Welcome to the Stocktwits Top 25 Newsletter for Week 2 of 2023!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for Week 2:

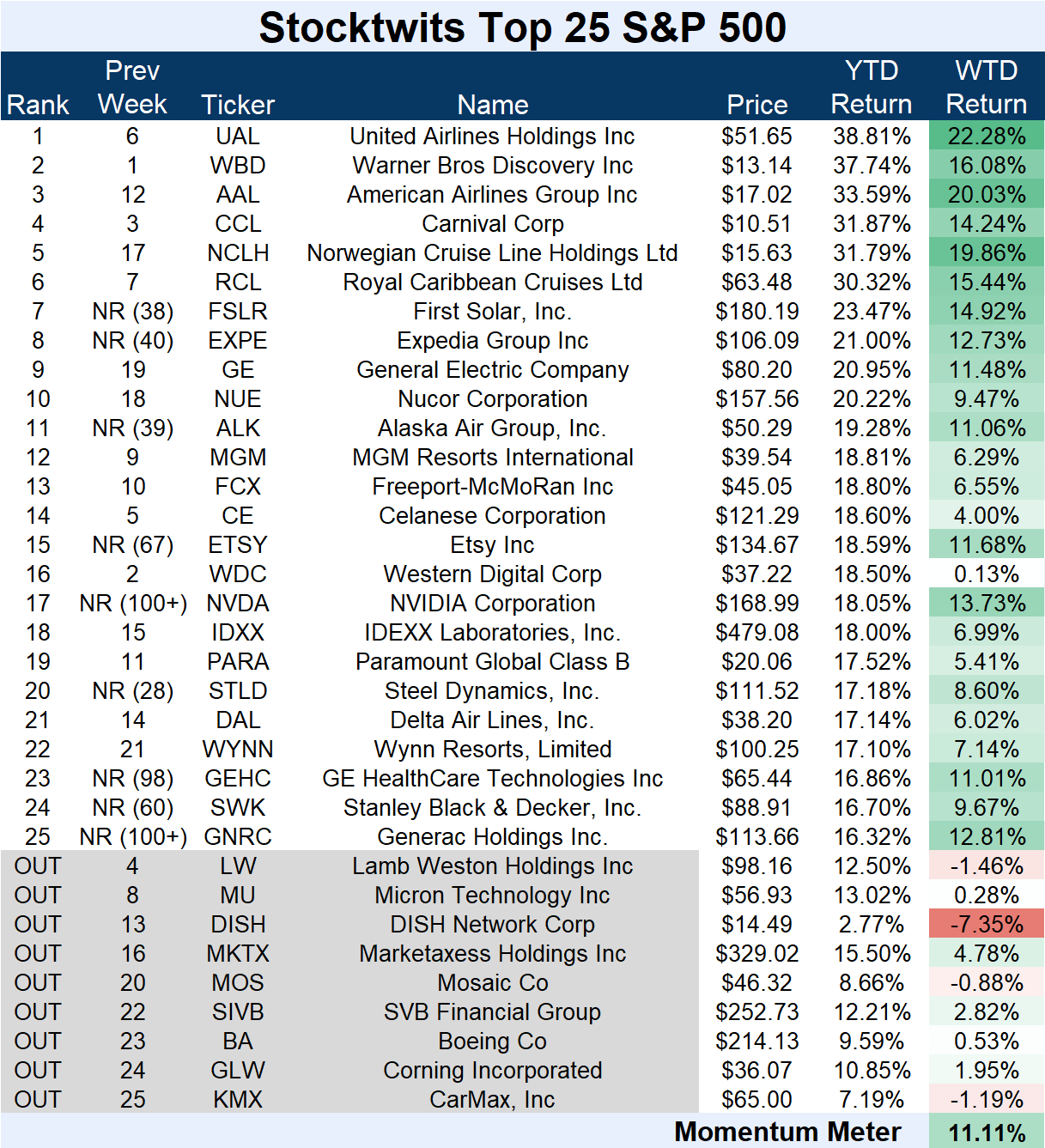

Standard and Poor's 500

ST Top 25 S&P 500

The S&P 500 Top 25 list (+11.11%) outperformed the S&P 500 index (+2.61%).

Volatility will continue in the list’s components until this year’s trends develop. As a result, there were nine major changes this week.

Joining: First Solar (+14.92%), Expedia (+12.73%), Alaska Air (+11.06%), Etsy (+11.68%), NVIDIA (+13.73%), Steel Dynamics (+8.60%), GE HealthCare Technologies (+11.01%), Stanley Black & Decker (+9.67%), and Generac Holdings (+12.81%).

Leaving: Lamb Weston (-1.46%), Micron (+0.28%), DISH Network (-7.35%), MarketAxess (+4.78%), Mosaic (-0.88%), SVB Financial (+2.82%), Boeing (+0.53%), Corning (+1.95%), and CarMax (-1.19%).

