Weaker-than-expected economic data sent stocks and bond yields tumbling, challenging the recent narrative that bad news for the economy is good for the markets. Let’s explore that further and see what else you missed today. 👀

Today’s issue covers the slew of economic data released, a truckload of earnings reports, and more from the day. 📰

Check out today’s heat map:

Every sector closed red. Communication services (-1.21%) led, and consumer staples (-2.73%) lagged. 🟥

Carvana shares fell 4.5% after the automotive retail company adopted a “poison pill” to protect its net operating losses and itself from a potential hostile takeover. Additionally, the company is selling up to $4 billion of auto loans as it restructures its finances. 💊

Party City shares were halted by the NYSE ahead of its bankruptcy announcement. The company told investors it’s secured $150 million in funding to continue operations through the bankruptcy process and has already reached an agreement with debtholders to reduce its $1.7 billion debt load. 🎉

Bed Bath & Beyond shares fell 4.8% after the company announced that it’s looking for a capital infusion and potential buyer ahead of a likely bankruptcy filing. 💰

In crypto news, the Justice Department charged the founder and majority owner of crypto exchange Bitzlato Ltd. with processing over $700 million of illicit funds. Coinbase is halting its operations in Japan, just weeks after rival exchange Kraken made its announcement. And crypto lender Genesis is preparing to file for bankruptcy. ₿

Other symbols active on the streams included: $HKD (+10.07%), $BTB (-69.43%), $BLUE (-17.24%), $MULN (-6.63%), $AMC (-6.92%), $TSLA (-2.06%), $SCLX (+22.77%), and $PRVB (-13.77%). 🔥

Here are the closing prices:

| S&P 500 | 3,929 | -1.56% |

| Nasdaq | 10,957 | -1.24% |

| Russell 2000 | 1,854 | -1.59% |

| Dow Jones | 33,297 | -1.81% |

It was a busy day for economic data, with it ultimately sending stocks and bond yields lower. So let’s get into all of it.

Overnight, the Bank of Japan surprised the market by making no changes to its yield curve range. Governor Haruhiko Kuroda said that it hasn’t been long since its December adjustment and that it will take time for measures to impact the market. As a result, it left its interest rate unchanged at -0.1% and reiterated it would maintain its dovish policy to support economic growth.

Japanese 10-year yields sat at the upper end of their range (0.50%), and the Japanese Yen fell more than 2% on the news. 💴

Eurozone inflation slid to 9.2%, its second consecutive decline, on the back of falling energy prices. With that said, the European Central Bank’s (ECB) policy rate is currently 2%, and most analysts expect the rate to head to 3% by the summer. ECB President Christine Lagarde was hawkish throughout December, stating that the bank has more ground to cover and is not pivoting or wavering but instead showing determination. 🌍

U.K. inflation also fell for the second straight month, from 10.7% to 10.5%. The Bank of England’s interest rate remains at 3.5%, with markets anticipating a rise to 4% at its February meeting.

In the U.S., producer prices fell 0.5% in December, well above expectations for a 0.1% decline. Driving the headline decline was a sharp drop in energy prices and softening in food prices. As a result, the core measure, which excludes food and energy, rose in line with expectations at 0.1%. 📉

Additionally, retail sales posted their biggest drop in a year (-1.1%). This is the second monthly decline in retail sales, as consumers pull back amid the economic uncertainty. Driving the decline were declining goods prices and holiday shopping being pulled forward in Q4 as retailers offered attractive discounts to lure shoppers. The cold weather the U.S. experienced also likely impacted sales as more people opted to stay home. 🛍️

Along with softening sales come rising inventories, with November seeing a 15.1% YoY increase in business inventories. The inventory-to-sales ratio rose to its highest level in two years.

U.S. industrial production also declined in December. The 0.7% decline was its second consecutive drop and steepest since September 2021. This data point adds to the mounting evidence that manufacturing activity has been softening. 🏭

Falling mortgage rates helped boost NAHB homebuilder sentiment for the first time in a year. However, some analysts believe the trough in builder sentiment was registered in December. Their thesis hinges on the fact that there’s still a structural housing deficit of 1.5 million units, and affordability will improve with falling rates and prices.

Lastly, there was some employment data worth noting. Amazon began a new round of layoffs targeting 18,000 people in its human resources and stores division. Meanwhile, Microsoft is laying off 10,000 workers due to “macroeconomic conditions and changing customer priorities.” ❌

Overall, lower inflation and weakening economic activity sent U.S. bond yields to fresh year-to-date lows. Despite the Fed’s hawkish rhetoric, the market is once again frontrunning the Fed in loosening financial conditions.

