Stocks pushed to new heights before reversing to close off the highs — let’s see what you missed on a busy news day. 👀

Today’s issue covers Walmart and Home Depot earnings surprises, October’s producer prices, and international stocks’ recent run. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Communication services (+1.43%) led, and materials lagged (-0.17%). 💚

The international community is on high alert after Russian missiles cross into Poland, killing two people. Meanwhile, the White House is asking Congress for another $37.7 billion in aid for Ukraine. And lastly, Japan’s economy shrunk by 0.3% QoQ in Q3, as inflation and the global economic slowdown took their toll. ⚠️

There’s too much Elon Musk news to cover every day, but he “welcomed back” the two fake employees that duped the media a few weeks back. On that note, he continues to scrap with current employees, firing several engineers who made critical comments on Twitter and Slack. 🤷

Carnival Cruise Lines fell 12% after announcing a new debt offering to refinance its ’24 maturities. 🚢

Several banking giants started a 12-week digital dollar pilot with the New York Fed. Crypto lender BlockFi is preparing for a possible bankruptcy filing. And the FTX accounts hacker swapped his/her stolen crypto for Ethereum, becoming its 35th-largest holder. ₿

Other symbols active on the streams included: $MMAT (+11.24%), $DWAC (-8.84%), $MMTLP (+15.70%), $SATX (+140.73%), $XELA (-31.37%), $QRTEA (+17.41%), $PDSB (+22.95%), and $AAP (-9.29%). 🔥

P.S. Stocktwits’ Senior Writer Tom Bruni joined “Nasdaq Trade Talks” to talk about how new investors are handling their first bear market. 📝

Here are the closing prices:

| S&P 500 | 3,992 | +0.87% |

| Nasdaq | 11,358 | +1.45% |

| Russell 2000 | 1,889 | +1.50% |

| Dow Jones | 33,593 | +0.17% |

Earnings

A Big Box Surprise

Yesterday we discussed investors’ fear that expectations may still be too high ahead of the holiday shopping season. Layoffs at Amazon and FedEx sparked speculation that retailers could be due for a rude awakening.

However, today’s Walmart and Home Depot results painted a slightly different picture. 🖼️

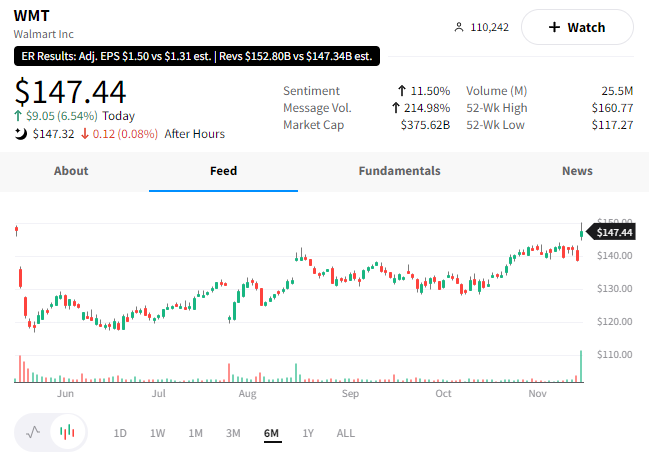

First up, big-box retailer Walmart reported earnings and revenue above expectations. Its adjusted earnings per share of $1.50 beat the $1.32 expected, while revenues of $152.81 billion exceeded the $147.75 billion expected.

Strength in its grocery department helped drive its overall 9% sales growth. The company reiterated that customers across income levels continue to favor lower-priced grocery items over discretionary items like electronics, apparel, etc. Meanwhile, a strong back-to-school season and successful promotions in its international markets also boosted sales. 🛒

With its online sales growth, the company’s ad business also saw a boost, rising 30% YoY. Walmart continues to rely on this and other new products, like its third-party marketplace, to help drive longer-term growth.

The company reiterated much of what we already knew regarding the consumer’s overall health. Consumers are being pinched by inflation, causing them to act with more discretion when spending money and trading down to lower-priced alternatives. With that said, the company noted the current quarter is “off to a pretty solid start.”

Overall though, Walmart feels like it’s well-positioned for the holidays. It’s worked through a lot of its excess inventory and has strong promotions planned to entice shoppers. Now it just has to hope that the global economy holds it together enough, so people continue shopping.

The better-than-expected news helped lift $WMT shares by nearly 7% today. 👍

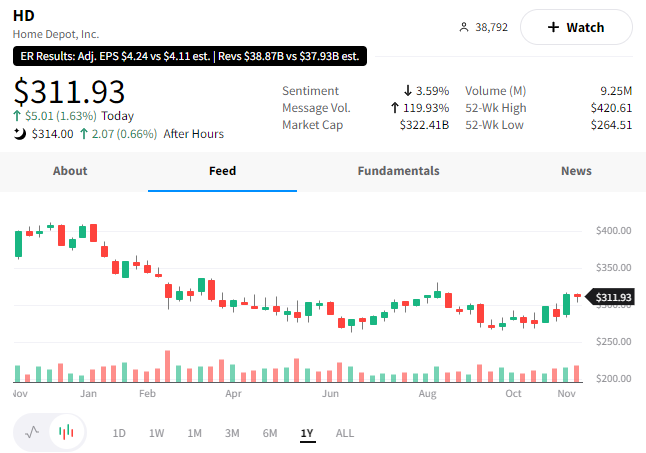

Turning to Home Depot, the company also beat on the top and bottom lines. Its adjusted earnings per share of $4.24 beat the $4.12 expected. Revenues of $38.87 billion exceeded the $37.96 expected.

