We’re back to business after a quick Monday off in the markets. We hope you didn’t miss us too much — let’s see what you missed today. 👀

Today’s issue covers the influx of bank earnings, why it’s almost decision time for the S&P 500, and a whole lot more. 📰

Check out today’s heat map:

5 of 11 sectors closed green. Technology (+0.45%) led, and materials (-1.03%) lagged. 💚

In economic news, New York state manufacturing activity plunged as new orders fell sharply and employment growth stalled. On the positive side, prices paid by manufacturers continue to fall. Canada’s inflation rate continues to fall alongside the U.S., though food prices remain a headwind. Meanwhile, China’s 2022 growth rate came in at 3%, well below its official target of 5.5%. 🏭

Meme-stock billionaire Ryan Cohen has built a stake in Alibaba and is pushing the Chinese tech giant to buy back its stock. 📝

Barrick Gold stumbled 5% after the world’s second-biggest gold producer said it produced 4.14 million ounces last year, marking its third-straight annual decline. ⚒️

And Roblox shares rose 12% after its December update showing an 18% rise in daily active users but a drop in bookings (revenue). 🎮

In crypto news, Three Arrows Capital founders are building a new platform for crypto debt claims, hoping to take advantage of the chaos they contributed to. People continue to distance themselves from Sam Bankman-Fried, including Skybridge’s Anthony Scaramucci. And one in three members of Congress reportedly received direct contributions from SBF and other FTX executives. ₿

Other symbols active on the streams included: $BBBY (+13.12%), $BBIG (+17.80%), $APRN (+1.98%), $MULN (-15.97%), $AMC (+19.96%), $TSLA (+7.43%), $DCFC (+10.07%), and $ATXI (+63.12%). 🔥

Here are the closing prices:

| S&P 500 | 3,991 | -0.20% |

| Nasdaq | 11,095 | +0.14% |

| Russell 2000 | 1,884 | -0.15% |

| Dow Jones | 33,911 | -1.14% |

Earnings

Bank Earnings Continue Rolling In

Bank stocks kicked off earnings on Friday and are back in the spotlight today with Goldman, Morgan Stanley, and Silvergate Capital reporting.

Let’s see what they had to say. 📝

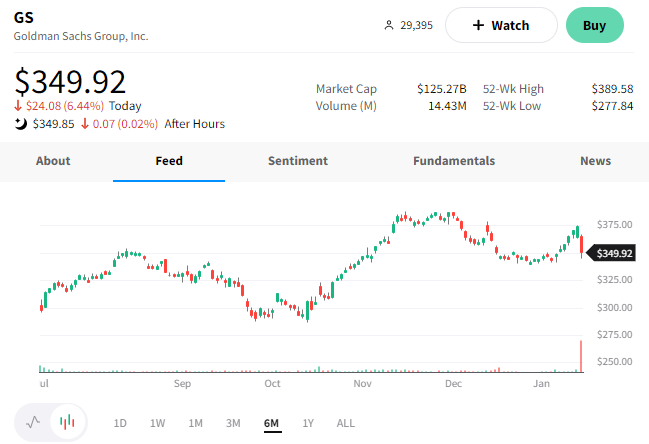

We’re starting with Goldman Sachs, which reported its worst earnings miss in a decade.

The investment bank reported earnings per share (EPS) of $3.32, well below the $5.48 estimated. The 66% plunge in quarterly profit drove the largest EPS miss since October 2011. Driving the weakness was an 11% rise in operating expenses due to higher compensation, benefits, and transaction-based fees. 😮

Additionally, it posted a $972 million provision for credit losses, up nearly 300% YoY and 50% higher than analysts expected. While other banks also set aside funds for credit losses, Goldman’s losses were particularly high due to its poor execution in the consumer banking business. The company plans to continue pulling back efforts in this space, opting to offer these services to its existing wealth management and corporate customers rather than fight for new business.

Revenues also fell short at $10.59 billion vs. the $10.83 billion expected. Investment banking fees fell 48% YoY, and asset and wealth management revenue fell 27%. 🔻

The bank expects the economic backdrop to remain challenging. As a result, in the short-term, its focus is its strategic realignment, scaling its growth platforms, and improving efficiency where it can.

$GS shares were down roughly 6% on the news. 📉

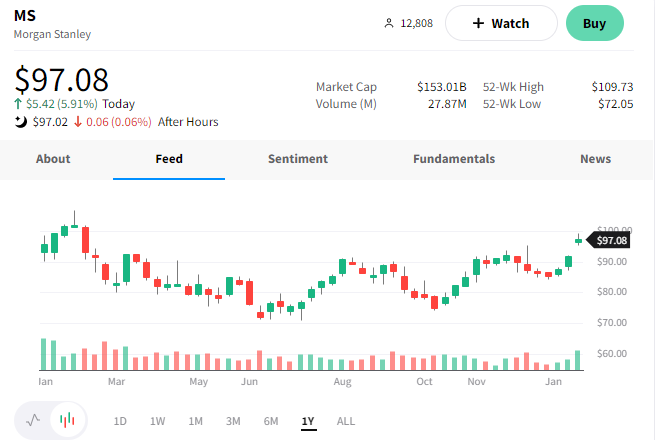

Next up is Morgan Stanley, whose bets in the wealth management space are paying off big time. 👍

The firm reported earnings per share of $1.26, topping estimates of $1.19. Driving the decline in profit were rising costs and charges associated with its cost-cutting measures.