We’ll have to see how the various Fed members’ speeches impact the market ahead of their January 31 to February 1 meeting. And we’ll also have to distinguish if today’s “bad news for the economy is bad news for the market” shift is a trend change or a one-off situation. 🤷

That’s all for now, though. ⌛

Earnings

Today’s Truckload Of Earnings

Financial services earnings continue to come in, but transportation stocks were top of mind given today’s economic data. 🚚

On that note, JB Hunt Transport Services reported earnings and revenue that missed expectations.

The trucking giant saw sales rise 4% YoY to $3.65 billion, missing the $3.84 billion expected. Earnings per share (EPS) of $1.92 missed analyst estimates of $2.46. 📝

Excluding fuel surcharge revenue, its operating revenue fell 3% YoY. Driving that decline was a 27% decrease in volume in Integrated Capacity Solutions (ICS) and a 1% decline in Intermodal volume. The company’s operating income fell 13%, and its operating margin was 7.7%.

Like other shippers, it’s experiencing shrinking volumes that are being offset by price increases. However, rising costs are eating at its margin and profitability.

Despite the weaker-than-expected results, $JBHT shares rose 5% today. 🤷

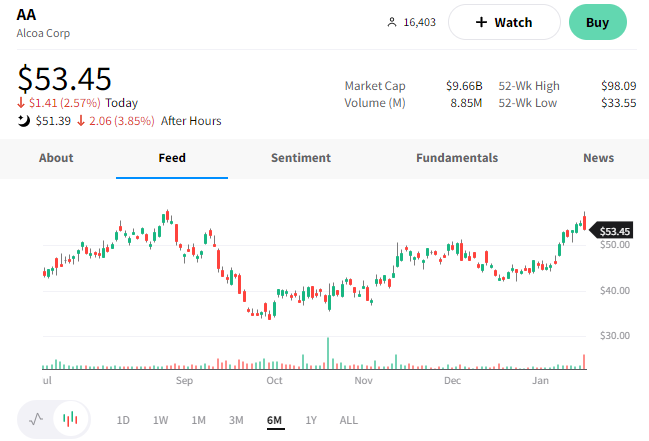

Aluminum company Alcoa is extending its decline after hours following a weaker-than-expected earnings report. 🏭

It reported Q4 earnings per share of $0.70, three cents worse than expectations. However, revenues of $2.7 billion topped expectations of $2.66 billion.

Driving the results was a 7% decline in third-party revenue, attributable to lower prices and shipments of alumina and aluminum. Average realized third-party prices were down 8% and 10%, respectively. Additionally, third-party shipments were down 2% and 3%, respectively. 🔻

The company generated roughly $118 million from operations and finished the quarter with a cash balance of $1.4 billion. It also paid a dividend of $0.10 per share, totaling $17 million.

Overall, investors remain concerned with how the economic slowdown will impact industrial companies like Alcoa.

As a result, $AA shares were down roughly 4% after hours. 📉

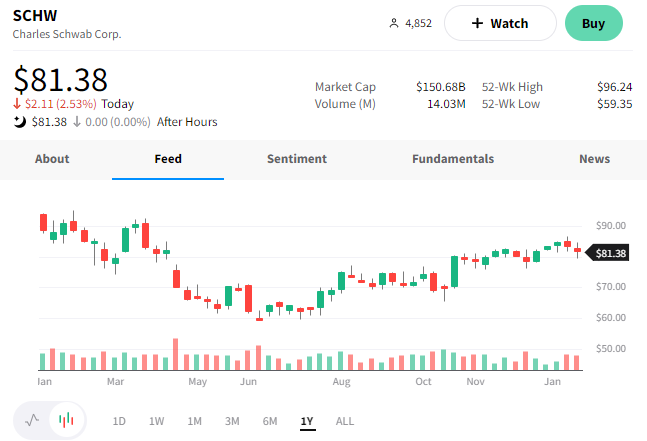

Financial services firm Charles Schwab reported earnings and revenue that fell short of expectations. 👎

Earnings per share of $0.97 were below the $1.09 estimate. And net revenues of $5.5 billion fell short of the $5.6 billion expected.

Interest income rose 65% YoY to $3.8 billion, with net interest expense rising 534% YoY to $812 million. Trading revenues declined by roughly 10.5% to $895 million. Investor appetite for savings accounts and other fixed-income products helped bolster the company’s results. It also managed to add new clients in the quarter. 💰

$SCHW shares were down 2.53% on the news.

