For a day when the major indexes were flat, you wouldn’t expect halts to be in the news. But two halts had people talking, so let’s see what’s up. 🕵️

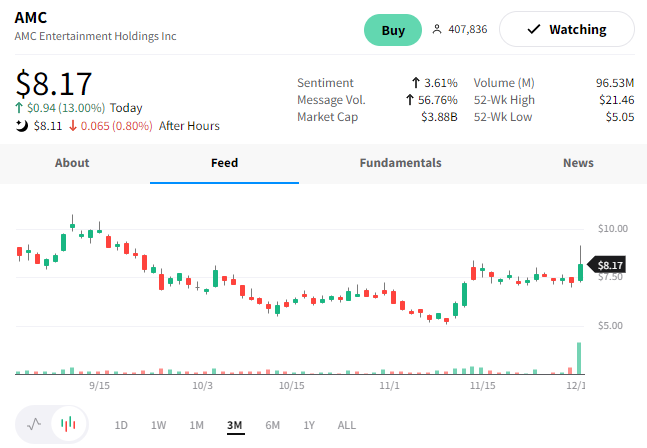

America’s favorite meme stocks were back on the move today, with AMC Entertainment halted once today for volatility. 🍿

After a sharp rally out of the open, the Nasdaq halted trading in $AMC shares after the stock rose more than 15% by 11:30 am eastern time. Shares dropped marginally after that, pushed to a fresh high, and ultimately traded lower late in the day to close up 13%.

There was no specific news related to the company today, but people tend to notice whenever a meme stock makes a big move. So this will definitely be on traders’ radars in the days and weeks ahead. 🗺️

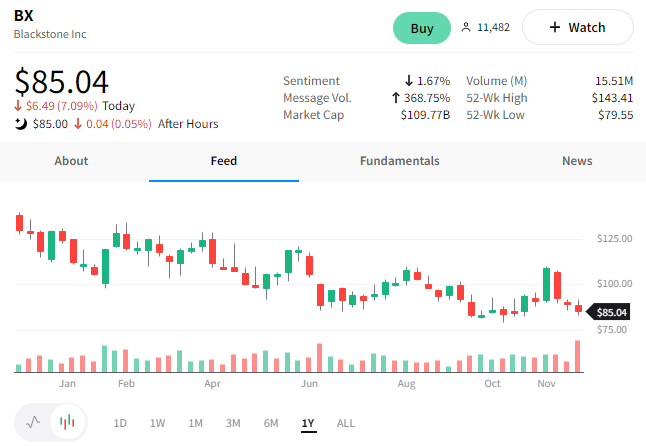

The second halt was not a trading one but a halt on redemptions. And we’re not talking about a crypto exchange here! Instead, Blackstone’s shares were down roughly 7% today and weighed on the financial sector after one of its largest private real estate funds halted redemptions. 🛑

Its “Blackstone Real Estate Income Trust Inc.” is a nontraded real estate investment trust (REIT) that invests in income-generating real estate. According to the company’s site, the portfolio is concentrated in rental housing and industrial in the Southern and Western U.S. and in sectors and markets with strong economic and demographic tailwinds. 🏘️

These vehicles typically include higher fees and are generally appropriate for wealthy individuals or “accredited investors” due to their lack of liquidity and complexity.

However, this specific fund grew massively over the last few years because of its strong return profiles. But as worries about the real estate market’s overall health continue to spread, withdrawal requests have picked up significantly, exceeding the monthly and quarterly limits imposed by the fund. ⚠️

And unfortunately for some investors, they’re learning the hard way the downsides of investing in illiquid assets. By definition, they’re hard to liquidate (i.e., sell them in a timely manner without a significant cut to their price).

How this plays out remains to be seen. But, given the amount of liquidity the Federal Reserve and other central banks are taking out of the market, today’s news spooked investors a bit. One thing is for sure; investors will be looking closely at the illiquid assets in their portfolios after today. Especially those in real estate. 👀

Lastly, it’s worth noting that Blackstone also sold its 49.9% stake in MGM Grand Las Vegas and Mandalay Bay to Vinci Properties. The company will receive $1.3 billion in cash and roughly $1.5 billion in debt relief as part of the deal. 💰