tom Ford becomes the latest fashion billionaire. The 61-year-old fashion designer becomes a billionaire 17 years after founding the brand. Cosmetic giant Estee Lauder will acquire the fashion brand in a deal that values it at roughly 2.8 billion dollars. And with Ford owning about two third of the company, the sale will push him into billionaire territory, even after taxes. More from Forbes.

🎮 Can games make virtual meetings enjoyable again? Most meetings suck. But Microsoft is looking to fix that by adding its diverse game library to its “Microsoft Teams” app as the company looks to brand its software as the premier destination for work. With Office 365 products driving roughly 20-25% of the company’s total revenues, it’s working hard to beef up the experience and entice companies to adopt (or keep) the software in their workflow. CNBC has more.

⚖️ Court orders Intel to pay $948 million in a patent trial. A federal jury in Texas ordered the company to pay VLSI Technology LLC for infringing a VLSI patent for computer chips. The patent-holding company made the case that Intel’s Cascade Lake and Skylake microprocessors violated its patent. Intel says it plans to appeal the decision, adding it to the other VLSI-related $2.2 billion verdict handed down by the court last March. More from Reuters.

📝 Popular note-taking app, Evernote, acquired. The note-taking and task management app founded over 20 years ago is being bought by Milan-based app developer Bending Spoons. Evernote’s CEO Ian Small said the transaction should close in early 2023 and is a strategic step forward on the company’s journey to be an extension of people’s brains. Meanwhile, Bending Spoons sees this as an opportunity to further expand its software offerings to current users and cross-promote its existing products to Evernote users. TechCrunch has more.