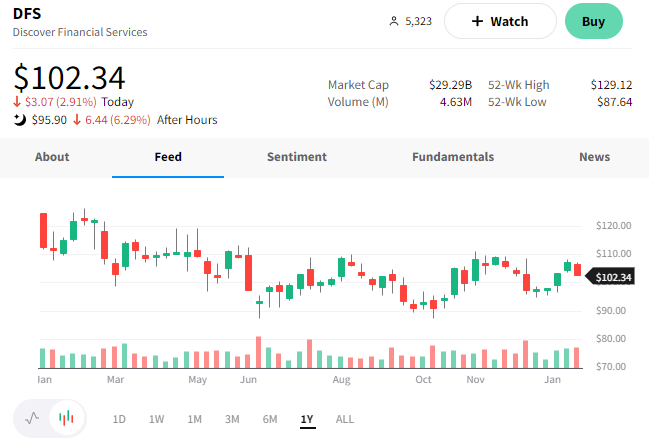

Discover Financial Services beat expectations, but the stock is falling sharply.

The company reported earnings per share of $3.77 vs. the $3.65 expected. And revenues of $3.73 billion beat the $3.668 billion expected.

Like other consumer banks, it increased its provision for credit losses by 42% to $883 million. It also saw its overall net charge-off rate (what the company believes it’s unlikely to recover) rise to 2.13%. 🔺

While the jump in loan growth helped its results, signs are mounting that consumers are struggling to cope with rising prices. Not only are they relying more on credit to maintain their lifestyles, but they’re having trouble making payments. And carrying balances with credit card interest rates at decade-plus highs is not a great thing over the long term. 💳

As a result, investors are looking past this quarter’s beat and ahead to the challenges ahead for Discover and other consumer banking businesses.

$DFS shares extended their decline after hours, falling another 6%. 📉

Bullets

Bullets From The Day:

✍️ Fake it ’til you make it…or at least until you get audited. A Sequoia-backed startup, GoMechanic, is cutting 70% of its workforce after a professional services firm EY probe identified ‘grave errors’ in its financial reporting process. The co-founders are now trying to take responsibility for their lapse in judgment caused by chasing growth at all costs. The company has struggled over the last year to raise funds, with a round that would’ve pushed it into unicorn territory being abandoned after investors found discrepancies during the due diligence process. The cuts come as they try to preserve their dwindling cash pile and raise funds to survive. TechCrunch has more.

❌ Southwest is about to face yet another issue…a pilot strike. Just weeks after the airline’s holiday meltdown, its pilots’ union is calling a vote to give it the power to call a potential strike. Like other airlines, the pilots’ union and Southwest have been negotiating contract details for years and have yet to reach an agreement. The focus of the union’s demands includes better work rules and scheduling, as well as compensation adjustments. The strike vote will begin on May 1st, giving customers time to find alternatives and the airline time to negotiate. More from CNBC.

📺 Was Netflix’s ad-supported tier bet a flop? The streaming company is warning Wall Street ahead of Thursday’s earnings report that it expects Q4 subscriber growth to be the worst since 2014. It’s forecasting that it brought in 4.5 million subscribers in Q4, a nearly 45% YoY decline and a sharp decline from what’s typically been a strong quarter for the company. The drop calls into question the company’s efforts to grow subscribers through an ad-supported tier, cracking down on password sharing, and other initiatives. Decider has more.

🤖 Boston Dynamics’ robot can now run, jump, grab, and throw. In a video that will likely keep you up at night, the company shared the latest demo of its humanoid robot, Atlas. While the robot could previously run and jump, its new “hands” or grippers that allow it to pick up and move (or throw) items. While there’s still a ton of work to be done on this technology, Boston Dynamics’ remains well ahead of its competitors in terms of its robotic capabilities. More from TechCrunch.

😆 Twitter’s new approach to a “sum of the parts” valuation. As insider reports indicate that Twitter’s daily revenue has fallen 40% YoY, the company is searching for ways to stop the bleeding. And one of those ways is commissioning Heritage Global Partners to auction off items from Twitter’s San Francisco headquarters. By the time you’re reading this, the bidding process and auction will be over, but the company’s financial and operational problems likely won’t be. If nothing else, the company knows how to make everything (including selling office supplies) a little more interesting… CNBC has more.

Links

Links That Don’t Suck:

🚗 Tesla video promoting self-driving was staged, engineer testifies

⚖️ WA Supreme Court clears way for Albertsons’ $4 billion dividend

💥 JetBlue plane bound for Puerto Rico hits empty aircraft at JFK Airport

🕵️ Apple will audit its labor practices in the U.S. after union-busting accusations

🥪 Fugitive $100 million New Jersey deli defendant Peter Coker Jr. arrested in Thailand

⏸️ Amazon’s Prime membership program stopped growing in the U.S. for the first time ever

📡 Record-breaking signal from distant galaxy is the furthest of its kind ever detected

🧑🚀 It looks like NASA will finally have an astronaut live in space for a full year

✈️ Netflix is hiring a flight attendant for one of its private jets – and the job pays up to $385,000

🧠 ADHD persists throughout life – strongly linked to mental health issues like anxiety and depression