Revenues of $12.75 billion also beat the $12.64 billion expected. But, like its peers, it saw a 49% YoY decline in investment banking revenue and a 17% decline in its investment management division. Offsetting that weakness was strength in its wealth management business (+6% YoY) and fixed-income trading (+15% YoY).

It also added an $87 million provision for credit losses. However, its consumer business is much smaller than the other banks discussed. 💳

Despite the challenging environment, the firm’s balanced business model helped deliver a return on average tangible common shareholders equity (ROTCE) of 16%.

$MS shares were up roughly 6% and nearing the all-time highs set last year. 📈

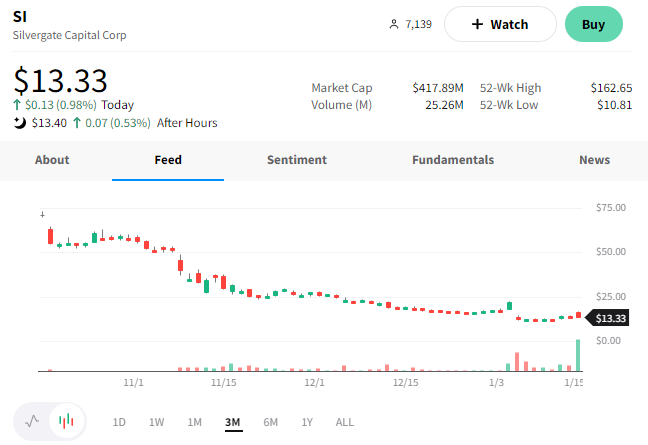

Last is Silvergate Capital, the bank caught up in the recent crypto and FTX turmoil. ₿

It reported earnings per share of $0.48, missing estimates of $0.67. Additionally, its revenues of $52.23 million also missed expectations.

The $1 billion Q4 loss comes two weeks after it warned investors that customers pulled more than $8 billion in deposits in the fourth quarter.

The beaten-down bank is evaluating its product portfolio and customer relationships as it looks to restructure its business to focus on profitability. Additionally, it’s aggressively cutting costs, laying off 40% of its workforce. ✂️

The bank made a big bet on the digital assets industry, helping propel its shares to new heights. However, the risks of that bet are now coming to fruition. Its shares are down 95% from their all-time highs and trading near their 2019 IPO price.

$SI shares were initially up 20% on the earnings news but faded throughout the day to close up 1%. 🤷

