It was a volatile session on Wall Street, but stocks managed to join their international counterparts in eking out a gain — let’s see what you missed today. 👀

Today’s issue covers the FOMC minutes’ hawkish tone, one university’s vote of confidence in Blackstone, and why Chinese stocks continued their rally. 📰

Check out today’s heat map:

10 of 11 sectors closed green. Real estate (+2.25%) led, and energy (-0.01%) lagged. 💚

In electric vehicle news, Rivian hit a 52-week low after missing its 2022 production target. Meanwhile, Tesla filed paperwork to make electric motors for airplanes, boats, and other vehicles. And an upstart Chinese electric brand, Nezha, claims it more than doubled its car deliveries in 2022 and topped Nio’s numbers. ⚡

Meta stock continued its rebound despite European Union regulators hitting the company with $400 million in fines for privacy violations. They also banned the company from forcing users in the region to agree to personalized ads based on their online activity. ⚖️

In crypto news, Coinbase reached a $100 million settlement with the New York Department of Financial Services over its compliance programs. U.S. banking regulators warned financial institutions that dealing with cryptocurrency exposes them to various risks. And the rally in crypto and crypto-related stocks continued today, with Silvergate Capital rising more than 20%. ₿

Other symbols active on the streams included: $GERN (+32.92%), $INM (-1.36%), $ENVX (-41.01%), $MULN (+4.36%), $COSM (-1.81%), $RSLS (-43.17%), $VERA (-64.70%), and $JSPR (-21.90%). 🔥

Here are the closing prices:

| S&P 500 | 3,853 | +0.75% |

| Nasdaq | 10,459 | +0.69% |

| Russell 2000 | 1,773 | +0.64% |

| Dow Jones | 33,270 | +0.40% |

Policy

No Cuts Are Coming

Those hoping for rate cuts in 2023 were severely disappointed by December’s FOMC Minutes released today. 📝

The notes from members showed little discussion about how much to raise rates at the February meeting. Instead, it focused on the need for flexibility and optionality in policy as inflation remains stubbornly high.

With that said, a new worry has emerged for the Fed.

Officials noted their concern that an “unwarranted easing in financial conditions” driven by the market’s perception that the Fed could loosen policy would further “complicate” their fight against inflation.

So what does that mean in English? 🤔

Recently the market has seen interest rates fall as participants began pricing in peak inflation and a looser approach from the Fed. However, the Fed says the data it’s looking at suggests inflation risks remain too elevated to begin adjusting their policy yet. But the market is doing its own thing. And if the market keeps rates subdued for a significant period, that will only make it harder for the Fed’s policies to have their desired effect on inflation.

In essence, the market positioning itself in anticipation of the Fed loosening its policy will only delay the Fed loosening its policy. 🤦

Jerome Powell has been clear on the Fed’s aggressive stance against inflation. For anyone paying attention, today’s “no rate cuts in 2023” messaging is nothing more than a reiteration of what we already knew. However, the market has yet to accept that rates will stay higher for longer; otherwise, they wouldn’t be pricing in rate cuts. So today’s messaging from the Fed is an attempt to talk rates back up where they want them to be. 🤷

We’ll have to see if this week’s December jobs data changes the broader inflation debate at all. But if today’s Job Openings and Labor Turnover Survey (JOLTS) is any indication, the labor market likely maintained its record strength last month.

And while we’re mentioning employment, it’s important to remember that certain pockets of the market continue to shed jobs. Particularly those who overexpanded during the pandemic or have weak overall business models. Salesforce cut 10% of its workforce today, and Vimeo laid off 11% of its employees. ✂️

Stocks

Chinese Stocks Extend Gains

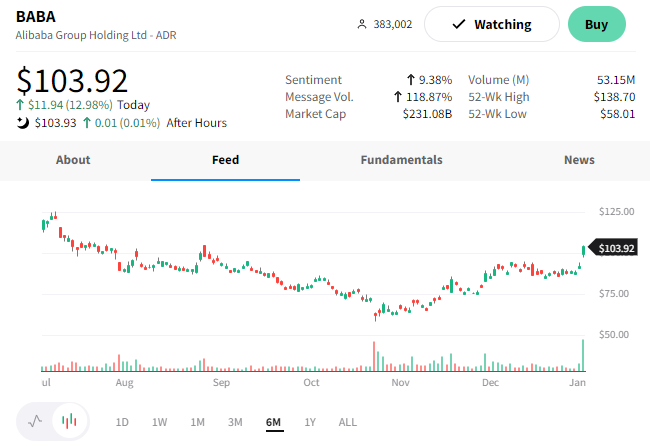

Due to their recent strength, Chinese stocks have been a focus of our newsletter for the last few months. And today, that strength continued with hopes that a more relaxed Chinese regulatory environment is on the horizon. 🌤️

Sparking this continued optimism was news that Chinese officials approved an expanded capital plan from Ant Group. The China Banking and Insurance Regulatory Commission approved the company’s request to increase the amount of registered capital for its consumer unit from 8 billion to 18.5 billion yuan.