Driving its 6% sales increase was positive growth in both its professional and do-it-yourself categories. The company says their professional customers’ backlogs remain strong and that the typical DIY-er customer can still afford home improvement projects. 💪

While inflation drove average ticket prices up 9%, it also pressured the company’s gross margin to fall to 34%. Like other retailers and shippers, transaction volumes were down 4%, but were offset by higher average prices.

Despite the challenges, the company remains confident heading into its key holiday quarter. It reaffirmed its full-year guidance despite the macroeconomic backdrop weakening. Whether or not they’ll be right about the consumers’ resilience remains to be seen.

$HD shares were up marginally on the day as investors digested the news. 📈

Don’t forget – tomorrow we’ll hear additional earnings insights from these companies’ competitors, Target and Lowe’s, before the opening bell.

Last week’s cooler-than-expected Consumer Price Index (CPI) print sparked a strong relief rally in bonds and risk assets. And today, producer prices followed suit.

October’s wholesale prices increased less than expected, rising 0.2% MoM vs. the 0.4% expected. On a YoY basis, it decelerated from 8.4% to 8.0%.

Driving this month’s data was a strong rebound in energy prices, which pushed up final demand prices for goods by 0.6%. Meanwhile, services inflation fell 0.1%, its first decline since November 2020. That helped drive the deceleration despite a 2.7% increase in energy and a 0.5% increase in food costs.

As the YoY % change chart from TradingEconomics shows, this is the fourth straight month of deceleration in producer prices. 👍

Ultimately, prices remain elevated above where the Fed wants them. But the continual improvement in wholesale prices is a positive sign for the “inflation has peaked” camp. Now we’ll have to see if this progress can continue into year-end. Risk assets certainly hope they will…

The only thing spicier than a performance from Pitbull, aka “Mr. Worldwide,” is international stocks over the last month. And while the sharp rebound in international stocks has been underway for some time, it hasn’t gotten a lot of coverage.

So today, as we highlight the move in Sea Ltd., we thought it’d be worth bringing that broader trend into focus.

For those unaware, Sea Ltd. is part of the group of widely-followed Chinese internet companies on Wall Street. It popped up on people’s radars today due to its better-than-expected earnings report, where the company saw its e-commerce revenue grow 32.4% YoY and gross orders rise 21.4%.

And given all the negativity around Chinese stocks and the global economy in general, this news was enough to spark a 36% rally in $SE shares.

The sharp move in Sea Ltd. helped push popular China ETFs like $KWEB higher as well, rising another 10% today. While this ETF is up over 50% from its October lows, it’s important to note that some of its largest components are reporting later this week. Companies like Alibaba, Weibo, and JD.com will be in focus and likely result in further volatility in these stocks.

Lastly, we want to highlight Taiwan Semiconductor, which isn’t a Chinese stock. But it’s an APAC company whose shares popped 11% after Berkshire Hathaway’s 13F revealed a new stake in the world’s largest semiconductor company. That certainly got people’s attention… 👀

Bullets

Bullets From The Day:

💰 Credit Suisse speeds up its restructuring. The Swiss bank announced it would accelerate its investment bank restructuring plan by selling a significant portion of its securitized products group to Apollo Global Management. The sale would reduce its SPG assets from roughly $75 to $20 billion, which will significantly de-risk the investment bank and give it capital to invest in its core business. CNBC has more.

⚕️ Amazon unveils its new virtual healthcare service. Shortly after scrapping its Amazon Care product, the company is reengaging the telehealth business with Amazon Clinic. The company describes the service as a virtual health “storefront” where users can search for, connect with, and pay for telehealth care for various common conditions. It will initially launch in 32 U.S. states and will not work with health insurance during its initial stages. More from TechCrunch.

💸 Airlines ordered to pay $600 million in refunds. The Department of Transportation ordered Frontier, Aeromexico, and other foreign airlines to pay refunds to travelers whose flights were canceled or significantly changed by the airlines. Passenger complaints surged along with Covid-19, with refund complaints accounting for 87% of those filed with the Department of Transportation in 2020 and 60% of those filed in 2021. This marks a continued effort by the administration to improve consumer travel protections. CNBC has more.

💳 Household debt rises at the fastest pace in 15 years. The third quarter figures showed a significant increase in credit card usage and mortgage balances. Credit card balances collectively rose 15% YoY, marking the largest annual jump in 20 years as consumers spend more to maintain their living standards. Auto loan debt has slowed, rising marginally QoQ and up just 5.6% YoY. Overall, analysts argue the increases show strong consumer demand and that delinquency rates remain near historical lows for the time being. More from CNBC.

🥒 Pickle Robot Company raises $26 million. As Amazon and other technology and retail giants look to improve their operations’ efficiency and efficacy through automation, many companies in the robotics category have risen to the forefront. One of those is Pickle, which just announced a Series A round, and is hyper-focused on the truck unloading aspect of the supply chain that’s not been addressed by the market yet. TechCrunch has more.

Links

Links That Don’t Suck:

₿ Manage cryptocurrency price risk with Micro Bitcoin and Micro Ether options from CME Group. See how.*

☄️ Black hole discovered after ripping a star to pieces

🛌 Sleeping with light pollution linked to diabetes, study says

🩴 Steve Job’s worn-out Birkenstocks sell for $218,000 at auction

🌎 There are now 8 billion people on Earth, according to a new U.N. report

⚖️ Goldman Sachs paid over $12 million to bury partner’s claim of sexist culture

📆 These companies ran an experiment: Pay workers their full salary to work fewer days

💰 Think you have what it takes to secure $5k at this year’s Chips for Charity? Secure your seat now.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.