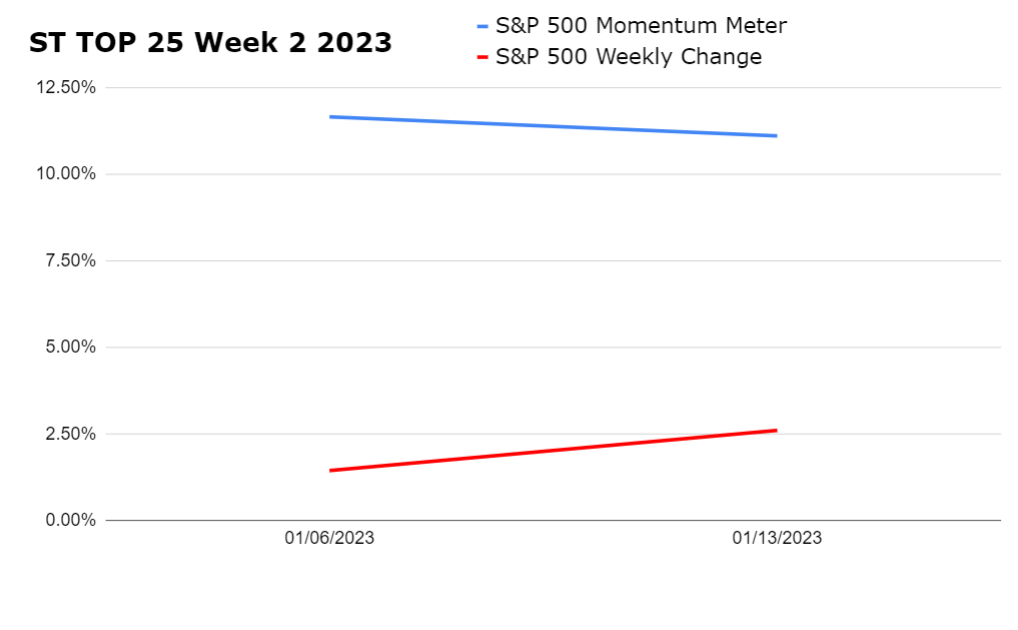

Check out how the momentum meter has performed vs. the S&P 500 index this year:

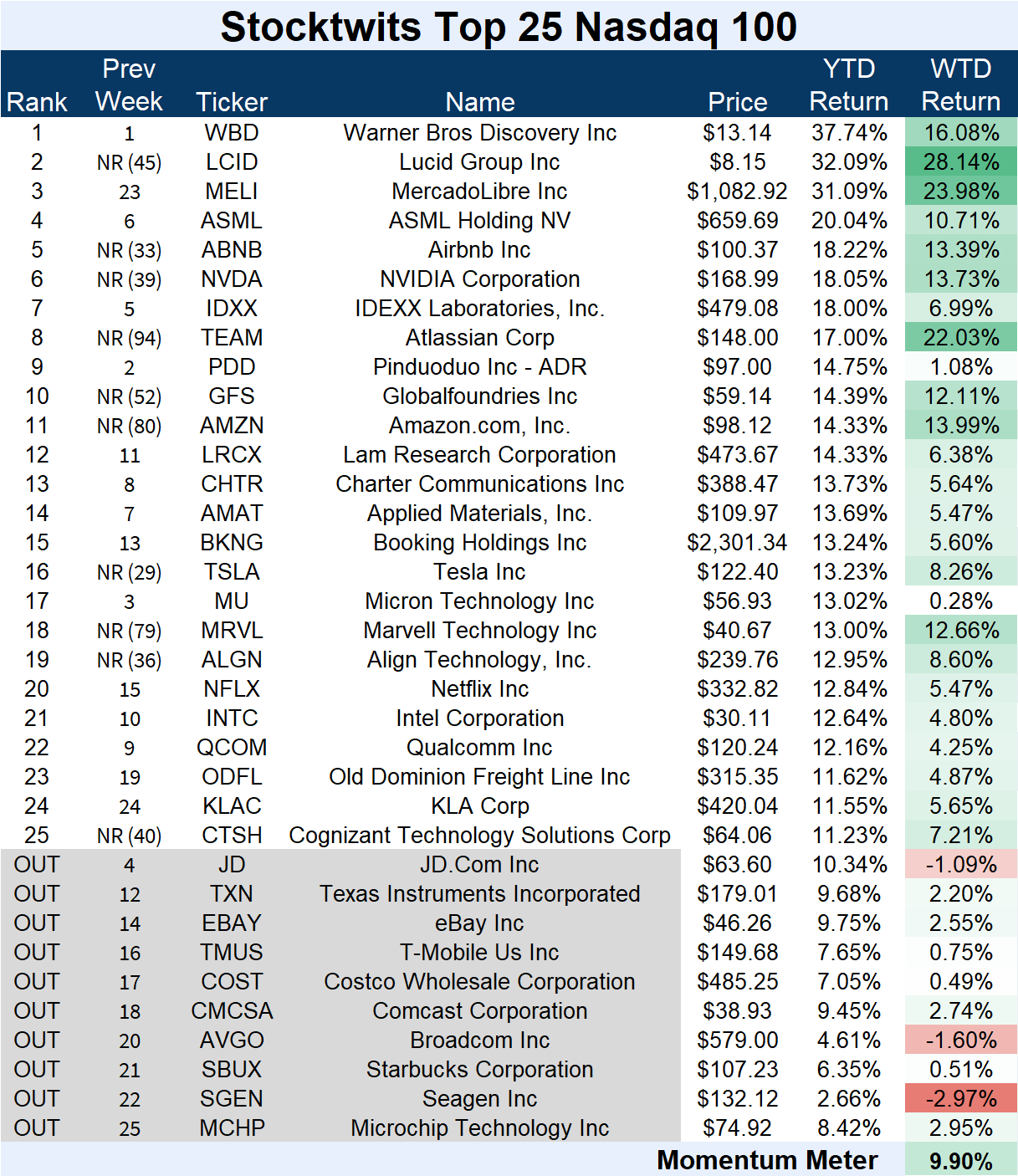

NASDAQ 100

The Large-Cap Nasdaq 100

The Nasdaq 100 Top 25 list (+9.90%) outperformed the Nasdaq 100 index (+4.54%).

Volatility will continue in the list’s components until this year’s trends develop. As a result, there were ten major changes this week.

Joining: Lucid Group (+28.14%), Airbnb (+13.39%), NVIDIA (+13.73%), Atlassian (+22.03%), Globalfoundries (+12.11%), Amazon (+13.99%), Tesla (+8.26%), Marvell Technology (+12.66%), Align Technology (+8.60%), and Cognizant Technology Solutions (+7.21%).

Leaving: JD.com (-1.09%), Texas Instruments (+2.20%), eBay (+2.55%), T-Mobile US (+0.75%), Costco Wholesale (+0.49%), Comcast (+2.74%), Broadcom (-1.60%), Starbucks (+0.51%), Seagen (-2.97%), and Microchip Technology (+2.95%).