This is a sign of improvement for Ant Group, which saw its record-breaking IPO halted by regulators in late 2020. And if regulators let this behemoth up for air, maybe that’s a sign of a more favorable business environment. 🤷

Combine that with the country relaxing its covid-19 measures and supporting its real estate sector, and you’ve got investors pushing Chinese stocks to fresh recovery highs.

Alibaba led the charge, likely because it owns roughly a third of Ant Group. $BABA shares rose 13% on the day, while broader China ETFs like $MCHI rose nearly 6%. 📈

Company News

A Vote Of Confidence?

Blackstone shares have been under pressure because of fears around their BREIT Real-Estate Vehicle, which we discussed in December. 📰

For those who aren’t up to speed, the private real estate investment saw redemptions cross their quarterly limit in November as investors worry about real estate values. The uptick in redemption requests caused the fund to limit redemptions, sparking broader fears about the fund’s (and Blackstone’s) overall health.

News broke today that the University of California is investing $4 billion in the unlisted real estate income trust (BREIT). And while some investors saw this as a significant vote of confidence from a large institution, others were less impressed by the deal terms. 📝

Under the deal, UC Investments will hold its investment in BREIT for at least six years. Meanwhile, Blackstone will offer $1 billion of its own investment in BREIT as collateral to make up for any shortfall if the university fails to achieve at least an 11.25% annualized net return through January 2028.

In other words, Blackstone guaranteed an 11.25% annualized return net of fees to secure this investment. 😮

Bearish investors view this as a sign of more severe problems in the real estate fund. However, bullish investors see this investment as a net positive, especially since Blackstone can charge its standard fees and an additional profit sharing once the minimum 11.25% return is met.

Time will tell who is right. But the initial reaction from the market was positive, with $BX shares rising 2.47%. 🔺

Bullets

Bullets From The Day:

🤔 Ever wonder how well a meeting is going? There’s now an app for that. Read is an app that lets meeting organizers see how engaged participants are, and it has just become one of Zoom’s Essential Apps. The company launched in 2021, led by former Foursquare CEO David Shim, and is backed by $10 million in seed funding from Madrona Venture Group, PSL Ventures, and other investors. The program itself uses artificial intelligence, computer vision, and natural language processing to gauge meeting participation engagement and sentiment. TechCrunch has more.

🥶 Manhattan apartment market freezes up. Rising interest rates, falling asset prices, and fears of an economic recession put pressure on the real estate market throughout 2022. Manhattan apartment sales continued their slump in Q4, falling 29% YoY to 2,546 sales, with prices falling for the first time since the pandemic began. Rising interest rates also caused more buyers to use all-cash deals, accounting for a record 55% of all sales. More from CNBC.

📝 Victoria’s Secret brand CEO resigns. The abrupt resignation came less than a year in the role and will take effect in March. The CEO of the brand’s parent company, Martin Waters, will take over as the brand’s CEO. The stock initially fell 8% on the news but reversed sharply to rise nearly 4% on the day. The company continues to struggle as it overhauls its advertising to appeal to a broader range of consumers. CNN Business has more.

🚗 General Motors takes the top spot in 2022 U.S. auto sales. Despite industry-wide supply disruption, GM was able to meet strong demand for its cars and trucks throughout 2022, with sales rising 2.5% YoY. Its full-year sales of 2,274,088 vehicles outpaced rival Toyota’s 2,108,458 units as the Japanese company continues its struggle with tight inventory. Meanwhile, other brands like Hyundai Motor America, Kia Motors America, Mazda North America, and American Honda posted YoY sales declines. More from Reuters.

🗳️ House Republicans fail to elect a speaker for the sixth time. After six votes in two days, Republican leader Kevin McCarthy failed to secure the support needed to win the House speakership. After much negotiation, he’s been unable to convince the 20 members of his caucus who are refusing to support his nomination and instead support Florida Rep. Byron Donalds. It remains to be seen when this situation will conclude. But for now, some view this as early signs of how a republican led house will operate in the years ahead. CNBC has more.

Links

Links That Don’t Suck:

🧑🚀 Last surviving Apollo 7 astronaut has died

🚫 Foreigners now banned from buying homes in Canada

🥸 There wasn’t a single bank robbery in Denmark last year

📦 DoorDash can now return your packages for you

🕹️ Dave & Buster’s co-founder James ‘Buster’ Corley dead at 72

🤝 Video game testers approve the first union at Microsoft

🚽 Pee is the magic number, as Withings puts a urine analysis lab in your toilet

🛬 Southwest Airlines apologizes and then gives its customers frequent-flyer points