Stocks

Stocks Near A Decision Point

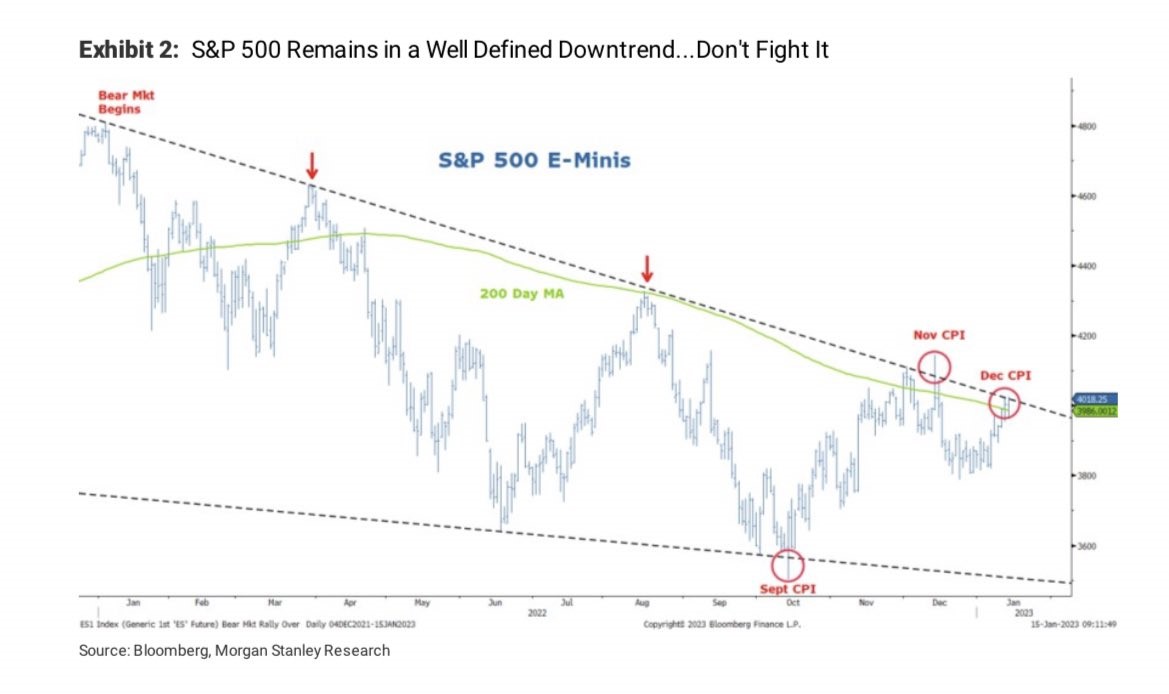

Six weeks after the Stocktwits community discussed the S&P 500’s downtrend line and 200-day moving average, it’s back again. But this time, it’s in a note from Morgan Stanley.

Carl Quintanilla’s tweet shares some insights from a recent Morgan Stanley research. However, its main point is that the firm believes the market will see lower lows ahead. Their thesis suggests that stocks remain vulnerable until this key resistance level is broken convincingly.

Another thing our community is watching is the “coiling” that’s occurring in the S&P 500. Technical analysts suggest that this pattern signals indecision in the marketplace but that once a direction is picked, then the move will be significant.

Whether prices break out or break down from here remains to be seen. But what’s clear is that it’s almost decision time for the market. ⌚👈

In the meantime, hop over to our Stocktwits post and share your thoughts. 🗯️

Bullets

Bullets From The Day:

✍️ Competition heats up among AI-powered writing tools. DeepL became a unicorn last week, raising a large round of funding at a $1 billion valuation. Now, it’s looking to expand from its popular AI-based translation tools into a new language product. The new tool, called Write, looks to take on Grammarly and other tools that fix your writing using the same neural network that powers the company’s translator. The trend of companies building tools to alter how humans communicate with each other continues. TechCrunch has more.

⚡ Emerson Electric goes hostile in a $7 billion takeover. After months of failing to buy National Instruments Corp, the U.S. engineering and industrial software giant revealed its $53 per share all-cash offer. The takeover attempt comes as Emerson looks to further establish itself as a provider of automation products and services using the cash it received from selling a majority stake in its climate technologies unit to Blackstone last October. Shares of EMR were down 7% on the news, while NATI made a fresh all-time high near the $53 offer price. More from Reuters.

📰 Robinhood is launching a new media arm. The retail trading platform’s independent media brand will be called Sherwood and led by veteran tech editor and media entrepreneur Joshua Topolsky. Robinhood initially plans to support the creation, but plans are for it to create its own commercial opportunities for the editorial products it builds. Topolsky said it’s “a significant, long-term investment” and that “a lot of resources are being dedicated to this project.” Over the last few years, media has become an effective marketing and customer acquisition tool for fintech companies. As a result, these organizations are making the investments necessary to keep pace. Axios has more.

💗 Dating apps expand their premium offerings to grow profits. Match-owned dating app Hinge is testing a premium subscription product at the $50-$60/month price point, compared to its current $35/month price point. The new product offering is aimed towards “highly motivated daters” who want to boost their exposure and allow them to receive better recommendations. During its last quarter, the company highlighted Hinge as a bright spot and said it’s investing in marketing the product more in the U.S. and abroad. Additionally, it’s testing a $500 monthly plan for Tinder, which it also owns. More from TechCrunch.

🏗️ Property transactions in Dubai hit a record high in 2022. The country’s property transactions surpassed its previous records over the same period of 2009, as the recent geopolitical crisis in Europe and surrounding areas has increased demand in the United Arab Emirates. Additionally, the country boasts a 90% ex-pat population and offers zero income tax, with it ranked as one of the world’s safest cities for years. With that said, the country acknowledges that this tension comes with risks and that a further escalation of the conflict could disrupt its overall economy. CNBC has more.

Links

Links That Don’t Suck:

👂 A sound you can’t hear but may one day change your life

🚫 Wyoming lawmakers propose ban on electric vehicle sales

🤔 There’s a simple way to offset the health risks of sitting all day

🥤 Microsoft to cut thousands of jobs across divisions – reports

🕵️ TikTok offers to have third-party monitor if China spying on U.S. users

📱 Discord acquires Gas, the popular app for teens to compliment each other

🚗 China allows Didi to resume signing up new users as tech crackdown eases

❌ Adidas says Berlin Fashion Week launch and co-CEO announcements are fake

⚡ GM reveals new Chevy Corvette E-Ray hybrid sports car, starting at over $104,000

🐎 Horse spotted waiting patiently in car at Australia drive-thru for McDonald’s ice cream