Due to their recent strength, Chinese stocks have been a focus of our newsletter for the last few months. And today, that strength continued with hopes that a more relaxed Chinese regulatory environment is on the horizon. 🌤️

Sparking this continued optimism was news that Chinese officials approved an expanded capital plan from Ant Group. The China Banking and Insurance Regulatory Commission approved the company’s request to increase the amount of registered capital for its consumer unit from 8 billion to 18.5 billion yuan.

This is a sign of improvement for Ant Group, which saw its record-breaking IPO halted by regulators in late 2020. And if regulators let this behemoth up for air, maybe that’s a sign of a more favorable business environment. 🤷

Combine that with the country relaxing its covid-19 measures and supporting its real estate sector, and you’ve got investors pushing Chinese stocks to fresh recovery highs.

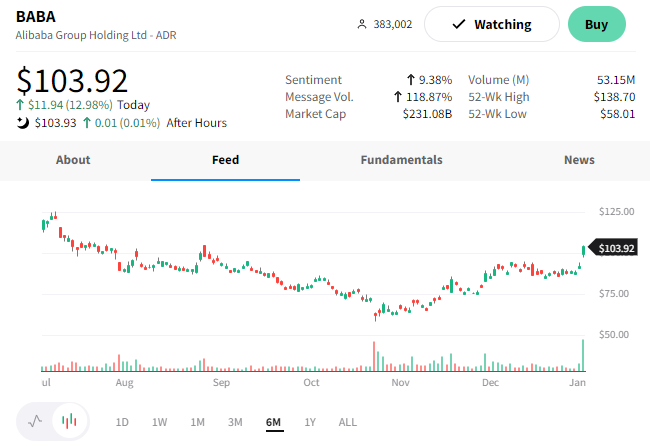

Alibaba led the charge, likely because it owns roughly a third of Ant Group. $BABA shares rose 13% on the day, while broader China ETFs like $MCHI rose nearly 6%. 📈