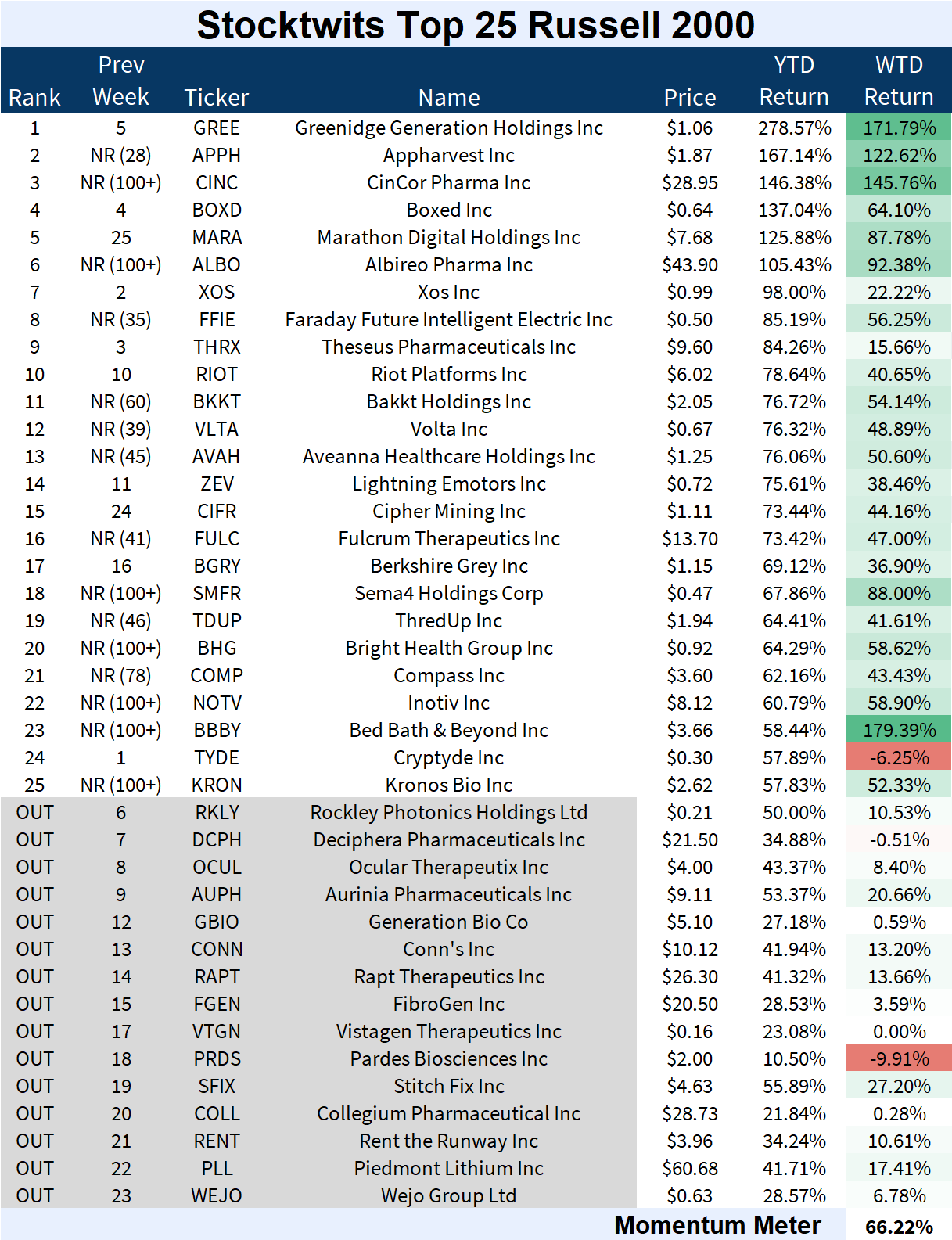

RUSSELL 2000

The Growth-Centric Russell 2000

The Russell 2000 Top 25 list (+66.22%) outperformed the Russell 2000 index (+5.26%).

Volatility will continue in the list’s components until this year’s trends develop. As a result, there were fifteen major changes this week.

Joining: Appharvest (+122.62%), CinCor Pharma (+145.76%), Albiero Pharma (+92.38%), Faraday Future Intelligent Electric Inc (+56.25%), Bakkt Holdings (+54.14%), Volta Inc (+48.89%), Aveanna Healthcare (+50.60%), Fulcrum Therapeutics (+47.00%), Sema4 Holdings (+88.00%), ThredUp (+41.61%), Bright Health Group (+58.62%), Compass (+43.43%), Inotiv Inc (+58.90%), Bed Bath & Beyond (+179.39%), and Kronos Bio (+52.33%).

Leaving: Rockley Photonics Holdings (-10.53%), Deciphera Pharmaceuticals (-0.51%), Ocular Therapeutix (+8.40%), Aurinia Pharmaceuticals (+20.66%), Generation Bio (+0.59%), Conn’s Inc (+13.20%), Rapt Therapeutics (+13.66%), FibroGen (+3.59%), Vistagen Therapeutics (+0.00%), Pardes Biosciences (-9.91%), Stitch Fix (+27.20%), Collegium Pharmaceuticals (-0.28%), Rent The Runway (+10.61%), Piedmont Lithium (+17.41%), and Wejo Group (+6.78%).

🐶🐶🐶

ST Top 25 TOP DAWG OF THE WEEK 🐶

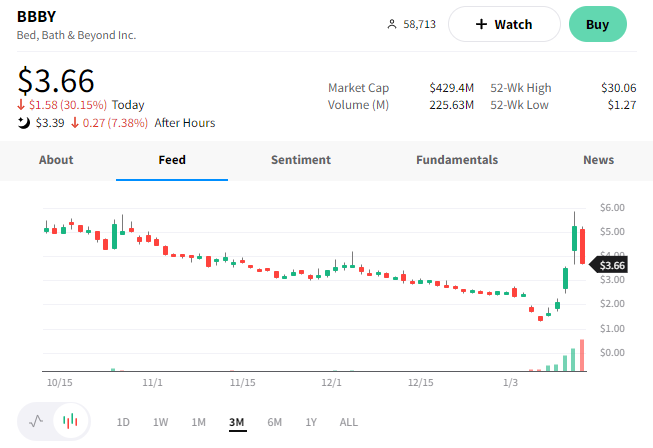

The Top 25 lists’ Top Dawg was Bed Bath & Beyond, which rallied 179.39%. 📈

So far this year, there’s been a resurgence in stocks with “bad businesses” in what investors/traders believe is a massive short-covering rally. And Bed Bath & Beyond has been at the forefront. 🏬

Over the last week, we’ve covered the volatility. First, the stock fell sharply after issuing a “going concern warning” about its business. After it began rallying, we provided a potential explanation of why it rallied even after reporting a significant earnings miss. 🤔

And now we’ll just have to see what the coming weeks bring for Bed Bath & Beyond and its peers. 👀

$BBBY is up 58.44% YTD.

See Y’all Next Week 🤙